Sibanye-Stillwater has secured $500m upfront cash payment by entering into a streaming agreement with Wheaton Precious Metals International, a wholly-owned subsidiary of Wheaton Precious Metals.

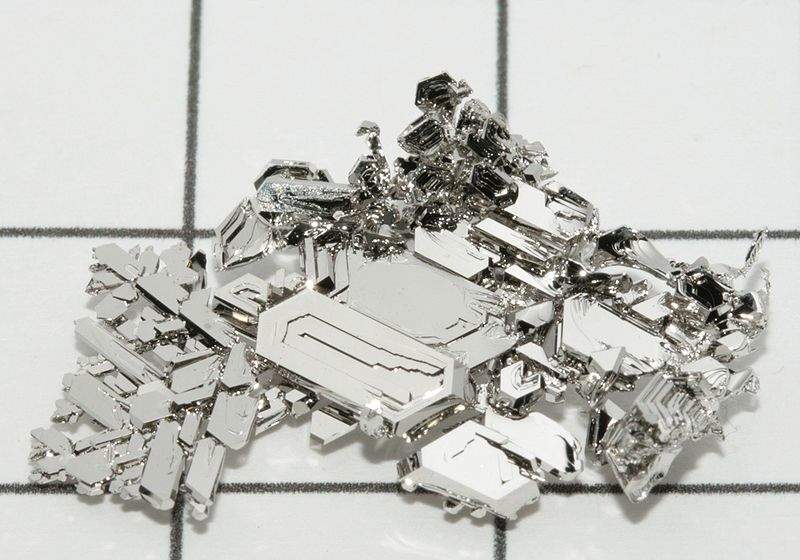

Image: Crystals of pure platinum. Photo: courtesy of Periodictableru/Wikipedia.org.

Under the terms of the agreement, Sibanye-Stillwater will deliver a percentage of gold and palladium produced from its United States (US) Platinum Group Metals (PGM) operations.

Sibanye CEO Neal Froneman said: “The streaming transaction is further delivery on our strategic commitments and validates the value we identified in the Stillwater assets.

“Importantly the transaction results in a significant reduction in Group leverage, improving flexibility and reducing financing costs and risk. We are extremely pleased to have secured this competitively priced financing arrangement with a company of the quality of Wheaton International.”

In addition, Wheaton International will pay Sibanye-Stillwater 18% of the spot palladium and gold prices for each ounce delivered under the agreement.

Wheaton International will continue to pay until the advance amount of $500m has been reduced to nil through metal deliveries.

Thereafter, it will pay 22% of spot US$ palladium and gold prices for each ounce of palladium and gold delivered.

The transaction is expected to further optimise the group’s capital structure by diversifying Sibanye-Stillwater’s sources of funding.

Sibanye-Stillwater said: “The streaming agreement provides Sibanye-Stillwater with a long-term funding instrument that is linked to the operational performance of the US PGM operations and to the performance of the underlying commodities.”

“Sibanye-Stillwater’s obligations under the stream are limited to delivery of a percentage of actual production, without repayment of the Advance Amount under any circumstances, and without minimum deliveries. This introduces a funding instrument with limited obligations, minimising any potential for default.”

The transaction, which is effective from 1 July 2018, is expected to result in the realisation of significant value uplift from the US PGM operations for Sibanye-Stillwater shareholders.