The Carbon Tracker Initiative said the fossil fuel industry is taking this action as the world “starts to tackle plastic waste” and governments “act to hit climate targets”

The report claims the oil industry's action risks up to $400bn worth of stranded petrochemical investments, increasing the likelihood of peak oil demand (Credit: Needpix.com)

The oil industry is pinning its hopes on strong plastics demand growth that “will not materialise”, according to a new report.

Analysis by the Carbon Tracker Initiative, a London-based climate change think tank, said the fossil fuel industry is taking this action as the world “starts to tackle plastic waste” and governments “act to hit climate targets”.

It claims this risks up to $400bn worth of stranded petrochemical investments, increasing the likelihood of peak oil demand.

The central scenarios for UK oil major BP and the International Energy Agency imply that plastics demand will be the “largest driver of oil demand growth”, making up 95% and 45% of growth to 2040 respectively, as oil demand is “challenged in its core area of transport”, according to the report.

Carbon Tracker energy strategist and lead author of the report, Kingsmill Bond, said: “If you remove the plastic pillar holding up the future of the oil industry, the whole narrative of rising oil demand collapses.”

Virgin plastic demand growth could plummet from 4% a year to under 1%

Carbon Tracker’s analysis found that “mounting pressure to curtail the use of plastics” – now a worldwide public concern – could slash virgin plastic demand growth from 4% a year to under 1%, with demand peaking in 2027.

It said the implication for Big Oil is that the industry will “lose its primary growth driver”, making it “more likely” oil demand peaked as early as 2019.

The petrochemical industry is already facing record-low plastic feedstock prices as a result of massive overcapacity.

But, despite that, it plans to expand supply for virgin plastics use by a quarter at a cost of at least $400bn in the next five years, which Carbon Tracker believes is risking “huge losses for investors”.

The think tank claims the plastics industry is a “bloated behemoth, ripe for disruption”.

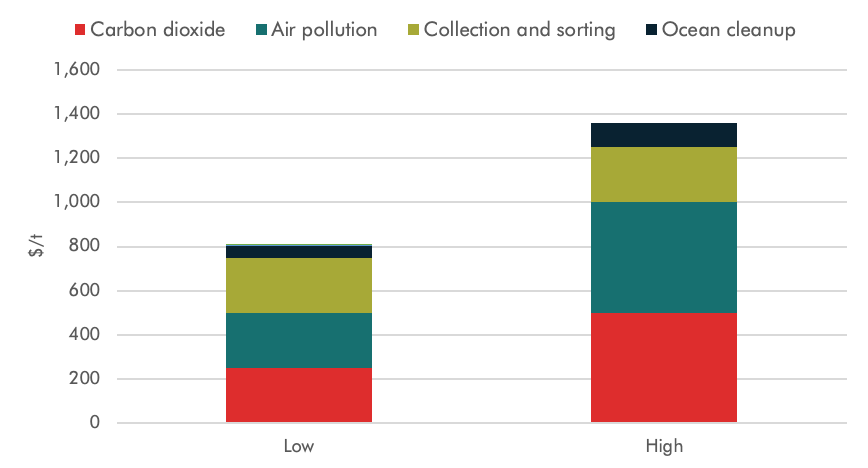

It added: “Plastics imposes an externality cost on society of at least $1,000 per tonne, or $350 billion a year, from emitting carbon dioxide, associated health costs from noxious gases, collection costs and the alarming growth in ocean pollution.

“And yet, it receives more in subsidy than it pays in taxation, and until recently there have been very few constraints on how you can use plastics.

“Meanwhile, 36% of plastic is used only once, 40% ends up polluting the environment and less than 10% is actually recycled.”

Policymakers in Europe and China taking steps to ‘clamp down on plastics waste’

SYSTEMIQ, a systems change company that worked on the report with Carbon Tracker, said technological innovations are already available to enable a “massive reduction” in plastic usage at “lower cost than business as usual”.

The solutions it notes include reuse, with better design and regulation of product, substitutions such as paper, and a large increase in recycling.

The report highlights how policymakers in Europe and China are already taking steps to “clamp down on plastics waste” and said they have a wide range of tools they can use, from regulation and bans to taxes, targets and recycling infrastructure.

“The EU, for example, in July 2020 proposed an €800/t ($944) tax on unrecycled waste plastic, while China has similar regulatory aspirations and has started to ban certain types of plastic,” it added.

“In China, the first major flag came in 2018 when the country largely closed down its industry for importing and processing plastic waste – the world’s largest – forcing exporters to solve the waste issue at home.”

A ‘stagnation’ in plastic demand in developed markets

The report notes that there has been a “stagnation in demand” in developed markets and a “leapfrog” in emerging markets.

“As has been seen in other areas of the energy system, OECD plastic demand is stagnating at the same time as emerging market leaders are looking for alternative solutions to plastic,” it added.

“A further critical element that will dim the rosy petrochemical demand picture painted by incumbents is the effects of global policy action to tackle climate change.

“Carbon dioxide is produced at every stage of the plastic value chain – including being burnt, buried or recycled, not just extraction of oil and manufacturing.”

Carbon Tracker said its analysis therefore finds that “plastic releases roughly twice as much CO2 as producing a tonne of oil”.

On the assumption that 350 million tonnes (Mt) of plastic demand with a total carbon footprint of about five tonnes of CO2 per tonne of plastic, that implies 1.75 gigatonnes (Gt) of CO2, according to the report.

It notes that a continuation of current growth rates would see the carbon footprint of plastics double by the middle of the century to about 3.5Gt.

This is despite the Paris Agreement, an international climate pact aiming to limit the rise in global temperatures, implying that CO2 emissions — which stood at 33Gt from the energy sector in 2018 — will have to halve by 2030 and reach zero by the middle of the century.

Bond believes it is “simply delusional” for the plastics industry to imagine it can double its carbon emissions at the same time as the rest of the world is attempting to cut them to zero.