Global gold output is expected to decline in 2020 following the effects of the coronavirus pandemic, says an analyst.

The virus, which has had a significant impact on several key sectors, led to a number of mine closures across the world due to lockdown restrictions imposed by individual countries across the second quarter.

But with coronavirus cases continuing to rise again, it is unknown how the situation will evolve over the next months, but data and analytics firm GlobalData is already anticipating a 1.7% decline in global gold production this year.

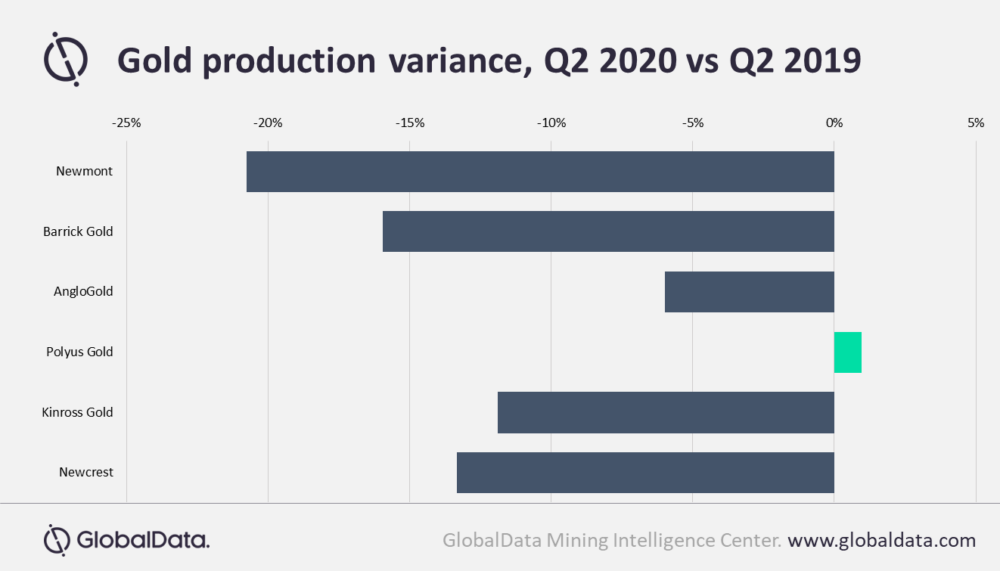

Vinneth Bajaj, senior mining analyst at GlobalData, expects almost all of the top producers to experience a “decline in the production levels” during 2020 following the lockdowns across several key markets, “such as South Africa”.

“The widespread uncertainty due to the fear of a possible global economic downturn, however, pushed gold prices to an all-time high in August 2020, which has been supporting profit growth for a number of gold miners, despite the falling output,” he added.

Major gold miners have suffered production dips in 2020

Following the outbreak, the two largest gold producers in the world, Colorado-based Newmont and Toronto’s Barrick Gold, reduced their guidance from a collective 11.6 million ounces to about 11 million ounces.

Production from these companies more than halved in the second quarter from a collective 2.9 million ounces in Q2 2019 to 1.4 million ounces in Q2 of this year.

Operations at Barrick’s Veladero and Porgera mines and Newmont’s Cerro Negro, Yanacocha, Eleonore, Penasquito and Musselwhite were all temporarily suspended for most of April and May due to the outbreak.

But, following the record gold prices, which soared beyond $2,000 per troy ounce for the first time last month, Barrick posted large profits in the second quarter.

The firm reported an adjusted profit of $415m, or 23 cents a share, up from $154m across the same period of 2019, which it said was driven by “strong operating performances”, particularly from Nevada Gold Mines in the US, Loulo-Gounkoto in Mali and Kibali in the Democratic Republic of Congo.

But Barrick’s fellow gold miners are unlikely to have performed as well, with Johannesburg’s Anglogold Ashanti and Toronto-headquartered Kinross both being forced to suspend their outlook for 2020, while Moscow-based Polyus Gold’s guidance remains the same.

The COVID-19 restrictions on AngloGold Ashanti’s South African operations led to a 63,000-ounce year-on-year drop in the output in the first half of 2020, while the company’s overall decline across the same period was 85,000 ounces.

Leading gold companies’ outputs affected by “lower ore grades and sale of assets”

Bajaj said other factors that have impacted the leading gold companies’ output this year has been “lower ore grades and sale of assets”.

In the case of Melbourne-based Newcrest, he added that its output was lower due to the sale of the Gosowong mine – one of the largest mines in Indonesia – to Jakarta’s Indotan Halmahera in March.

For Newmont, Bajaj said the sale of its Red Lake project in Canada and the Kalgoorlie projects in Western Australia towards the beginning of the year were contributing factors to its lower production rate.