In addition to the nuclear Group from China, the US also banned a Hong-Kong based company for alledgedly selling US tech to Iran and North Korea

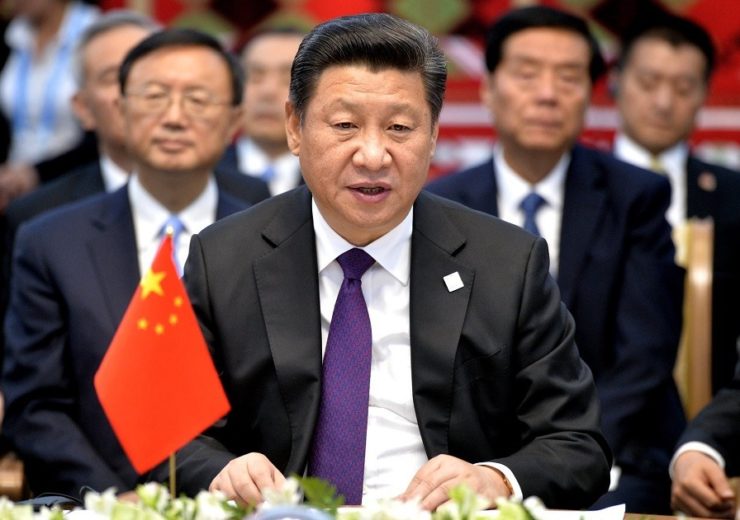

Chinese president Xi Jinping has set his country on a course away from coal and oil, using vast quantities of natural gas a replacement (Credit: Kremlin.ru)

The US has blacklisted China General Nuclear Power Group (CGN) for allegedly stealing the country’s nuclear technology for ‘military uses’, it was announced on 15 August.

The Federal Register added the state-owned Chinese firm and its three subsidiaries, all of which operate in the nuclear power industry, to its ‘entity list’. This makes it virtually impossible for American companies to supply CGN without specific licences.

It also placed Hong-Kong-based Corad Technology on the banned list for being ‘involved’ in the sale of US tech to Iran, North Korea and China.

The announcement read: “Entities for which there is reasonable cause to believe, based on specific and articulable facts, have been involved, are involved, or pose a significant risk of being or becoming involved in activities that are contrary to the national security or foreign policy interests of the US, and those acting on behalf of such persons, may be added to the Entity List.

“Each of these four Chinese entities [CGN and its three subsidiaries] has engaged in or enabled efforts to acquire advanced US nuclear technology and material for diversion to military uses in China.

“Corad Technology has been involved in the sale of US technology to Iran’s military and space programs, to front companies of the Democratic People’s Republic of Korea, and to subordinate entities of China’s Government and its defense industry.”

China-US nuclear scuffle just the latest chapter in a damaging story for energy

The decision by the US Government to blacklist CGN is the latest chapter in what has become a saga of hostilities between the country and China, typified by the ongoing trade war between the two gargantuan economies.

In a joint 2018 report for think tank French Institute of International Relations, Sylvie Cornot-Gandolphe and Jean-François Boittin predicted the tit-for-tat process could wreak havoc with the global energy sector.

They said: “US-China trade disputes could mean a slow-down in the growth of the deployment of renewable energy sources in the US and a missed opportunity for US coal to develop its exports to China as domestic demand has been slightly declining, with less new job creations in this sector and possibly, job losses.”

Crude prices have fallen to $57 per barrel this week, their lowest point so far in 2019, with demand continuing to fall short of supply.

This year, the market uncertainty caused by the reciprocal tariff impositions from both countries has greatly affected the global oil market.

On 7 August, Brent crude dropped to its lowest point since January at $56.67 a barrel, 25% below its current 2019 peak in April, while Western Texas Immediate took a 4% hit to $52.04 per barrel.

Share prices in some of the world’s biggest oil companies slid at a commensurate rate, with ExxonMobil, BP and Royal Dutch Shell all falling 7% over the past seven days.

Elsewhere, the prices of various commodities key to the global energy sector and the continued progression of electric vehicles have been placed in a state of flux.

Cobalt, a key component in the production of lithium-ion batteries, had reached more than $40/lb this time last year, but has over the first seven months of 2019 seen its price slashed by as much as 60%.

Companies far and wide are feeling the strain, with Switzerland-based mining giant Glencore going as far as to announce its temporary withdrawal from activity at the world’s largest cobalt mine in the Democratic Republic of Congo.

Nickel prices, meanwhile, surged to as much as $16,690 a tonne on the London Stock Exchange during Asian trading on 8 August, before settling at around $15,635 per tonne.