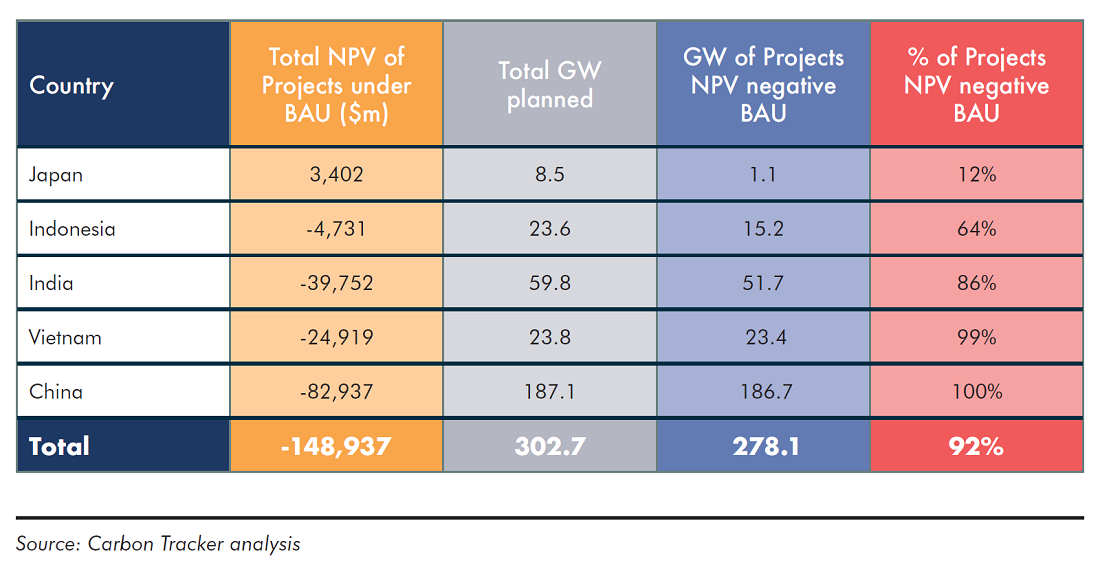

New coal power projects planned across Asia pose a $150bn investment risk – even in the absence of tougher climate policies – and should be cancelled, according to a new analysis from financial think tank Carbon Tracker.

These include the vast majority (92%) of more than 600 planned or under-construction projects in China, India, Indonesia, Japan and Vietnam – totalling 300 gigawatts (GW) capacity and accounting for 80% of the global development pipeline.

“These last bastions of coal power are swimming against the tide, when renewables offer a cheaper solution that supports global climate targets,” says Catharina Hillenbrand von der Neyen, Carbon Tracker’s head of power and utilities.

“Investors should steer clear of new coal projects, many of which are likely to generate negative returns from the outset.”

Carbon Tracker’s analysis suggests progress towards reducing global coal-fired power generation this decade rests “almost entirely” with this handful of Asian markets, particularly China and India, which collectively account for around three quarters of total installed capacity worldwide.

But some investors appear to be ignoring the risks of backing new projects, both in terms of climate and economic arguments, the report states. “By committing money to operating coal assets there is a significant risk of either not recouping the investment or achieving an investment return below what was originally expected.”

A quarter of coal power already unprofitable, and new climate policies would pose further investment risk

Faced with “overwhelming” competition from low-cost renewables, the analysis finds the economics of even existing coal plants to be “extremely fragile”, with 27% of the current global fleet already unprofitable – rising to 66% by 2040 based on current policies and regulations.

Even where profits are being made, almost one-third of worldwide coal operations are returning “very close to break-even levels” of no more than $5 per megawatt hour (MWh).

“A 5% annual reduction in utilisation versus our base case would see global coal unprofitability almost double to 52% by 2030 and rise to 77% by 2040,” the report adds.

With around 70% of the world’s coal plants currently reliant on some form of government policy support such as subsidies, any tightening of emissions regulations that removes these “market distortions” would likely leave projects further exposed to value destruction.

Stronger national commitments to achieve Paris Agreement targets could create a $220bn stranded asset risk for coal plants currently in operation, with ten companies accounting for 40% of this risk exposure, notably India’s NTPC and Adani Group, and Indonesia’s PLN.

Coal projects still being planned, despite ‘fragile economics’

According to Carbon Tracker’s analysis, new renewables already outperform 77% of operating coal facilities on the cost of producing electricity – with this figure rising to 98% by 2026 and 99% by 2030 based on current policy scenarios.

This finding is backed up by a recent report from the International Renewable Energy Agency (IRENA), which says 62% of the renewable capacity added globally in 2020 is undercutting even the most cost-competitive coal-fired units.

Ahead of the COP26 climate summit in November, pressure is mounting on major economies to commit to a coal phase-out, while UN Secretary General António Guterres has urged international investors to end financing support for new projects.

Hillenbrand von der Neyen says: “Coal no longer makes sense financially or environmentally. Governments should now create a level playing field which allows renewables to grow at least cost, using post-Covid stimulus spending as an opportunity to lay the foundations for a sustainable energy system.”

But despite a record 4% drop in coal generation in 2020 caused by the coronavirus pandemic, a rebound in the sector is expected this year, driven by higher usage across Asia, particularly China.

The International Energy Agency (IEA) has warned this trend will drive the largest annual rise in energy-related carbon emissions for more than a decade – around 1.5 billion tonnes.

At the Leaders’ Summit on Climate hosted by the White House in April, Chinese President Xi Jinping – whose country accounts for more than half the world’s coal-fired generation – hinted at a national coal phase down, but not until at least 2026 during China’s 15th five-year economic plan.

“New coal plants are still being built and planned, which typically implies a commitment of at least 40 years,” Carbon Tracker states.

“This is a risky bet as these coal plants are highly unlikely to generate a return above their cost of capital over the project lifetime as a cocktail of carbon pricing, lower-cost renewables continuing to displace fossil fuels, and tight carbon budgets in the wake of net-zero announcements leave limited space for running polluting coal plants and may lead to early closures driven by policy decisions.”