The transaction will combine Copper North’s Carmacks deposit with Granite Creek’s Stu Project, creating a significant copper-focused exploration and development company

Granite Creek Copper to acquire Copper North Mining. (Credit: Granite Creek Copper.)

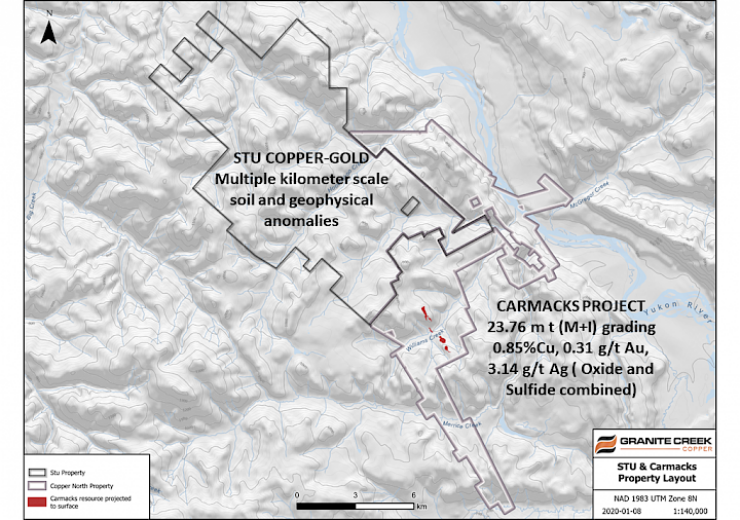

Granite Creek Copper Ltd. (TSXV: GCX) (“Granite Creek”) and Copper North Mining Corp. (TSXV: COL) (“Copper North”) announced today that they have entered into a definitive arrangement agreement (the “Arrangement Agreement”) pursuant to which Granite Creek has agreed to acquire all of the outstanding Copper North common shares (the “Copper North Shares”) not already owned by Granite Creek through a plan of arrangement under the British Columbia Business Corporations Act (the “Arrangement”). Upon completion of the Arrangement, Granite Creek will control a large regional land package, including the advanced-stage Carmacks Copper Project and the highly prospective Stu Copper-Gold Project, in Canada’s Yukon Territory. The combined land package will cover approximately 176 square kilometres within the Minto Copper District.

Under the terms of the Arrangement, Granite Creek has agreed to acquire all of the outstanding Copper North Shares it does not already own in an all-share transaction in which Copper North shareholders will receive 1 (one) common share of Granite Creek (a “Granite Creek Share”) for every two and one-half (2.5) Copper North Shares (the “Exchange Ratio”). All outstanding warrants and options of Copper North will be exchanged (or deemed to be exchanged) for warrants and options, respectively, of Granite Creek at the Exchange Ratio, with appropriate adjustments to the exercise price, but shall not otherwise be amended, including with respect to vesting and expiry. From and after closing of the Arrangement, the Copper North options will be governed by, and deemed to be outstanding under, Granite Creek’s existing long-term performance incentive plan.

Based on a price of $0.15 per Granite Creek Share, being the closing price of the Granite Creek Shares on August 28, 2020, the Exchange Ratio represents an offer price of $0.06 per Copper North Share, being a premium of 20% to the closing price of Copper North Shares on the TSX Venture Exchange on August 28, 2020.

The special committee comprised of independent directors of Copper North has, based on such financial and legal advice as it considered necessary, determined that the consideration to be received by Copper North’s shareholders is fair, from a financial point of view, to the holders of Copper North Shares (other than GCC and its affiliates).

The Board of Directors of each of Granite Creek and Copper North have each unanimously approved the transaction. Upon completion of the transaction, it is expected that, based on the outstanding Granite Creek Shares on the date hereof, and on the basis that Granite Creek is acquiring only the outstanding Copper North Shares it does not already own, Granite Creek will have 84,414,707 common shares outstanding and Granite Creek shareholders will own approximately 72% and Copper North Shareholders will own approximately 28% of the combined company. Including the 10,529,664 Granite Creek Shares previously issued by Granite Creek to certain Copper North shareholders to acquire its existing 26,146,233 Copper North Shares, Copper North Shareholders will own approximately 41% of the combined company.

Tim Johnson, Granite Creek CEO stated: “Since early 2019, Granite Creek has moved quickly to advance and enhance its position in the Minto Copper district. Upon completion of the Arrangement, the combined company will have consolidated 176 square kilometers of the district including the mineral resources previously confirmed on the PEA-stage Carmack copper deposit and the highly prospective Stu Project. With the second-largest land package in the district with an advanced project, Granite Creek is positioned to rapidly develop the overall potential of its holdings and is evaluating the potential for initiating a diamond drill program on high-priority targets at Stu.”