WaterBridge will acquire saltwater disposal wells and associated produced water infrastructure in Reeves County from Centennial Resource Production

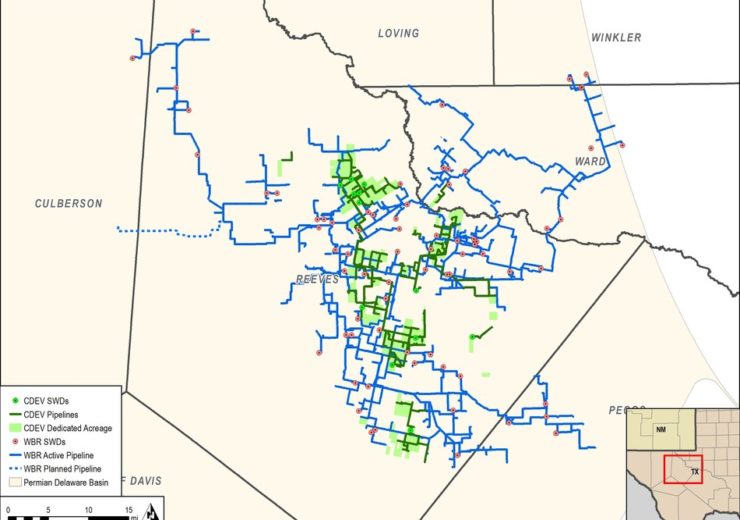

WaterBridge’s Produced Water Handling Network Spans the Southern Delaware Basin. (Credit: WaterBridge Holdings LLC)

US-based water utility firm WaterBridge has agreed to acquire produced water assets in the southern Delaware basin from Centennial Resource Development for $225m.

Under the deal, WaterBridge will acquire saltwater disposal wells and associated produced water infrastructure in Reeves County from Centennial’s subsidiary, Centennial Resource Production.

The water utility firm will pay $150m in the form of cash and an additional $75m will be paid over a three-year period based on Centennial achieving certain incentive thresholds.

WaterBridge, which is a portfolio company of midstream energy-focused private equity firm Five Point Energy, has also signed a 15-year produced water management agreement with Centennial for Centennial’s operated acreage within an extensive area of mutual interest.

Five Point Energy CEO and WaterBridge Board chairman David Capobianco said: “With the addition of Centennial’s produced water handling assets to WaterBridge’s network, the company has expanded the capabilities of its system and firmly established itself as the largest pure play water midstream company in the industry.

“The capacity and redundancy offered by our systems will continue to be instrumental in supporting current and future customers’ development programs in the Southern Delaware Basin.”

The transaction is expected to be closed in March 2020

After completion of the deal, the produced water midstream company’s Southern Delaware Basin will have more than 600,000 acres which are operated by more than 23 blue-chip producers under long-term dedication.

Through 1834.6km of large-diameter pipelines and 87 handling facilities, the firm has approximately two million barrels per day (bpd) water handling capacity.

Subject to certain regulatory approvals and other customary closing conditions, the deal is estimated to be completed in March this year.

Centennial is planning to utilise the $150m cash proceeds to repay borrowings under its revolving credit facility.

For the deal, Winston & Strawn is acting as legal advisor to WaterBridge.

In December last year, WaterBridge raised $345m of equity capital to fund its acquisitions of water infrastructure and growth projects.