Oil and gas production from the US Scoop Stack shale play will not recover to pre-pandemic levels in the coming years, even as commodity prices continue to show signs of recovery.

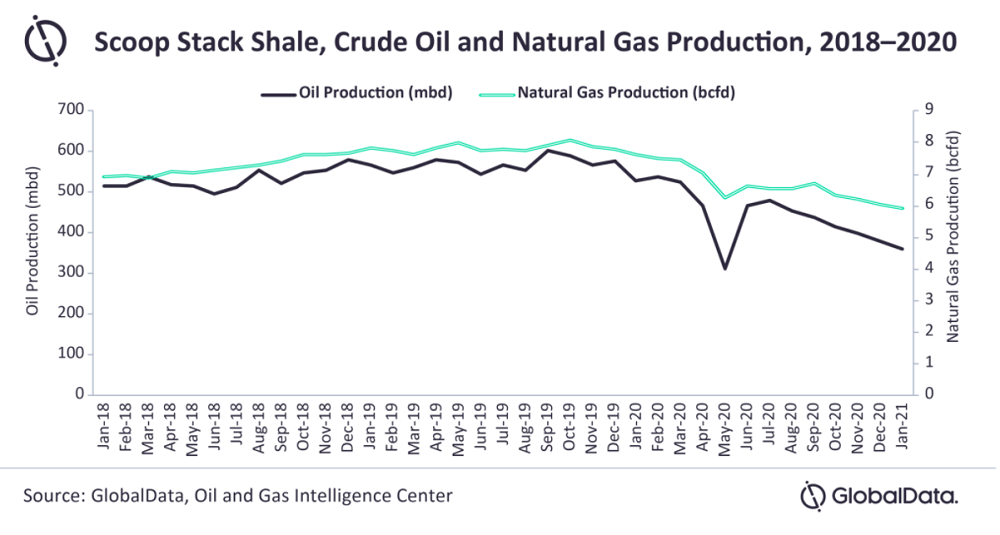

Output from the region peaked in September 2019, according to research group GlobalData, but has been in decline since then, with the dropoff in production exacerbated last year by the impact of the pandemic.

In February 2021, Scoop Stack oil production is expected to be 342 million barrels per day (bpd), with gas at 5.8 billion cubic feet (bcf) per day. That is a decline of 43% and 27% respectively compared to September 2019 levels.

The fall is linked closely to capital spending reductions taken by oil producers in response to the steep demand loss and falling oil prices caused by the pandemic, with companies looking to reduce activity and cut costs wherever possible.

“The Scoop Stack averaged 84 drilling rigs in 2019 and decreased to an average of 20 drilling rigs in 2020 – which is a 75% drop,” said GlobalData oil and gas analyst Andrew Folse.

“Since commodity prices have stabilised from the Covid-19 pandemic, rig count has increased a small amount, with West Texas Intermediate (WTI) crude future prices averaging $51.37 per barrel for the remainder of 2021. GlobalData expects an uptick in the rig count, but not to the level that was present in 2019.”

Future growth in Scoop Stack shale production will depend on capital decisions of major operators

The Scoop Stack shale play in Oklahoma accounts for around 4.5% of oil production across the US Lower 48 region, and 7.2% of natural gas output.

Over the course of 2021, GlobalData expects oil and gas production to average 373 million bpd and 5.8 bcf per day respectively.

Any future rise in production will depend on the capital allocations of the major operators across the region, including Continental Resources, Devon Energy, Cimarex Energy, and Ovintiv.

Any future rise in production will depend on the capital allocations of the major operators across the region, including Continental Resources, Devon Energy, Cimarex Energy, and Ovintiv.

GlobalData notes these companies all have active operations in other shale plays, where strategy and return to capital may prove better than in the Scoop Stack. “Companies are going to deploy the capital to the acreage with the best economics,” the group said.

Folse added: “GlobalData builds three different production scenarios based on three different future average prices: $44, $49, and $54 per barrel. In all current scenarios, production from the Scoop Stack continues to decline before growing in the second half of 2022.

“Even in the high-price case, production would not get back to the peak levels seen in 2019.”