A blockage in the Suez Canal has caused the build-up of oil and gas vessels looking to transit the essential waterway at both the northern and southern anchorages.

The Egyptian canal, which connects the Mediterranean Sea to the Red Sea, has been blocked since Tuesday (23 March) after strong winds and a dust storm caused the 200-000 tonne MV Ever Given, a Panama-flagged vessel operated by Taiwanese shipping company Evergreen, to become wedged sideways across the canal.

There are now believed to up 150 ships lined up waiting to pass through the canal and, according to Wood Mackenzie’s VesselTracker, the largest impact is on container shipping.

The energy researcher estimates there are a total of 16 laden crude and product oil tankers that are expected to transit the canal delayed by the incident, amounting to 870,000 tonnes of crude and 670,000 tonnes of clean products.

“These ships are currently in the canal itself or waiting at either the North entrance to the Suez Canal (Port Said Anchorage and Great Bitter Lake Anchorage) or at the Southern Suez Anchorage,” said Wood Mackenzie principal analyst Mark Williams.

“There are several vessels that are located to the south of the canal entrance that we believe are scheduled to discharge at various southern Suez ports. Our data suggests that there have been no cargoes diverted to alternative routes such as around the Cape of Good Hope.”

Suez Canal blockage impact on oil price

Following the news of the Suez Canal blockage, oil prices have risen by about $2 per barrel. But, according to Wood Mackenzie, stocks of both crude and products are high in the Atlantic basin.

“A few days of delays in crude or product travelling through the Suez Canal to the west (Europe/Americas) should not have a prolonged impact on the Atlantic basin market,” said Wood Mackenzie vice president Ann-Louise Hittle.

“After the canal reopens, the crude market will shift focus towards the April 1 OPEC+ meeting to determine production levels for May.”

Update: Ever Given still run aground on the side of the Suez Canal. All tugboats available in the canal zone are assisting. Moving into the 13th hour with no movement. pic.twitter.com/ScARdwGTfF

— OSINTtechnical (@Osinttechnical) March 23, 2021

But if the blockage is prolonged, given the weakness in European demand for middle distillates and low refinery utilisation rates, Williams believes oil product trade flows from Europe/Mediterranean to the East of Suez will suffer a “greater impact”, reducing the availability of naphtha, petrochemical feedstocks and fuel oil to Asia.

“This would be supportive for Asia product prices and widen the West-East arb in the near term,” he added.

“The Sumed pipeline between the Red Sea and the Mediterranean is used to divert Middle East crude oil flows to Europe around the Suez Canal, so we expect minimal impact on such flows.

“Russian Black Sea crude exports beyond the Mediterranean will be limited by the blockage of the Suez Canal, so will need to be processed within by Mediterranean refiners.”

Suez Canal blockage impact on LNG

As for the impact of the blockage on liquefied natural gas (LNG), at least 15 ships initially due to transit the Canal on the same day were forced to wait at anchorages, with more arriving since Tuesday.

“The impact of this disruption on the LNG market will be limited if the disruption is solved within a day or two,” said Wood Mackenzie principal analyst Lucas Schmitt.

“Only a handful of LNG cargoes were in the close vicinity of the Suez Canal when the incident started. At this stage, we don’t expect major bottlenecks, unless the situation drags on.”

The waterway, which is believed to carry about one-tenth of the world’s trade, is a key channel for LNG ships – with about 8% of global LNG trade passing through it. So far in March 2021, a handful of cargoes had been transiting each day in both directions before the disruption.

“The impact could be greater if the disruption lasts longer, as the recent delays at the Panama Canal illustrated,” said Schmitt.

“However, the timing of this incident means it will have less impact on prices than that of the Panama since we’re entering the shoulder season for the LNG market.”

While charter rates are currently low – about $30,000 per day – Schmitt believes this could “tighten up” if the disruption lasts.

“Shipping optimisation might be complicated, particularly for ships already within the Mediterranean and Red Sea,” he added. “Further delays would impact both loading and discharge schedules and disrupt some flows, mostly to the European market.”

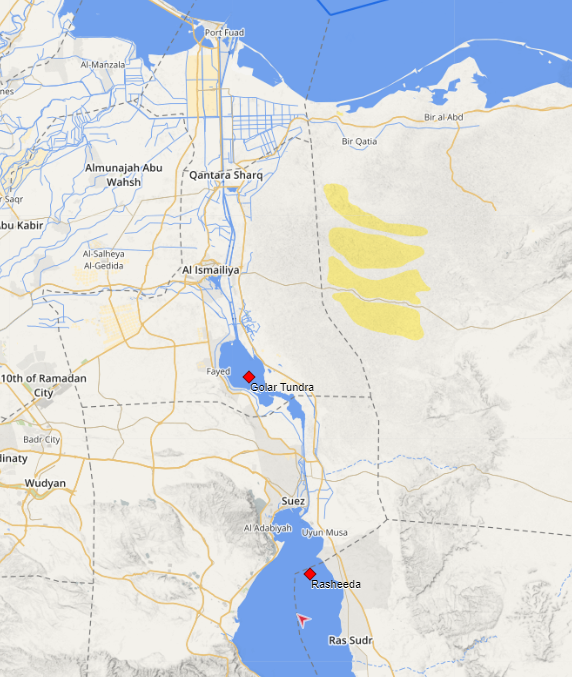

As of yesterday (24 March), Wood Mackenzie’s VesselTracker shows that one LNG vessel is “trapped” within the canal. The Golar Tundra loaded at Egypt’s Idku on 21 March and was transiting to Asia. At the Southern entrance, the Rasheeda is awaiting to transit with a shipment from Qatar.

The VesselTracker also shows there are three LNG tankers (two full, one empty) waiting or approaching the south side of the Canal, two full tankers waiting at the north entrance, and the full Golar Tundra is stuck in the middle.

Meanwhile, at least one US export, the Pan Americas, has potentially been rerouted in the North Atlantic towards the Cape of Good Hope, away from its previous heading towards the Mediterranean/Suez.