Norway-based multinational energy company Equinor has completed acquisition of 40% operated interest of California-based Energy Company Chevron in the Rosebank project.

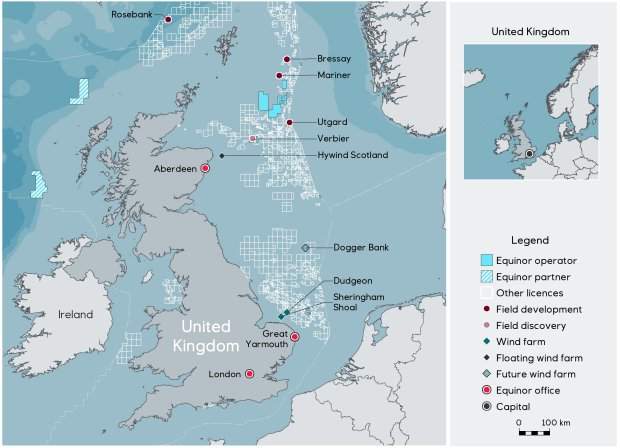

Image: Equinor has completed acquisition of 40% operated interest of Chevron in the Rosebank project. Photo: Courtesy of Equinor ASA.

The Rosebank Field was discovered nearly 15 years ago, which is located around 129km northwest of the Shetland Islands, is currently heading towards development. The offshore field is in water at a depth of around 1,110m.

The proposal for the current transaction was announced in October 2018. The acquisition of stake in Rosebank project is expected to strengthen the Equinor’s UK upstream portfolio.

Equinor’s UK portfolio includes the Mariner development, which is expected to start commercial production during the first half of 2019.

The firm said: “Equinor’s UK portfolio also includes attractive exploration opportunities and three producing offshore wind farms. In addition, Equinor is the largest supplier of crude oil and of natural gas to the UK.”

In August 2013, under its former name Statoil, Equinor had sold its 30% stakes in the Rosebank field to Austrian oil and gas company OMV in a $2.65bn transaction, which also included a 5.88% interest in the Schiehallion field.

Three years later, OMV sold 30% of its stake to Suncor Energy for $215m. In November 2016, Siccar Point Energy acquired OMV (U.K.) and with that its then parent company OMV’s remaining 20% stake in the Rosebank project.

Currently, Suncor Energy, which holds a stake of 40%, and Siccar Point Energy with a stake of 20%, will be the partners of Equinor in the North Sea field.

Equinor global strategy & business development executive vice president and UK country manager Al Cook earlier said: “The acquisition of Rosebank complements our portfolio of oil, gas and wind assets in this country, in line with our strategy as a broad energy company.

“This new investment underlines Equinor’s commitment to be a reliable, secure energy partner for the UK.”