Petrochemicals are set to dominate upcoming projects across the oil and gas value chain in China by 2025, says an industry report.

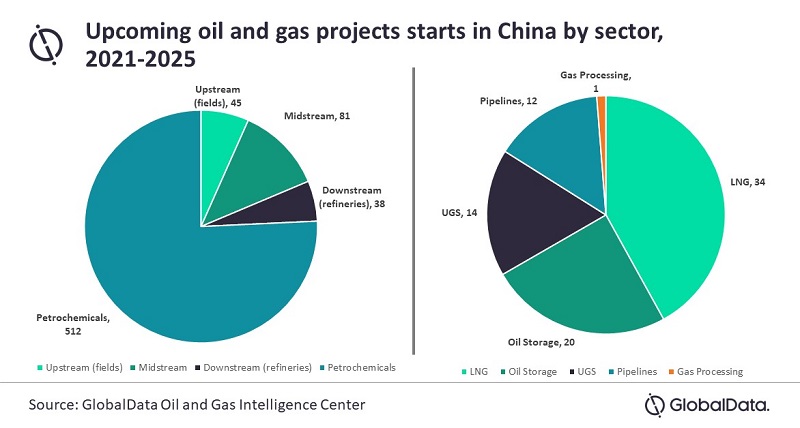

The analysis by GlobalData shows that of the 676 projects set to begin operations between 2021 and 2025, 512 will be in the petrochemical sector – accounting for 76% of the total number of developments across the country’s oil and gas industry.

The data and analytics firm notes that in petrochemicals, new builds dominate the project starts with more than 90% while the rest are expansion projects.

“Massive investments are currently underway in the Chinese petrochemicals sector by both domestic and foreign investors to meet the ever-growing demand,” said Soorya Tejomoortula, oil and gas analyst at GlobalData.

“Some of the major sectors driving petrochemicals demand in China include packaging, consumer durables and automobiles.”

Midstream segment set to make up 12% of upcoming oil and gas projects in China

Amongst the upcoming petrochemical projects in China is the Zhejiang Petrochemical Daishan Xylene Plant 2 – a key development with a capacity of 4.8 million tonnes per annum (mtpa).

The new-build plant, which is expected to cost $4.5bn, is currently in the construction stage and is expected to start operations by 2022.

In the upstream segment, GlobalData expects 45 projects to start operations in China by 2025. One notable project is Kenli 6-1 – a shallow water conventional oil field currently in the construction stage that is expected to begin operations this year.

Elsewhere, Weirong Phase II, which is the expansion of the Weirong shale gas field, is part of China’s efforts to push for unconventional resources development and increase domestic gas production.

The 81 midstream projects in the pipeline will mark about 12% of all oil and gas projects in the country, most of which are made up of LNG regasification developments.

One of the largest projects is the Yantai Expansion terminal, which has a capacity of 487 billion cup feet (bcf). It has received approval to start operations in 2025 and will cost $1.1bn.

In terms of pipelines, the 3,371km-Power Of Siberia 1 gas pipeline is currently under construction and is expected to start operations in 2025 at a cost of $9.3bn.