Analysis by Wood Mackenzie suggests a supercycle is on the way but warns that this time it will be “different from any that have come before”

The energy transition is likely to fuel a sustained increase in demand over the next two decades for metals such as lithium (Credit: Shutterstock/Ksenia Ragozina)

The next commodities “supercycle” will be driven by the global energy transition, with China’s dominance of renewables value chains set to be key.

That is according to analysis by Wood Mackenzie, which suggests a supercycle is on the way but warns that this time it will be “different from any that have come before”.

The energy researcher claims fossil fuels won’t be in the vanguard and the winners will be the industrial metals needed to electrify society – cobalt, lithium, copper, nickel, and aluminium.

“While China’s move to secure battery raw materials is well documented, less well-known is its increasing self-sufficiency extending downstream,” said Simon Morris, Wood Mackenzie’s head of metals.

“75% of global lithium-ion batteries, 70% of all solar panels, and 60% of electric vehicles (EVs) are made in China. But its aspirations have not yet been satisfied and we expect its control to continue to grow.”

Energy transition gathering serious momentum, with commodities supercycle just around the corner

While post-pandemic government stimulus packages have provided a sugar rush for commodities and prices of base metals have surged, this in itself is not supercycle material, according to Wood Mackenzie.

But it said the markets have also sensed that the energy transition is now “gathering serious momentum” and is likely to fuel a sustained increase in demand over the next two decades, supporting a new supercycle narrative.

It is projected $50tn of investment will be needed over the next three decades to achieve a 1.5C global warming trajectory, as outlined in the Paris Agreement.

This will electrify societies’ infrastructure and engineer out the aspects of economic activity that most significantly contribute to carbon emissions, with metals supply set to play a vital role in achieving this.

Wood Mackenzie’s report identifies three potential developments that could challenge how the next commodities supercycle unfolds and who, ultimately, benefits from it.

Firstly, the concentrating control of metals’ supply chains is likely to exclude many from the party.

The systemic supply uncertainty and ensuing price volatility, encouraging disruptive new technologies such as next-generation electrofuels, polymeric energy storage, and cobalt-free batteries – thereby forcing “traditional” commodities into obsolescence.

And finally, the rise of “consumption consciousness”, undermining the long-term reliance on primary metal.

China dominating energy transition value chains

With China dominant in its control of energy transition value chains, non-Chinese entities face an ever-diminishing share of any commodity windfall, according to Morris.

“With greater cash comes greater investment capability, enabling China to realise a strategy of supply security at any cost,” he added.

“Those that choose to participate too late in the cycle – be they nations seeking to secure supply for themselves, customers wanting to protect their production lines, or investors wanting to cash in on supernormal profits – are likely to find that they either can’t afford to participate or are precluded altogether.”

Morris believes price fluctuations could also throw a spanner in the works. He said that with EVs emerging as a “critical source of demand”, metals producers will have to consider how they supply a new type of consumer – one with an “acute focus on price and supply predictability”.

“If EV manufacturers cannot guarantee access to critical metals at an affordable and predictable price, they will look to innovate or thrift them out to the greatest extent possible,” added Morris. “As the supply challenge materialises, the inexorable rise in prices will surely incentivise alternatives.

“As we saw with the increasing rejection of plastic usage, a greater focus on sustainability may see society react against the very considerable rise in the use of primary metals used in cars, mobile phones, telecoms, and infrastructure. Either buying less or demanding greater re-use presents a considerable downside risk for the producers of tomorrow.”

Required increase in metals supply presents challenges for producers and consumers

Wood Mackenzie’s report shows the forces that are shaping up to drive this boom are unique. But even for those commodities stepping into the limelight, it said decarbonisation creates as many risks as it does opportunities.

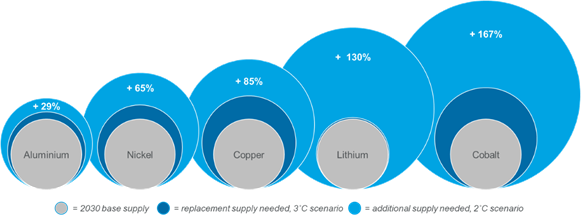

Under the energy researcher’s proprietary Accelerated Energy Transition-2 (AET-2) scenario, which is consistent with limiting the rise in global temperatures since pre-industrial times to 2C, 360 million tonnes (Mt) of aluminium, 90 Mt of copper, and 30 Mt of nickel will feed the energy transition over the next 20 years.

The report notes that this level of additional metal presents obvious challenges for producers and consumers alike.

“As with all commodities, the metals that are key to the transition will have to bring on replacement capacity to replace existing mines as they deplete and close,” said Morris.

“Under our base case, which is broadly consistent with a 2.8-3˚C global warming view, this requirement is manageable. However, under our AET-2 scenario, the new annual installed capacity required becomes eye-watering.

“By 2030, cobalt producers would need to have built 167% more supply than we currently have in our forecast, while copper would need to find 85% more mine supply than in our base-case forecasts. This will present a huge challenge for the sector.”