The firm proposes issuing 5,000,000 units priced at $0.20 for net proceeds of $1,000,000

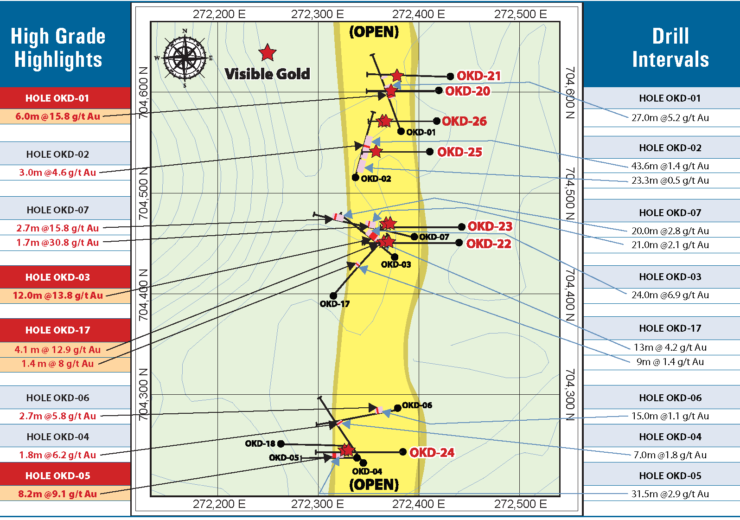

Modelling the results of the 2019 drill program showed a north – south trending zone of mineralization 1.1 km long and approximately sixty meters wide. (Credit: G2 Goldfields Inc.)

G2 Goldfields is pleased to provide an update on the Company’s ongoing drilling project at the OKO property, Guyana. During 2019, G2 completed twenty drill holes totalling 3,179 meters. Modelling the results of the 2019 drill program showed a north – south trending zone of mineralization 1.1 km long and approximately sixty meters wide. A program of drill holes designed to test this model commenced on the 12th of January and, to date, seven holes have been completed totalling 1093 meters. This drilling supports the geological and gold mineralization model with visible gold (vg) being noted within the predicted host horizons in all seven new holes to date. All of the mineralized sections lie above 100m vertical from surface. G2’s geological team notes that the style of mineralization and the geological setting has similarities to the Obuasi gold deposit in Ghana; 62 million ounces Au past production + resources; (Fourgerous et al ‘Economic Geology (2017 112 (1): 3 -22’) such that Orogenic gold mineralisation occurs as native gold in quartz veins and disseminated gold bearing sulphides within poly-deformed carbonaceous basin sediments within a Paleo-Proterozoic greenstone terrane.

Mineralisation hosted in similar or nearby deposits is not necessarily indicative of mineralisation hosted at Oko.

Drilling is ongoing at the 18,000-acre property and, as noted in the press release of November 20, 2019, G2 is mobilizing a second drill to the property.

Proposed Financing

The Company proposes issuing 5,000,000 units priced at $0.20 for net proceeds of $1,000,000. Each unit is comprised of one common share and a one-half share purchase warrant. Each whole warrant shall entitle the holder to purchase an additional common share at $0.35 for a period of eighteen months after closing.

Participation of Robert Cudney and Insiders in Proposed Financing

G2 has received an initial order from mining investor Robert Cudney for $250,000 (25%) of the proposed financing. Additionally, insiders of the Company may subscribe for an additional $400,000 (40%) of the proposed financing.

The offering is subject to certain conditions, including, but not limited to, the receipt of all necessary regulatory approvals. Securities issued under the offering will be subject to a four-month-plus-a-day statutory hold period in Canada.

Source: Company Press Release