Mining and metals experienced a “drastic decline” in M&A deals in the first quarter of 2020, according to an analyst.

It is just one of many industries feeling the effects of the coronavirus pandemic, which has significantly hit demand, production and critical supply chains all over the world.

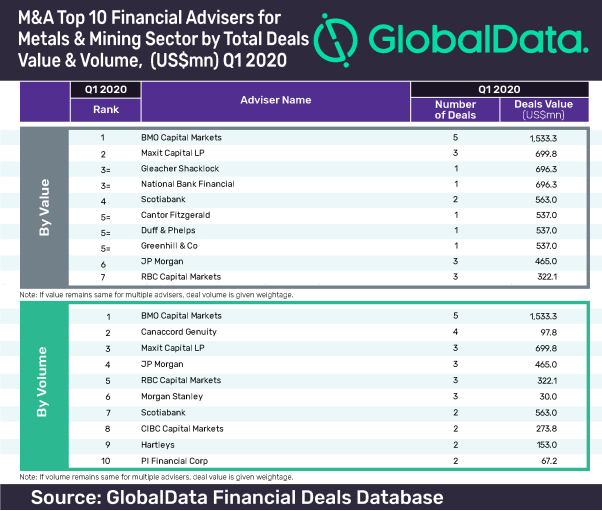

According to data and analytics firm GlobalData, BMO Capital Markets, a Montreal-based investment bank, led the latest M&A league table of the top 10 financial advisers for the mining and metals sector by value and volume in the first quarter of this year.

But as companies look to avoid any unnecessary risks in such unprecedented circumstances, Aurojyoti Bose, a financial deals analyst at GlobalData, revealed that the industry witnessed a “drastic decline in deal value in the first quarter of this year compared to the same period in 2019”.

“Under this environment, BMO Capital Markets was the only player to cross the $1bn mark,” he added.

“On the other hand, the total value of deals advised by three of the top 10 firms by volume was less than $100m.”

How mining and metals M&A deals dropped in the first quarter of 2020

GlobalData’s analysis shows that M&A deal values in the industry dropped from $21.9bn in the first quarter of 2019 to $6bn in the opening months of this year – marking a 73% fall in activity.

Although the number of deals that took place declined from 346 across the period last year to 308 in 2020, it is clear that while companies remain keen to increase their portfolios, few are willing to make big moves in the current climate.

BMO Capital Markets has provided financial services on five deals this year, which reached a value of $1.53bn – more than a quarter of the total figure that has so far been spent on M&As.

Taking second spot in the table was Maxit Capital, as the Toronto-headquartered firm ended the period with three deals to its name worth $699.8m — considerably less than its Canadian rival BMO.

Elsewhere, London-based Gleacher Shacklock and Montreal-headquartered National Bank Financial shared third position after they both secured one deal each worth $696.3m.

In terms of volume, Vancouver-based Canaccord Genuity took second spot behind BMO with four deals – but its agreements had a combined value of just $97.8m.

Top mining and metals legal advisers in 2020

Toronto-headquartered McCarthy Tetrault ensured Canadian firms also led the way in the mining and metals M&A table for legal advisers during the first quarter of 2020, with two deals worth $748.4m.

Another Toronto-based company Davies Ward Phillips tied for second place, alongside Montreal-headquartered Vineberg.

In terms of volume, Calgary-based Bennett Jones was the top M&A legal advisor, with four deals worth $15.1m in the first quarter.

Bose said that while there was a decline in volume, the drop was “more pronounced in terms of value with no firms in the top 10 list by value achieving the $1bn mark”. Results saw five of the companies with the highest amount of deals secured “failing to cross $100m”.