After years of high production rates for US shale oil and gas, the industry is currently facing some of its biggest-ever challenges following the effects of the coronavirus pandemic and a drastic drop in energy demand

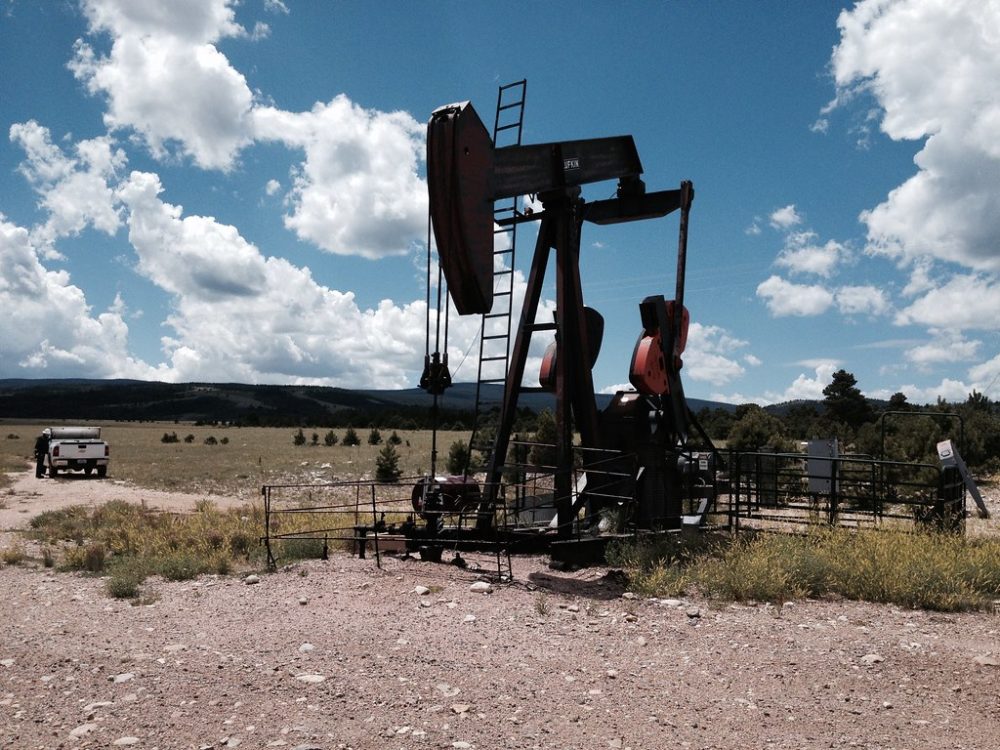

The US has about 27.2 million tonnes per annum of petrochemical capacity under construction (Credit: Pxhere)

The US shale industry has gone through several boom and bust cycles since exploration of the sedimentary rock first took place in the 1800s. But following the effects of the coronavirus pandemic, up to 73 shale producers could be at risk of filing for bankruptcy this year. James Murray finds out how the industry arrived at this point in the US and what its future might hold.

Just over a decade ago, Chesapeake Energy led from the front as a “new wave of fracking” set US shale on its way towards an unprecedented rise in popularity.

The Oklahoma-headquartered oil and gas firm was recognised as one of the stars of the hydrocarbon exploration boom and was named Energy Producer of the Year by S&P Global Platts in 2009.

That same year, US shale gas production grew by 54% to 3.11 trillion cubic feet from 2008, while remaining proven US shale reserves at the end of 2009 increased by 76% to 60.6 trillion cubic feet, according to the US Energy Information Administration (EIA).

The industry also catapulted the nation from a minor player to becoming the world’s largest oil producer, explaining why President Trump has prioritised fossil fuels and removed the US from the 2015 Paris Agreement.

But after years of high production rates for shale oil and gas, the industry is currently facing some of its biggest-ever challenges following the effects of the coronavirus pandemic and a drastic drop in energy demand.

That drop in demand has already led to 19 of the nation’s smaller companies filing for bankruptcy this year, according to Texas-based law firm Hayes and Boone.

Recent analysis from Rystad Energy, an independent energy researcher, placed as many as 73 exploration and production (E&P) firms in the US at risk of filing for bankruptcy if the situation continues without intervention from the federal government.

In a damning indictment of the struggles E&Ps are facing, it has been reported that Chesapeake is ‘preparing for bankruptcy’.

The International Energy Agency (IEA) estimated in May that US shale will suffer a 50% decline in investment activity by the end of the year, as companies struggle to balance the books amid the crisis and investors show reluctance to fund new production efforts in the low-price environment.

The Suadi Arabia-led price war — triggered in March after Russia refused to cut oil production to keep prices at a moderate level — led to US oil temporarily falling into negative pricing and has inflicted a significant impact on E&Ps this year.

This is not the first major hurdle shale producers have faced in recent years — a previous Saudi-led price war in 2015 saw the oil price tank from about $100 per barrel to about $50 per barrel.

But Diveena Danabalan, senior upstream energy analyst at the Energy Industries Council (EIC), says that move “didn’t kill” US shale then and she doesn’t believe it will this time around either.

“However, I think there will be a wave of bankruptcies and, bizarrely, a lot of people have been saying this is needed for this sector because a lot of the companies in the shale patch are uneconomical,” she adds.

What is shale?

Shale is a fine-grained sedimentary rock that forms when silt and clay-size mineral particles are compacted, and it is easily broken into thin, parallel layers.

Black shale contains organic material that can generate oil and natural gas, which is trapped within the rock’s pores.

To retrieve the resources, a drilling technique known as fracking is required, which involves fracturing rock deep underground.

Energy firms will first drill vertically downwards into the ground at between 6,000ft and 10,000ft, and then horizontally by more than a mile.

Hairline cracks with a radius of about 300ft are then opened up in the rock by pumping in water, sand and some chemicals, allowing gas to flow into the pipes.

In the US, shale natural gas resources are found in shale formations that contain significant accumulations of either one of or both natural gas and oil – and these sites are found in about 30 of the nation’s states.

Why is fracking a contentious issue?

Daniel Yergin, vice-chair of global consulting firm IHS, told the US Congress in February — before the effects of the coronavirus began to take effect — that his company projected the industry to rake in about $113bn in federal and state government revenues this year.

But despite the economic pitfalls associated with fracking’s downturn, there will no doubt be many environmentalists celebrating its demise.

Ever since it was introduced, it has been a contentious issue, which is why the UK, Ireland, France, Germany and the Netherlands have all banned the activity.

Supporters of the complex engineering process claim it can provide investment, jobs and energy assets — but environmentalists strongly oppose it due to concerns it can contaminate the water supply, cause earthquakes and destroy natural landscapes.

Do the positives of fracking outweigh the negatives?

Those in favour of fracking argue it is a technology that provides benefits the world cannot afford to live without.

Their reasoning follows that renewable energy is not yet ready to meet the demands of the planet’s population on its own, and using shale gas — which has enough supply to last 200 years, by some estimates — is the only viable alternative to the continued consumption of other fossil fuels.

But hydraulic fracturing is also highly water-intensive — wells require anything up to 20 million gallons of water and a further 25% on top of that is needed for drilling and extraction.

This has a major impact on local water sources and the communities that use them, with a 2013 Wall Street Journal study finding that more than 15 million Americans have lived within a mile of an exhausted fracking site since 2000.

Additionally, residents often have no say as to whether operations may be approved near their home, as the approval process considers the oil beneath the land, rather than the land itself – which could have a knock-on effect on housing markets.

Are environmentalists’ fracking concerns overstated?

The pro-fracking camp argues claims from environmentalists concerning the potentially damaging impact of the process are overstated.

And there is research to back this up — a 2014 US Department of Energy study found no evidence that chemicals from the fracking process had contaminated groundwater at one Pennsylvania drilling site, a claim that’s been one of the chief complaints from those opposed to the process.

But anti-fracking environmentalists have plenty of research to support their assertions and can point towards the well in Bradford County, Pennsylvania, as evidence.

In 2011, it malfunctioned and spewed thousands of gallons of contaminated water for half a day, showing the potential dangers associated with hydraulic fracturing.

That same year, Duke University tested drinking water at 60 fracking sites across Pennsylvania and in New York.

Its researchers found levels of methane in the sites’ drinking water “fell squarely within a range that the US Department of the Interior says is dangerous and requires urgent hazard mitigation”.

What was the US shale boom?

US shale history

The exploitation of shale in the US dates back to the 1800s and has gone through “several boom and bust cycles”, according to the EIC’s Danabalan.

She says a lot of the wells that were drilled up until about 2009 were “conventional” — meaning there was “no stimulation from fracking”.

“What we started seeing from 2009 onwards was the rise of unconventional, which is hydraulic fracturing and stimulation,” she adds.

“There were advances in this in the late 1990s and early 2000s and that really changed the game — in terms of what could be taken out of shale rock.”

At first it was only shale gas that was built around the hydraulic fracturing process, but to start stimulating the shale boom in around 2009, Danabalan says horizontal drilling made it possible to “expose a greater area of productive rock”.

“So, neither of these practices were new, however, using these techniques and combining them together actually transformed the viability of shale gas.”

Fracking impact on US oil production

The US’ oil output was thought to have peaked back in 1970, when it was producing just over 10 million barrels per day (bpd).

But until about 2009, which was when the “new wave of fracking” came about, the nation appeared to be in “long-term, terminal decline from conventional wells”, claims Danabalan.

She says producers previously never thought the complex fracking techniques they had been using to retrieve shale gas were viable to also extract oil from the rock, but Texas-based EOG Resources was one of the first companies to prove it was possible.

“Between 2010 and 2015, US oil production grew in a way that has very few parallels to this day,” she adds.

“In 2009, the export average was about 5.4 million bpd and, by 2015, it had pretty much doubled that output – which is unheard of.

“However, despite the initial rise in the US’ output, there was actually no discernible effect on global markets until around 2014 and 2015, which was when we saw the oil price crash.”

She believes this is largely because the US “doesn’t export a lot of crude oil” – although figures from the EIA show that last year it increased its exports of the fossil fuel by 45% to 2.8 million bpd.

Danabalan says it does, however, export a “high amount of refinery products like gasoline, jet fuel and diesel”.

She adds that it was imports of crude from other countries that dropped during the crash, before then being replaced by domestic production.

By 2019, the US’ oil production had risen to just short of 13 million bpd, of which about 53% was produced from shale, according to Danabalan.

“Without shale, the US would not be on the same levels of production as Saudi Arabia and Russia,” she adds.

“Back in 2019, it briefly surpassed both Saudi Arabia and Russia in terms of oil export and became the top producer in the world because of shale — which is why it’s so important.

“Shale essentially gave the US energy independence.”

Is the shale boom over?

Financial woes

Danabalan admits that shale has always been a “massively puzzling market” to her, mainly because everybody from major operators, to banks and private equity firms have “always been willing to take a chance on shale”.

But the main criticism she’s heard labelled at the industry is that it was “basically a losing proposition for most companies”.

Analysis published in March by the US-based Institute for Energy Economics and Financial Analysis (IEEFA) claims that, in 2019, the US fracking industry “continued its unsuccessful decade-long quest to produce positive free cash flow”.

Its data looked at a cross-section of 34 North American shale-focused oil and gas producers, which found that the companies spent $189bn more on drilling and other capital expenses over the past decade than they generated from selling oil and gas.

On top of that, the results included a “disappointing” $2.1bn in negative free cash flows last year.

Kathy Hipple, a financial analyst at the IEEFA, said the institute has been sending out warnings for a long time that E&Ps have “created an oil and gas glut that has not been rewarded by anticipated earnings”.

“In what world could this be considered a successful business model?” she added.

The IEEFA’s analysis noted four worrying trends for the US shale industry:

- High and rising debt — Total long-term debt rose to $106bn at the end of 2019, an increase of $1.5bn from the prior year, and the highest level since 2015. If these companies are unable to produce significant cash flows over the next several years, they may be unable to pay off their debts as they mature – which could trigger debt write-downs or bankruptcies.

- Disappointing revenue — Despite higher production levels, total 2019 revenues among this cross-section of companies fell by $5.6bn year-over-year.

- Significant net losses — Collectively, these companies reported net losses of $6.7bn in 2019, largely due to accounting impairments and write-downs of oil and gas assets.

- Declining cash balances — The 34 companies spent down their cash reserves by $14.4bn from 2016 through the end of 2019. At the end of 2019, cash reserves among these companies were at their lowest level since 2012.

In the analysis, IEEFA’s director of finance Tom Sanzillo, said that “even after a decade of technical improvements and increasing investor scrutiny, most shale-focused companies still burn through more cash than they produce”.

“The truth is undeniable — fracking is a failed experiment,” he added.

Bankruptcies

Danabalan says shale has had “quite a unique mind-set compared to other markets”, because it’s been producing high volume to “get market share regardless of how much free cash flow it’s making at the time”.

“Even though the US eventually flooded the market with shale oil and gas, shale has actually yielded quite low returns for investors,” she adds.

“Shale companies instead reinvested pretty much all of their money into re-fracking and drilling new wells, and it also just raised top executive pay — instead of paying dividends back to investors.”

She believes those actions started “burning” the E&Ps in 2019.

But some shale companies began “belt-tightening activities” last year, in which they “basically stopped drilling unproductive wells and started trying to refine their portfolios to focus on high-return wells”, according to Danabalan.

“However, I think it was a case of too little too late for some investors and they started withdrawing from the sector, which is what started sparking off the bankruptcies,” she adds.

“Some companies haven’t actually generated a single year of free cash flow in the past decade and Chesapeake is notorious for doing this.”

But, with a bankruptcy filing just around the corner, this lack of financial stability appears to have finally caught up the Oklahoma-based producer.

At the peak of its powers, Chesapeake’s value stood at about $35bn. But its shares have plummeted by more than 90% since the turn of the year and its market capitalisation now stands at just under $127m.

The former shale giant is just one of several producers to have been caught in the eye of the storm, though, as the biggest independent shale oil groups in the US totalled a record combined loss of $26bn in the first quarter of this year, the Financial Times reported.

With more than 200 North American oil and gas bankruptcies taking place between 2015 and 2019, analysts have warned that figure could double by the end of next year if oil prices fail to rise quickly enough – with several firms drowning in their debts.

After the last downturn in oil prices led to more than 200,000 job losses across the US oil and gas industry, there will be huge fears that another wave of that magnitude could well be on its way.

Current production levels

Although crude oil prices have recently rebounded slightly and now sit above $40 a barrel, the break-even for shale oil producers is between $50 and $70 a barrel.

Some previous estimates forecasted that this year’s price collapse sent the US’ output down by as much as 2 million bpd in April, Reuters reported.

The EIA projected in May that crude oil production in the seven major US shale basins would fall from 8.019 million bpd to 7.822 million bpd – marking a record monthly decline of 197,000 barrels.

But the situation appears to be even worse than initially expected, with June levels currently at 7.725 million bpd and July’s production set to slump further to 7.632 million bpd.

The EIA also predicted shale gas production from the seven basins would drop from 82.24 billion cubic feet per day (Bcfd) to 81.47 Bcfd in June.

Current levels have fallen just under the agency’s projection at 81.25 Bcfd and are expected to be about 80.56 Bcfd in July as production continues to drop.

Outlook for US shale

Investment woes

The outlook for the industry could be set to take a further hit this year, as it is poised to suffer a 50% drop in investment activity, piling further pressure on a sector already taking extreme measures to survive the pandemic-triggered oil crash.

Although the market is now showing signs of rebalancing as lockdowns ease and production cuts are enforced, there remains a severely weakened appetite for investment in this low-price, demand-sapped environment.

It is a problem facing the oil and gas industry as a whole, with investment across the spectrum expected to decline by almost a third this year, according to analysis in May by the IEA — but shale will be by far the worst-affected, particularly the smaller independents.

Energy-focused private equity firm Kimmeridge Energy Management published a report in February that called for a “new business model” for E&Ps.

The New York-headquartered company labelled the shale industry as currently “uninvestable” and said it was in a “time of crisis”.

It added: “The industry’s response so far has been to hunker down, change little about the business model, and hope for a cyclical recovery. We believe this is a mistake.

“What is happening is more than a cyclical low, it is a response to a decade of poor capital allocation choices made with a mind-set of growth for growth’s sake, which has only hurt public equity investors.

“The central issue is that the business model of shale was based on resource scarcity, and that premise drove capital allocation decisions, executive compensation schemes and valuation methodologies.

“Instead, the abundant production from shale has turned the notion of scarcity on its head.”

Kimmeridge believes the world will “inevitably transition away from fossil fuels” and the US public E&P sector is “woefully unprepared”.

“Companies should be selling assets, cutting costs, repairing balance sheets and returning capital to shareholders at an accelerating pace,” it added.

“Despite all the forces that are conspiring to make the E&P sector uninvestable today, we remain optimistic that prospective returns can be attractive if the appropriate actions are undertaken by the industry with the immediacy and voracity that they demand.”

Muted production restarts for major E&Ps

As the industry looks to reconsolidate, Danabalan believes we are “probably likely to see mergers, acquisitions and assets being sold at bargain-basement prices”.

“Hopefully, that is going to put a lid on growth in shale for a bit,” she adds.

“Mainly because as soon as the West Texas Intermediate (WTI) starts moving above $30 a barrel again — which it is at the moment — the producers are going to start turning on the taps again because they need to in order to generate revenue.

“But, at the moment, it’s only the small players — which is good to a certain extent because they don’t really have much effect on the output from the US.

“I guess the response from the majors in terms of restarts for production is incredibly muted.

“US companies can’t really afford to come roaring back into production as soon as the oil prices come back to life, because this is going to cap the price rise for everybody else.

“Basically, in trying to claw back production and revenue, they’re going to tank the rest of the sector — which is untenable.”

Decline curve for shale is ‘very steep’

Denabalan says the decline curve for shale oil and gas is “very steep” and this is “being seen more and more in mature basins, such as the Permian”.

She believes that if the industry wants to “continue making decent returns”, it’s very likely that it’s going to have to “exploit new plays” by potentially moving out of existing basins and going to find new ones.

“I think there is going to definitely be an emphasis on lower break-even costs,” she adds.

“The companies that do survive are going to have to really bring down break-even costs and start thinking more about returning dividends to their investors – instead of blindly continuing to drill.

“It’s almost like this weird cycle of trying to keep your production on a plateau essentially, because wells decline so fast that you need to continue re-fracking and drilling new wells at quite a substantial rate, and that’s where most of your reinvestment goes.

“So, I believe portfolio vetting is the way forward for those companies.”