BP profits suffered in the third quarter of 2019 on the back of weak oil and gas prices, the impact of Hurricane Barry and infrastructure maintenance.

Underlying profits for the quarter stood at $2.3bn, compared to $3.8bn in the same period of last year – reflecting a 40% year-on-year decline, which was less than analysts had expected.

The effect of a one-off $2.6bn charge linked to asset sales caused the UK oil major to report a $700m net loss for the quarter – the first time that has happened for more than three years.

At the time of writing, shares in the company were down just over 3% in the day’s trading following the news.

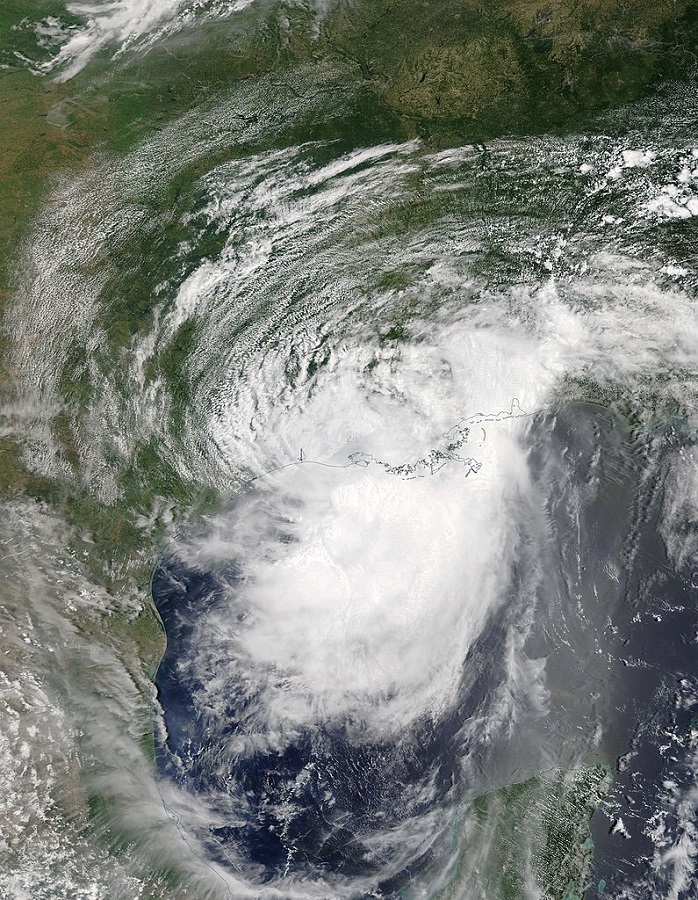

Outgoing BP chief says third quarter 2019 profits were hurt ‘significantly’ by hurricane in US Gulf of Mexico

BP chief executive Bob Dudley said: “BP delivered strong operating cash flow and underlying earnings in a quarter that saw lower oil and gas prices and significant hurricane impacts.

“Our focus remains firmly on maintaining financial discipline and delivering safe and reliable operations throughout BP.

“We’re also continuing to advance our strategy, making strong progress with our divestment plans and building exciting new opportunities in fast-growing downstream markets in Asia.”

Earlier this year, it was confirmed Dudley will step down from his role at the helm of BP after almost a decade in February.

He will be succeeded in the role by Bernard Looney, who currently heads the firm’s upstream division.

BP offloads Alaska interests during as part of restructuring drive

Low oil prices were partly to blame for the drop in earnings during the quarter, with weak market conditions seeing a barrel of Brent crude trading at an average of $62 during the quarter, compared to $69 in the previous three months and $75 a year earlier.

BP revealed that upstream production – excluding output from its near-20% stake in Russian oil company Rosneft – was down 2.5% on the previous year at 2.568 million barrels of oil equivalent per day.

This decline coming as a result of “maintenance across a number of regions and weather impacts of Hurricane Barry in the US Gulf of Mexico”.

Divestment income rose to $7.2bn at the end of the quarter, buoyed by the sale of all BP’s interests in Alaska to Hilcorp Energy in August for $5.6bn – with this income expected to rise to $10bn by the end of the year.

The decision to restructure the business follows BP’s $10.5bn purchase of shale assets from miner BHP in 2018, which has seen it increase its presence across the productive oil and gas regions of the US.

The company confirmed it will issue a quarterly dividend of 10.25 cents per ordinary share, expected to be paid in December.