Ascot Resources has signed agreements with Jayden Resources and Mountain Boy Minerals to acquire a 100% interest in the Silver Coin property in northwestern British Columbia.

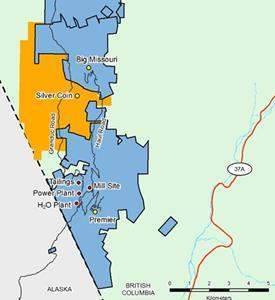

Image: A map showing location of the Silver Coin property. Photo: courtesy of Ascot Resources Ltd.

Highlights of the Silver Coin Property

- Approximately 244,000 AuEq1 ounces of high- grade resources with significant exploration upside that adjoins the Ascot Property boundary

- Located immediately adjacent to Ascot’s Big Missouri project with access to the Big Missouri haul road

- Identical ore type/mineralization as Ascot’s current resources

- Extensive pre-existing underground infrastructure with side hill portal

- Approximately 5 kilometers from Ascot’s mill facility with expected low transportation costs

- Silver Coin ore was previously processed at the Premier mill

Derek White, President and CEO of Ascot commented, “Material from the Silver Coin property was successfully mined and processed in the early 1990s at the Premier mill. The project’s proximity to Ascot’s infrastructure and the identical metallurgical characteristics create key synergies with Ascot’s existing resources. We are excited about the exploration potential at the Silver Coin property and the potential to rapidly add to our resource base on our path forward. We are very pleased that we were able to reach a mutually beneficial agreement with Jayden and Mountain Boy and look forward to creating value for all stakeholders by consolidating the high-grade resources in the southern part of the prolific Golden Triangle.”

Summary of Transaction terms

Pursuant to the share purchase agreement with Jayden (the “Jayden SPA”), Ascot will acquire all of the issued and outstanding shares of Jayden’s subsidiary, Jayden Resources (Canada) Inc. (“Jayden Canada”), in exchange for 14,987,497 Ascot common shares (“Ascot Shares”). In addition, Ascot will issue up to 1,715,684 additional Ascot Shares for the settlement of options and warrants exercised before the closing date with the net cash proceeds of the warrants accruing to Ascot. Jayden Canada owns an 80% joint venture interest in the Property pursuant to a joint venture agreement with Mountain Boy (the “JV Agreement”). Concurrent with the entering into the Jayden SPA, Ascot has entered into a purchase agreement with Mountain Boy (“Mountain Boy Purchase Agreement”) to acquire the remaining 20% joint venture interest in the Property in exchange for 3,746,874 Ascot Shares. In addition, Ascot will issue up to 428,921 additional Ascot shares to Mountain Boy for the settlement of Jayden options and warrants which may be exercised before closing. Pursuant to the Mountain Boy Purchase Agreement, Mountain Boy has also agreed to waive its right of first refusal under the JV Agreement. The Mountain Boy Purchase Agreement provides that Ascot’s acquisition of the 20% interest in the Property from Mountain Boy is conditional on the acquisition of the 80% interest in the Property from Jayden.

The Jayden SPA contains standard representations, warranties and covenants for a transaction of this nature. The Jayden SPA also includes standard non-solicitation provisions of Jayden in favour of Ascot and requires Jayden to pay Ascot a break fee of $450,000 in the event of the acceptance by Jayden of a superior offer or a change in recommendation by the Jayden board of directors in respect of the Transaction. Completion of the Transaction is subject to a number of conditions, including receipt of shareholder approval by the Jayden shareholders and receipt of approval by the TSX Venture Exchange. Certain shareholders of Jayden and all of the officers and directors of Jayden (collectively, the “Locked-up Shareholders”) have entered into voting support agreements with Ascot, whereby they have agreed to vote their Jayden common shares in favour of the Transaction and to restrict trading of Ascot Shares distributed by Jayden to its shareholders pursuant to the Transaction for a period of 6 months following closing of the Transaction. The Locked-up Shareholders own or have control or direction of over approximately 31.4% of the current issued and outstanding shares of Jayden. The Jayden shareholder meeting is expected to occur in early October, 2018 and the Transaction is expected to close shortly thereafter.

The Silver Coin Property

The Silver Coin Project is an advanced-stage, gold-silver property located 25 kilometers north of Stewart, B.C., 800 metres from Ascot’s Big Missouri project and 5 kilometers away from the Premier mill. Mineralization is characterized as epithermal gold-silver deposit with base metal sulfide-bearing breccias and veins similar to those mined at the Premier Mine. The total mineral resource estimate for the high-grade core of Silver Coin already consists of 702,000 tonnes grading 4.46 g/t Au in the indicated category and 967,000 tonnes grading 4.39 g/t Au in the inferred category in accordance with National Instrument 43-101 standards by Mining Plus Canada dated August 23, 2013. The resource estimate was stated at a cut-off grade of 2 g/t Au. In 1991, Westmin Resources mined the Facecut-35 zone and extracted 102,539 tonnes of material grading 8.9g/t Au and 55.5g/t Ag for an equivalent grade of 9.28g/t AuEq. The gold recovery for this material was 92.9% and the silver recovery was 45.7%2. The project has room for expansion of the mineralized zones and significant exploration potential for additional zones.

Source: Company Press Release