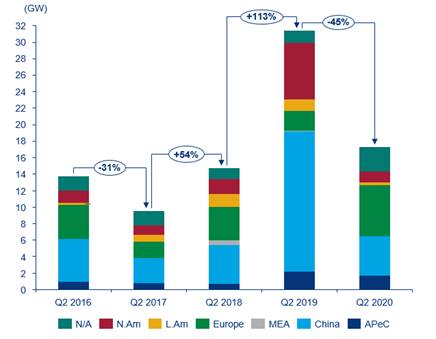

The second quarter of 2020 saw more than 17 gigawatts (GW) of wind turbine capacity ordered globally – equating to an estimated $16bn.

That is according to the latest industry research from Wood Mackenzie, which shows that Q2 2020 global wind turbine order intake decreased by 45% compared with the same period of 2019.

But, despite the significant year-on-year decline, order intake in the second quarter of this year still represented a “solid haul” and exceeded Q2 order intake for 2016, 2017 and 2018.

The US and China combined for a drop of almost 18GW in Q2 year-on-year order capacity, which follows a record 2019 where developers in these regions accumulated a “robust backlog” ahead of policy changes scheduled for the year ahead.

Luke Lewandowski, Wood Mackenzie’s research director, said: “Chinese developers ordered more than 2GW of offshore turbine capacity for the sixth consecutive quarter, with Envision capturing 66% of Q2 demand in China.”

“Wave of offshore demand” helped to lift wind turbine order capacity in Q2 2020

Wood Mackenzie notes that a “wave of offshore demand” in the second quarter of this year, located in countries such as the UK, the Netherlands and France, helped to lift overall turbine order capacity despite a “drop in the US and China”.

Global offshore order intake captured 38% – or 6.5GW – of all Q2 orders, which marks an increase of 40% year-on-year.

“SGRE and MHI Vestas each landed more than a gigawatt of orders in Europe for new offshore turbine models rated over 10 megawatts (MW),” said Lewandowski.

“This flurry of orders for 10MW+ turbines in Q2 helped to lift the average rating of global offshore orders to 7.5MW.

“Developers continue to seek higher-rated onshore models to maximize site constraints, with SGRE Vestas and Nordex capturing all demand in Q2 for onshore models rated 5MW or higher.”

Wood Mackenzie’s data shows that SGRE edged ahead of Vestas for announced global wind turbine order intake in Q2, for both onshore and offshore, reaching 4.1GW.

Lewandowski added: “Although SGRE topped the list for overall global turbine order intake, Vestas’ V150-4.2 won top onshore model for consecutive quarters after a particularly strong Q2 in Asia Pacific excluding China.

“In the offshore sector, Envision’s impressive haul in Q2 for its EN-161 5.2 model led to the company taking top spot for Q2, coming in slightly ahead of SGRE.”