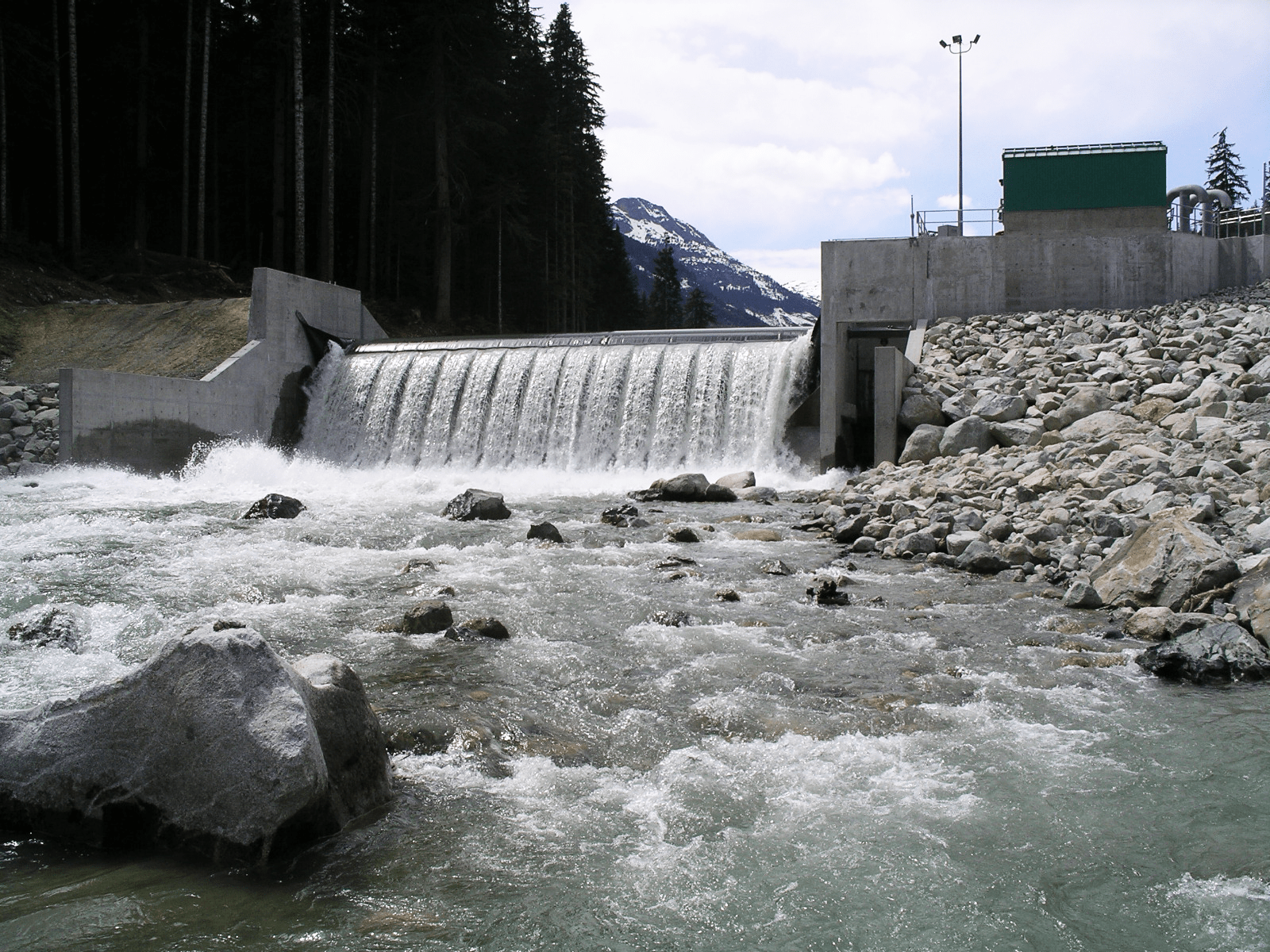

Innergex Renewable Energy Inc. (TSX: INE) (“Innergex” or the “Corporation”) has closed a $185.5 million non-recourse project financing, including $179.9 million in term loans at an effective interest rate of 6.14%, and a $5.5 million reserve facility, both with The Canada Life Assurance Company (“Canada Life”), to finance a portfolio of unlevered Canadian hydroelectric facilities in operations comprising the Gilles-Lefrançois, Miller Creek and Rutherford Creek facilities. The term loans are set to mature in 2038 and 2043 corresponding to the remaining duration of the facilities’ power purchase agreements. The proceeds will be used mainly to repay the corporate revolving credit facility, thereby reducing the corporate leverage.

“This step underscores our commitment to strengthening our financial position and ensuring long-term financial flexibility to continue our growth,” said Michel Letellier, President and Chief Executive Officer of Innergex. “By financing unencumbered assets, we are taking proactive steps to substantially reduce our corporate debt. Alongside this milestone, we are proud to highlight our recent accomplishments, including securing financing for our Boswell Springs wind project and establishing a long-term partnership agreement in France. This shows how we have executed our funding strategy to increase liquidity, and how we are on track for further growth.”

“We are very pleased to support Innergex with this financing of renewable hydroelectric facilities,” said Brian Allison, Executive Vice-President and Chief Investment Officer of Canada Life. “We are committed to an investment strategy that generates value while supporting energy security, transition and sustainability in Canada.”