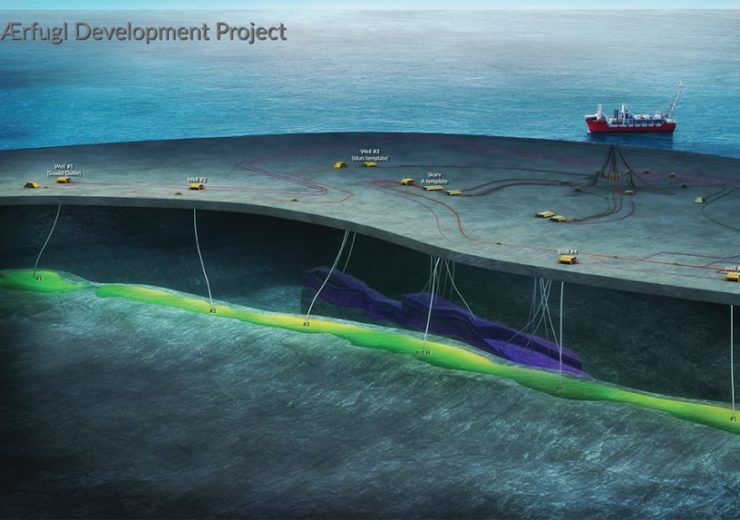

The two phases of the Ærfugl project will be tied into the existing FPSO unit at the Skarv field

The Ærfugl field is being developed in two phases. (Credit: Aker BP)

Aker BP and partners have commenced production from the first Ærfugl phase 2 well in the Norwegian Sea, three years ahead of schedule.

The NOK8bn ($880m) Ærfugl project is being developed in two phases, both of which be tied into the existing floating production, storage and offloading (FPSO) unit at the Skarv field, located about 210km west of Sandnessjøen.

The first phase of the project involves the development of the southern part of the Ærfugl field using three new wells. The second phase consists of an additional three wells in the northern part of the field.

Aker BP operations & asset development senior vice-president Kjetel Digre said: “The acceleration of production from Ærfugl Phase 2 means increased value creation for the Ærfugl joint venture, the supplier industry and the Norwegian society in the form of increased revenues.”

Norway’s Ministry of Petroleum and Energy approved the plan for development and operation for both the phases in April 2018.

As per the plan for development and operation (PDO) estimates, the Ærfugl holds gas reserves of about 35 billion standard cubic metres (Sm3).

The Ærfugl reservoir extends over 60km and is 2-3 km wide.

Original start-up plan for Ærfugl project phase 2 was 2023

Last year, Aker BP and its partners Equinor, Wintershall DEA and PGNiG have agreed to go ahead with the Ærfugl project phase 2, with an objective to bring it online three years ahead of the original target of 2023.

Digre continued: “However the good news are offset by the fact that we are facing a global crisis that none of us have experienced before. Investments and explorations activities offshore Norway are put on hold. Tens of thousands of employees in our industry are currently at risk.”

“It is clear that the industry’s proposal for temporary adjustments in Norway’s tax regime to improve the industry’s cash flow in the short run – without reducing the total tax payments in the long run – will result in increased activity and new investment opportunities offshore Norway within the next 12 – 24 months.”