The hydroelectric portfolio has a weighted average remaining concession term of 45 years

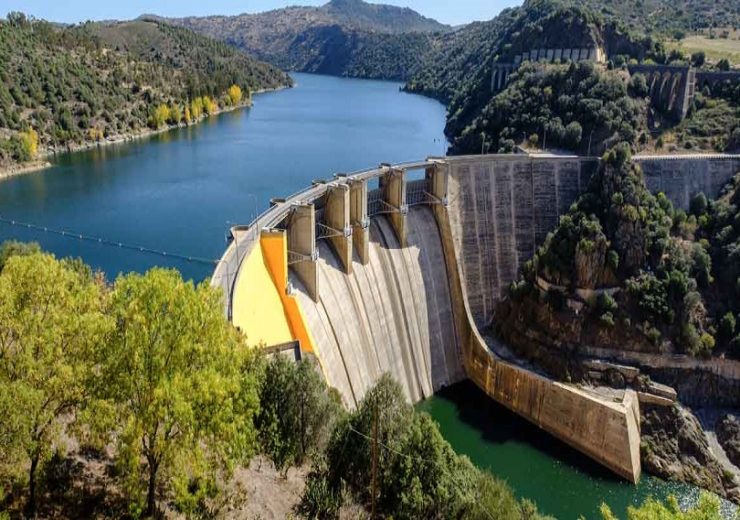

ENGIE will operate and maintain the hydroelectric portfolio. Credit: ENGIE.

A consortium led by French electric utility ENGIE has won a bid to acquire a hydroelectric portfolio from EDP for €2.2bn ($2.45bn) in Portugal.

The 1.7GW hydroelectric portfolio comprises of three newly commissioned pump storage units along with three recently repowered run-of-river plants. It has a weighted average remaining concession term of 45 years.

ENGIE will operate the hydroelectric portfolio

ENGIE, which has a 40% stake in the consortium, will operate and maintain the hydroelectric portfolio and also offer energy management services.

The other partners in the consortium include Crédit Agricole Assurances (35%) and Mirova (25%), an affiliate of Natixis Investment Managers.

Part of the Douro river system, the hydroelectric facilities consist of six units divided into two categories that include three cascade Run-of-River plants with pondage, and three recent Pumped storage units.

The acquisition of the hydroelectric portfolio will assist ENGIE in the implementation of its zero-carbon strategy. The portfolio is expected to complement the company’s existing Iberian portfolio of onshore wind (1.1GW) and solar (50MW) power, most of which is already in partnership with Mirova.

The transaction is expected to be completed during the second half of next year.

ENGIE CEO Isabelle Kocher said: “Our increased focus on providing clients with 100% renewable power tailored to their needs will enable ENGIE to be the leader of the zero carbon transition.

“This transaction accelerates the implementation of ENGIE’s strategy. Our target to add 9 GW renewables over the period 2019 – 2021 is confirmed and this acquisition comes on top of it.”

EDP said in a statement: “This transaction aims to optimize our portfolio, decreasing our exposure to concentrated hydro volatility and merchant prices, reinforcing the low business risk profile and improving financial leverage.”

The acquisition will have a net debt impact of €650m for ENGIE, which claims to have a global hydro capacity of 20GW currently.