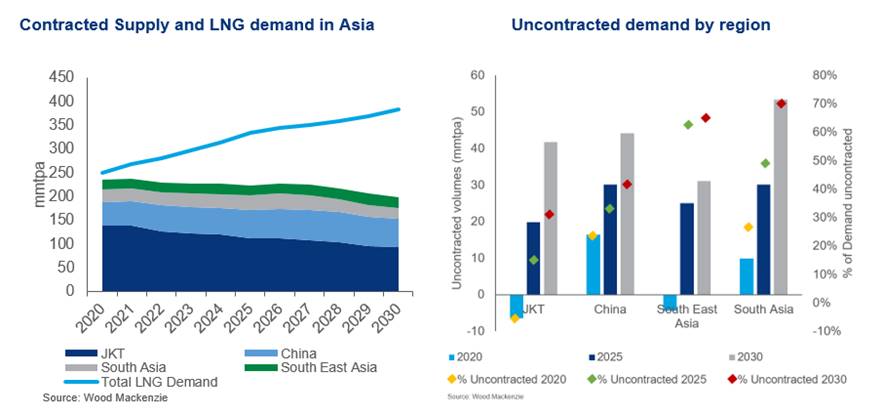

Analysis by Wood Mackenzie claims the long-term buyers’ market is only likely to end once it becomes clear that demand will outstrip new supply available from Qatar and Russia

Currently, there is more LNG available for sale through long-term contracts than there are buyers (Credit: Shutterstock/Vytautas Kielaitis)

The liquefied natural gas (LNG) long-term contract market and LNG spot market are both currently “travelling in opposite directions”.

That is according to analysis by energy researcher Wood Mackenzie, which claims the long-term buyers’ market is only likely to end once it becomes clear that demand will outstrip new supply available from Qatar and Russia.

It added that buyers in the market for LNG contracts starting after 2025 are “spoilt for choice”, as there are more volumes available than they need – but it notes that those that need volumes before 2025 are facing higher spot prices and expensive short-term deals.

Wood Mackenzie does believe there is a possible solution, though. It said purchasers may be able to use longer-term contracts that “bridge” the short- and long-term market, as a bridging contract would potentially give buyers lower prices over the next five years in exchange for the seller receiving the security of long-term contracts.

“Spot prices are presently averaging about $12 per million British thermal units for June and July delivery into North-East Asia, their highest at this point in the summer for over six years,” said Giles Farrer, Wood Mackenzie’s director of global LNG.

“While prices may briefly dip next year, Wood Mackenzie expects this rally to extend over the next five years because rising Asian LNG demand will outstrip global LNG supply growth, pulling Atlantic supply into the Pacific and tightening the market.”

More LNG currently available for sale in the market through long-term contracts than there are buyers

But Daniel Toleman, Wood Mackenzie’s senior LNG analyst for Asia, said long-term contracts signed in 2021 are not following the change in spot market sentiment.

“Most legacy buyers in Asia are presently out of the market for new long-term volumes, focusing instead on increasing flexibility in their LNG procurement portfolio, partly due to energy transition concerns,” he added.

“There are some buyers looking for term contracts, particularly in markets like China, South Korea, Pakistan and Bangladesh.”

Currently, there is more LNG available for sale through long-term contracts than there are buyers, according to Wood Mackenzie.

Farrer claims this is because uncontracted supply from legacy projects is “growing as existing contracts expire”.

“Also playing a role is the fact that major suppliers, including Novatek, Total and Petronas, are structurally long, having sanctioned projects over the past few years without contracting all the associated supply,” he added.

“The addition of supply controlled by Qatar is a key factor, too. New supply from its North Field East project and the Golden Pass joint venture in the US, plus the expiry of 20 million tonnes per annum of legacy contracts (mostly into North Asia), means over 60% of its portfolio is uncontracted by the end of the decade.

“So, it’s unsurprising that it has been busy of late – having signed eight million tonnes per annum of long-term deals since the third quarter of last year.”

Potential of buyers’ market ending anytime soon likely to depend on new supply

Qatar has what buyers want – it is offering reliable low-cost and low-carbon LNG – and it has plenty of it to offer the market.

Wood Mackenzie notes that this is putting pressure on competitors and forcing other sellers, who are keen to lock in long-term contracts, to the same level – currently about 10.2% Brent plus a small constant (in some cases).

“Will this buyers’ market for long-term LNG continue?” asked Farrer. “At the moment it seems so. We expect contract prices for shorter-term deals of less than five years to rise.

“But if a buyer commits to a long-term deal, lower prices are possible – even if that deal is starting next year.

“Many sellers are offering contracts that ‘bridge’ the short and long-term market, giving buyers a potentially lower price over the next five years in exchange for the seller receiving long-term demand security. This allows the seller to de-risk project investments they have already committed to.”

Whether the buyers’ market ends anytime soon is likely to depend on the development of new supply.

And with a supply-demand gap of 50 million tonnes per annum expected by 2030, Wood Mackenzie believes there are opportunities for developers of new facilities, particularly in North America, to secure buyers.

“Rising oil and gas prices could see US LNG and Henry Hub-linked deals back in the money,” said Farrer. “And it is possible that portfolio players and traders that are short in the mid-2020s may see an opportunity to access new North American supply now.”

But for many buyers, the fact that Qatar and Russia appear willing to develop new projects without firm contracts in place seems a “blessing”, claims Wood Mackenzie.

It said the projects currently on the countries’ drawing boards can almost plug the expected 50 million tonnes per annum supply gap, which will result in a continued buyers’ market for long-term LNG contracts.