The Rubi Project hosts two such targets and is readily accessible year-round. MDF is fully funded to complete the committed 2,000m drill program at the project

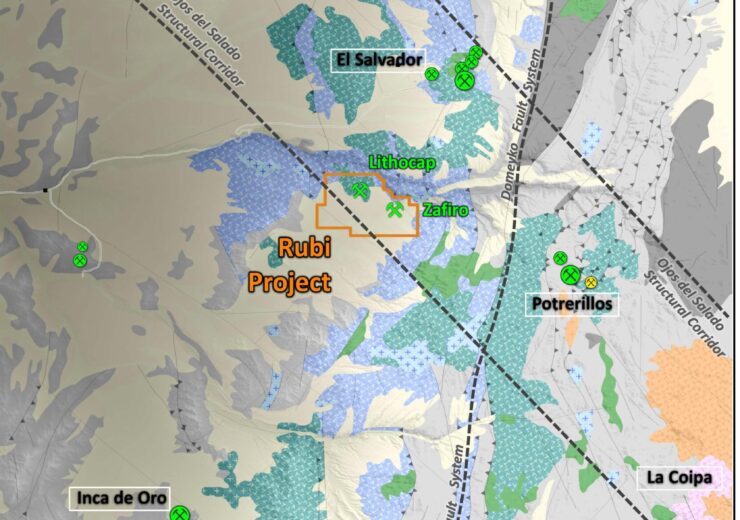

Project Location and Regional Settings. (Credit: Mirasol Resources Ltd.)

Mirasol Resources Ltd. (TSX-V: MRZ) (OTCPK: MRZLF) (the “Company” or “Mirasol”) is pleased to announce the signing of a definitive option agreement for its Rubi Copper Porphyry Project (the “Project” or “Rubi”) in northern Chile with Mine Discovery Fund Pty Ltd. (“MDF”), a private Australian company. Through this transaction, Mirasol adds two additional large-scale copper-molybdenum-gold targets to be drill tested this fiscal year.

MDF is a private investment vehicle focused on the discovery of tier-one base metal and gold deposits by funding drilling of well defined, large-scale exploration targets. The Rubi Project hosts two such targets and is readily accessible year-round. MDF is fully funded to complete the committed 2,000m drill program at the project. It is expected that drilling will occur in the second quarter of 2021, following completion of the permitting process, which is underway.

Mirasol’s Chair and Interim CEO, Patrick Evans, stated: “We are pleased to partner with MDF to drill test the Lithocap and Zafiro targets at Rubi, which have the potential to host large-scale porphyry deposits. Drilling will commence as soon as permits are in hand.”

Mirasol has granted to MDF the option to earn-in 80% of the Project over eight years. MDF has committed to funding a 2,000 m drill program at Rubi. Following the completion of this initial commitment, MDF is required to spend a minimum of US$1 million per year in exploration expenditures over the term of the Agreement. In addition, and to exercise the option, MDF must deliver a positive NI 43-101 compliant Prefeasibility Study Report on the Project. Mirasol will be the operator during the option period.

Following the completion of the 80% earn-in, MDF will have a one-time option to acquire the remaining 20% interest on terms to be negotiated between the parties. If this option is not exercised, the parties will form a participating joint venture to further fund the development of the Project.

If either party’s interest in the joint venture is diluted to 10% or below, it will convert to a 1.5 % net smelter returns (“NSR”) royalty. The non-diluting partner can buy back 0.5% of the NSR royalty for the fair market value as determined by a qualified independent valuator.

The 7,543 ha Rubi Project is located within the Paleocene age porphyry belt of northern Chile that hosts a number of significant, currently producing, porphyry copper deposits. The Project lies at relatively low elevation (1,900-2,100 m), within 20 km of the El Salvador and Portrerillos porphyry copper-molybdenum-gold mines and with good access to port facilities at Chanaral approximately 80 km to the west.

In a regional context, the Project has a prospective geological setting being centered on the structural intersections of the Domeyko fault system and the Ojos del Salado trans-orogen structural corridor, which is interpreted to have influenced the emplacement of the nearby El Salvador and Potrerillos deposits.

The Rubi Lithocap target (“Lithocap”) covers a 3.5 km by 2.0 km area centred on a large, deeply weathered, advanced argillic alteration zone that is surrounded by gravel cover with thicknesses modelled from a gravity survey of 10-50 m. Large and productive porphyry copper deposits can be found below or adjacent to the type of lithocap alteration zones present at Rubi.

At Lithocap, previous explorers have drilled peripheral to, but not beneath or adjacent to, the post-mineral gravel covered western edge of the copper and locally strong Mo anomaly. Mirasol’s mapping and re-logging of previous drill holes have defined veining and brecciation with anomalous copper and molybdenum mineralization and alteration patterns that indicate potential concealed porphyry mineralization to the north and north-west of the previous drill holes.

This combined information suggests the presence of a deep weathering profile that could potentially overlie supergene enriched and sulfide mineralization, as indicated by an Induced Polarization geophysical chargeability anomaly, which remains open to the north. This type of deep weathering in porphyry environments in northern Chile is often conducive for the development of supergene enriched copper mineralization akin to the nearby El Salvador mining district.

Source: Company Press Release