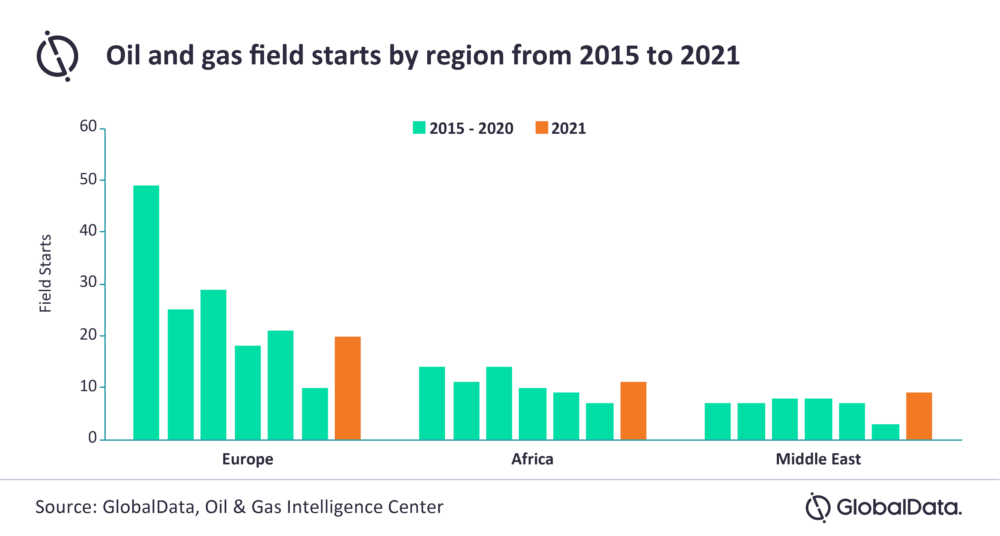

Analysis by GlobalData shows that 2021 is forecast to see a “bump” in both field starts and final investment decisions across the EMEA region

GlobalData's Daniel Rogers said a "strong start to 2021 has resulted in a number of project approvals across EMEA so far" (Credit: Wikimedia Commons/Floydrosebridge)

An early flurry of final investment decisions (FID) has kicked off a “more promising year” for the upstream oil and gas industry across the Europe, Middle East and Africa (EMEA) region.

That is according to analysis by data and analytics firm GlobalData, which shows that following a year of delays and COVID-19 restrictions hampering oil and gas project timelines in 2020, 2021 is forecast to see a “bump” in both field starts and FID’s across EMEA.

Daniel Rogers, senior oil and gas analyst at GlobalData, said: “A strong start to 2021 has resulted in a number of project approvals across EMEA so far, including the giant $30bn North Field East development in Qatar, which could well be the largest upstream project sanctioned globally this year.

“2021 has provided a ray of optimism for the sector so far as 2020 experienced multi-year lows for project starts and a slump in upstream investment, seeing a decline of about 30% in global upstream development and production capex.”

Upstream industry could be set for a number of FID’s across EMEA region in 2021

The market turbulence in 2020 led to the majority of E&P companies opting to defer project investment decisions amid capital preservation measures, according to GlobalData.

It believes this year could see those projects reconsidered for investment as lockdown measures ease and oil prices return to pre-COVID-19 levels while economies commence their recoveries.

“In the UK, Shell has stakes in two major greenfield developments due for sanction this year, Cambo and Jackdaw, which could see the company invest more than $1bn in the country,” said Rogers.

“In Norway, attractive tax incentives could push through a number of smaller developments being considered and field electrification projects at Snøhvit and Oseberg could also be approved.

“Some critical projects across Africa are poised for final approval, including Uganda’s first major oil development – the controversial but economically impactful Tilenga oil project led by Total.

“Furthermore, Morocco’s first offshore gas development, Anchois, aims to play a pivotal role in the country’s strategy of reducing gas imports from Algeria and transitioning to a lower-carbon energy source.”

Qatar Petroleum sanctioning the giant North Field East project earlier this month emphasises the long-term viability and commerciality of mega LNG projects.

But GlobalData warns that it may also raise competition for targeting LNG buyers into the late 2020s, potentially creating challenges for upcoming LNG developments elsewhere in the US, Canada and Mozambique.

It highlights that other notable projects due for sanction are UAE-based gas developments including the multibillion-dollar Hail and Ghasha sour gas projects and the development of the Umm Shaif gas cap.

“Despite continued trepidation going into 2021, the upstream sector will be optimistic with the price recovery and investment commitments already seen so far,” said Rogers.

“Sustained prices above $60 per barrel could well move forward developments that have been put on hold across EMEA throughout 2020.”