Asia is expected to “dominate” global liquefied natural gas (LNG) regasification capacity additions by 2025, says a report.

The analysis by data and analytics firm GlobalData shows that the region will contribute to about 74% of the total new build and expansion projects by the mid-decade.

Europe is set to be the second-largest contributor, accounting for about 9% of the total additions, while the Middle East will provide about 7% of the industry’s projects during the period between 2021 and 2025.

“China primarily drives the LNG regasification capacity additions in Asia by 2025,” said Bhargavi Gandham, oil and gas analyst at GlobalData.

“Amongst new build and expansion projects expected to start operations during 2021 to 2025 in China, the Tangshan II terminal is expected to witness the highest capacity additions in the country with 584.4 billion cubic feet (bcf) by 2025.”

China to help Asia lead the way in global LNG regasification capacity additions by 2025

GlobalData projects China to lead the global LNG regasification capacity additions, contributing to 27% of the total LNG regasification projects by 2025.

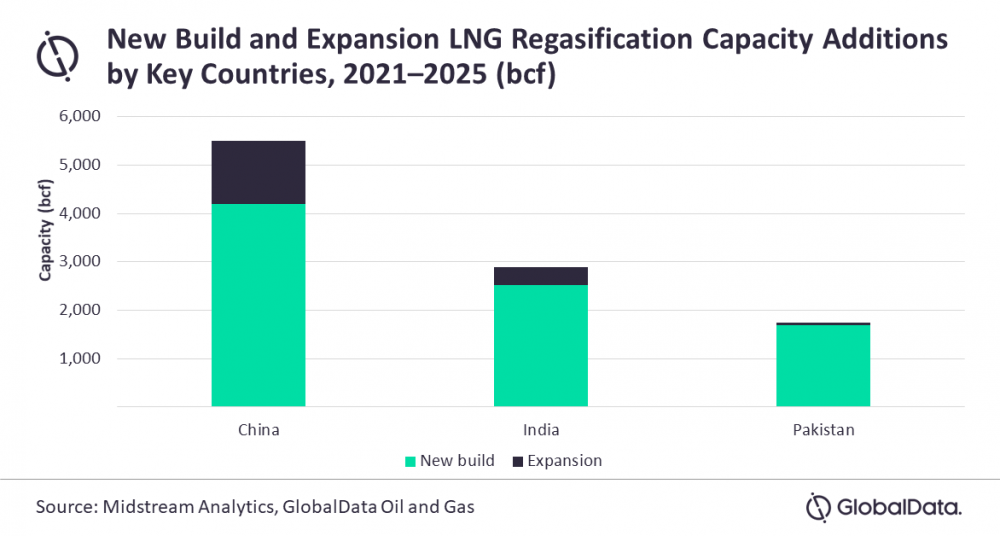

Its report shows that the East Asian powerhouse will add a new-build LNG regasification capacity addition of 4,191 bcf across the next four years, while expansion projects account for the remainder with 1,308 bcf.

Alongside Tangshan II, Yantai I and Zhoushan III are key projects that will help increase the nation’s capacity, providing 487 bcf and 340.9 bcf by the mid-decade.

GlobalData expects India to be the second-largest contributor to global LNG regasification capacity additions by 2025, adding 2,882 bcf. Expansion projects account for the remainder of its capacity additions at 365 bcf across the period.

The report highlights Karwar Floating and Jaigarh Port Floating as important contributors to India’s regasification additions, with the projects set to provide 365 bcf and 274 bcf.

Meanwhile, Pakistan is projected to be the third-largest contributor to the LNG regasification capacity additions globally at 1,752 bcf.

Its new build capacity additions will account for 1,697 bcf, while the country’s expansion projects will provide 55 bcf by 2025. Port Qasim, which is expected to start operations in 2023, is the largest upcoming new-build development with a capacity of 438 bcf.