The international gold mining industry has a role to play in reducing carbon emissions and addressing key climate change targets – but it could cost as much as $70bn to make the “green” transition.

That is according to the World Gold Council (WGC), which has charted a course for the gold industry to meet 2030 decarbonisation goals laid out by the Paris Agreement.

The trade organisation identifies “substantial opportunities for the gold supply chain, and particularly gold mining, to adapt to a net-zero carbon future”.

These achieved in a large part through decarbonisation of electricity and transport infrastructure, the development of self-sufficient energy sources and mini-grids, and offsetting emissions from hard-to-eliminate chemical processes.

The report states: “Ultimately, we believe that electrification of vehicles and other equipment, powered by renewables and combined with energy storage, will make it feasible and cost-effective for the gold industry to reduce emissions by up to 95% over the time-scale required.

“The technology, economics, and practicality of these solutions are set to continue improving rapidly over the next decade, and are already becoming increasingly accessible and cost-effective compared to fossil-fuelled alternatives.”

Gold mining industry has an ‘important role to play’ in tackling climate change

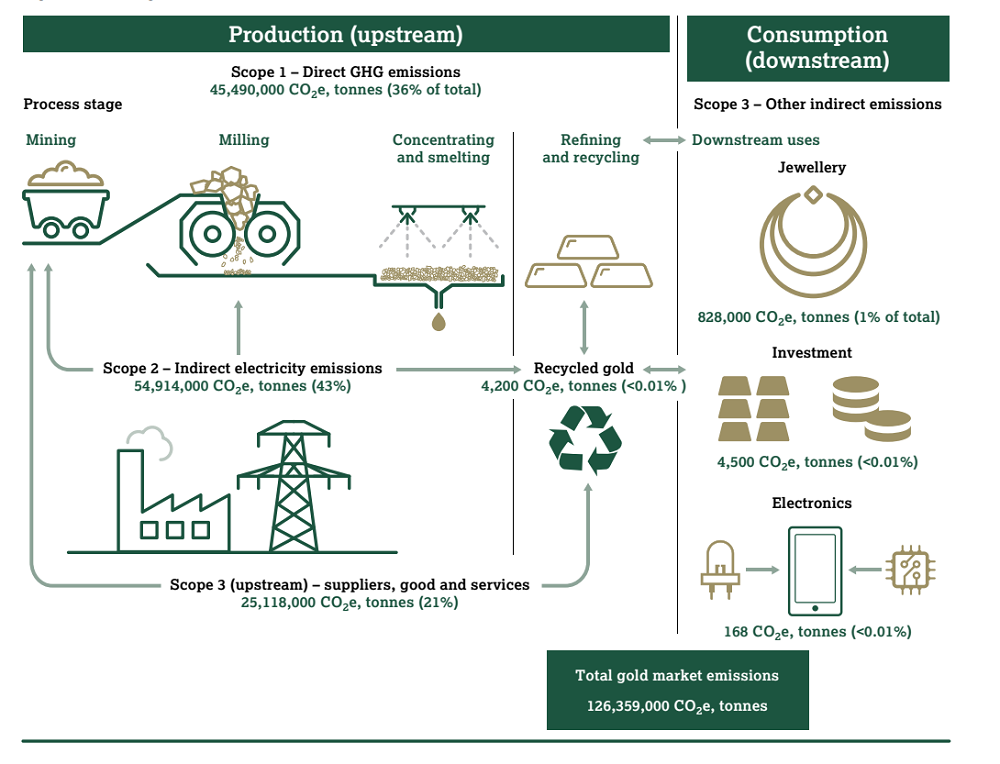

At present, greenhouse gas emissions across the entire gold industry – from exploration and extraction to downstream uses such as jewellery-making – contribute 36,793 tonnes of carbon dioxide (CO2) per tonne of the mineral.

This measurement provides an overall estimate for the industry at around 126m tonnes of CO2 emissions annually.

WGC chief financial officer Terry Heymann said: “We recognise that climate change imposes very substantial risks to the global economy.

“Gold has an important role to play in supporting the transition to a lower-carbon economy, both through decarbonisation efforts and as a compelling investment as investors look for resilient assets in their portfolios, which are less likely to be negatively impacted by the physical and transition risks associated with climate change.”

Gold will remain a ‘robust’ investment option amid climate risk

As a traded asset, gold was found to have a “relatively robust” outlook, compared to others – an important consideration for investors as public opinion turns increasingly in favour of more rigorous environmental standards.

Also given gold’s well-established status as a risk hedge, portfolio diversifier and market insurance asset, the WGC believes the commodity will be well-placed to withstand “heightened market volatility and uncertainty from climate-related risks” looking ahead.

It was a positive outlook for gold in the context of climate risk, with the report concluding the commodity is “likely to exhibit a relatively robust performance across all climate scenarios”.

Dr Ben Caldecott, director of the Oxford Sustainable Finance Programme and associate professor at the University of Oxford, said: “Investors all over the world, from large institutional investors to small millennial retail savers, have become increasingly aware of their portfolios’ environmental footprints.

“The global challenge of transitioning to a negative carbon footprint poses a massive challenge but also opportunity and will reshape the value of assets and companies across sectors of the global economy.”

World gold production is expected to increase in the coming years

Global gold production is forecast to increase at a compound annual growth rate of 2.5% to reach 132 million ounces by 2023, according to market analysts, driven largely by new projects in Russia, the US and Australia.

In Russia alone, there is expected to be a net increase of 3.4 million ounces in gold production by 2023 – a CAGR of 4.5%.

In the US and Australia, the long-established Turquoise Ridge, Round Mountain, St Ives Gold Mine Complex, and Olympic Dam facilities are all currently undergoing expansion.

Production in China, Chile and Mexico, however, has been on the decline, with the Environmental Protection Tax in China having a particular impact due to increased costs and leading to a 5.9% reduction in the country in 2018.