The pandemic has seen the value of acquisitions falling to $46.6bn in the first half of 2020 - more than $18bn down on the same period of 2019

David Kurtz, director of analysis, mining and construction at GlobalData, believes investment in predictive maintenance is “critical for mines looking to improve productivity and reduce expensive downtime” (Credit: Pixabay/herbert2512)

The coronavirus pandemic caused an “unanticipated shock” and crippled global mining deal value in the first half of 2020, says an industry analyst.

The impact of the virus, which has had a significant effect on a number of key sectors, led to the value of acquisitions falling to $46.6bn in the first half of 2020 — more than $18bn down on the same period of 2019

According to data and analytics firm GlobalData an “expected slump” in the global economy, steered by a series of challenges, has kept investors away from “long-term financial instruments”, resulting in a 12.7% year-on-year fall in the capital raised by mining companies.

Mining mergers and acquisitions (M&As), despite experiencing a “decent” first quarter due to deals involving gold, fell by 51.6% during the first half of 2020.

Kirkland Lake Gold made the largest mining deal despite coronavirus

Vinneth Bajaj, senior mining analyst at GlobalData, said the largest of the completed deals was Toronto-based Kirkland Lake Gold’s acquisition of its fellow Canadian miner Detour Gold for $3.79bn.

“By including the Detour Lake mine to its production assets, the company aims to produce up to 1.5 million ounces of gold in 2020,” he added.

“With this acquisition, Kirkland also added $173.9m in cash and repaid Detour’s debt of around $98.6m.

“Furthermore, with strong liquidity, the company is well-positioned to cope with Covid-19 challenges.

“Kirkland also raised $1m in a private placement of shares primarily to complete phase 2 permitting of its Hasbrouck project in the US.”

Coronavirus impact was ‘evident on the completion rate’ of deals

On a global scale, the impact of coronavirus was “evident on the completion rate”, following a 41.7% year-on-year fall in completed deal values, according to GlobalData.

Seven of the top 10 asset transaction deals across the first half of the year involved gold.

Topping the list was New York’s Mudrick Capital Acquisition Corporation, which acquired an equity interest and assets from Colorado-headquartered Hycroft Mining Corporation for $537m to form Hycroft Mining Holding Corporation.

Elsewhere, state-owned PT Indonesia Asahan Aluminium raised $2.5bn in the first half by offering three sets of bonds at 4.75% (due in 2025), 5.45% (due in 2030) and 5.8% (due in 2050).

Of that total, 60% will be used to pay debts and to acquire 20% of PT Vale Indonesia, a subsidiary of Brazilian miner Vale, while the remaining 40% will be used to refinance the company’s older bonds.

Arizona-based miner Freeport-McMoRan managed to raise a collective $1.3bn, which will be used to fund its purchase of certain outstanding senior notes due in 2021 and 2022.

According to Bajaj, the total volume of deals increased from 1,811 in the first half of 2019 to 2,271 in the first half of 2020, due to a 79.7% increase in the total number of “announced capital raising deals” in that period.

“This was accompanied by a 28.4% increase in the volume of completed M&A deals,” he added.

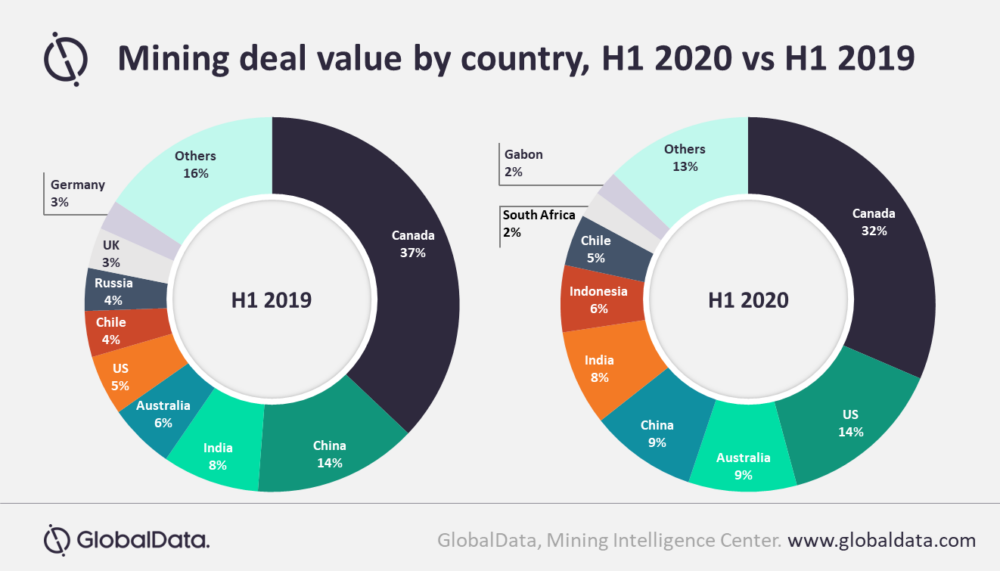

“Canada, US, Australia, China and India accounted for nearly 87% of the total deal volume and more than 72% of the total deal value.”