The Australian government has announced its federal budget for the upcoming financial year – but the commitments have provided a “mixed bag” for oil and gas, says the nation’s industry body.

The Australian Petroleum Production and Exploration Association (APPEA) believes the budget contains a “number of good measures” as it aims to help the country recover from the coronavirus pandemic.

But it has warned the government is risking investment confidence and jobs by waging a new levy on the industry to cover the 250 million Australian dollar ($196m) cost of decommissioning an offshore production vessel that fell into public ownership.

APPEA “disappointed” its measures for oil and gas industry were “not represented” in Australian federal budget

APPEA CEO Andrew McConville said the budget’s support for gas-related strategic basins is a big tick, as is the announcement for new hydrogen and carbon storage initiatives to help lower emissions.

“Increased funding for gas infrastructure of A$173.6m ($136m) in the Northern Territory on top of the A$58.6m ($46m) will mean more supply for the domestic market and that will help keep prices competitive,” he added.

“Natural gas is a pathway to a large-scale hydrogen industry and our members are already at the forefront of hydrogen development and carbon capture and storage solutions, and the announcement of A$1.2bn ($940m) over 10 years in a technology co-investment facility will help accelerate development.

“Our industry works both in Australia and around the world to accelerate the development of low-emissions technologies. Natural gas plays a vital role in reducing Australia’s and Asia’s emissions.”

McConville said the industry was “disappointed” measures outlined in APPEA’s pre-budget submission, such as making wage costs immediately tax deductible for capital-intensive industries, were “not represented”.

“We will continue to work with the government to get the fiscal settings right and the extension of the temporary full expensing and temporary loss carry back measures are a good first step.”

A recent report by professional services firm Ernst & Young, commissioned by APPEA, showed the oil and gas sector could provide a A$350bn ($274bn) boost to the economy and more than 220,000 jobs over the next two decades.

Oil and gas levy in Australian federal budget a “blow to jobs and investment”, says APPEA

For all the positive measures McConville felt were included in the budget, he admitted that the new Laminaria-Corallina oil fields and associated infrastructure levy was a “blow to jobs and investment”.

APPEA claims it will see a number of offshore oil and gas companies footing the bill for a project they have never been involved in, never benefitted from, and is based up to 3,500 kilometres away from their operations.

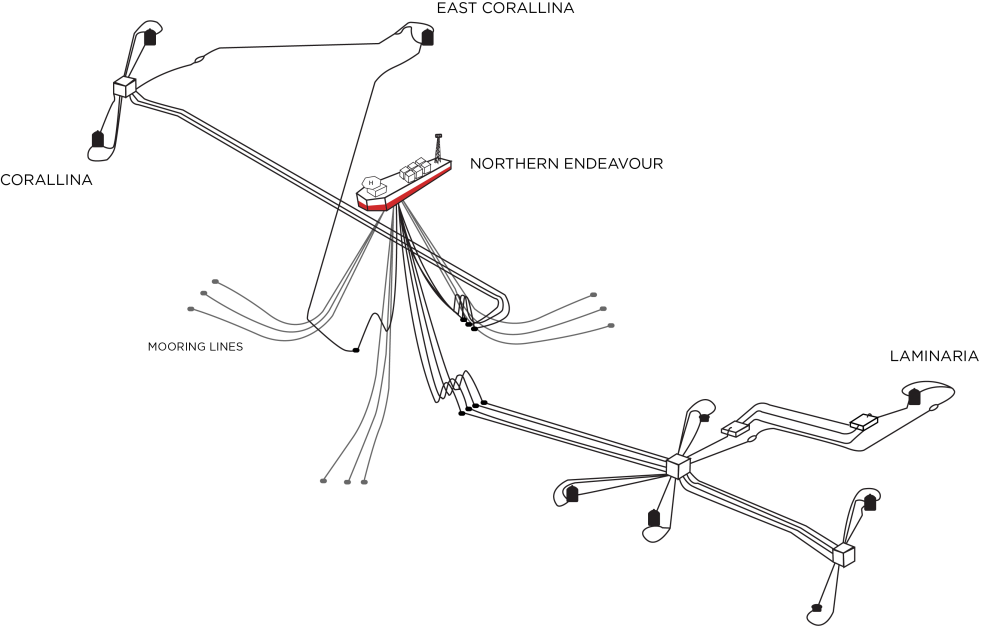

But McConville said he is glad there will be extra consultation where APPEA will put forward alternatives to the government ahead of what it deems to be a “blunt instrument” to meet the cost of decommissioning the Laminaria-Corallina fields and the Northern Endeavour floating production storage and offloading (FPSO) unit in the Timor Sea.

The project requires decommissioning after its owner, the Northern Oil and Gas Australia group of companies, went into liquidation and in accordance with legislation, the government took ownership of the asset.

McConville said APPEA and its members are committed to providing support to the government to ensure the safe and timely decommissioning of the Northern Endeavour and related infrastructure, but warned the new impost had the potential to hold back Australia’s economy and the 80,000 jobs the industry supports.

He added that the announcement of a new levy on the entire offshore oil and gas industry is a “terrible precedent” and could have “serious repercussions to Australia’s economy and to jobs”.

“Everyone agrees that the Northern Endeavour needs to be decommissioned and the costs managed – but there are a number of ways that the government can do so without risking undermining investment confidence in the offshore oil and gas industry,” said the APPEA CEO.

Other options available to government for Northern Endeavour decommissioning, says APPEA

McConville believes other options were still available, including making the government’s current management of the operations more efficient; reducing the cost of decommissioning through working collaboratively with industry; and looking at alternative funding such as selling the asset or accessing petroleum resource rent tax (PRRT) credits.

“We have consistently maintained to government the importance of considering other cost recovery measures like selling the asset, working constructively with creditors, making available PRRT credits, seeking in-kind contributions from industry, and fully exploring a commercial solution,” he said.

“We stand ready to work with the government to look at how to best manage decommissioning of the Northern Endeavour. A levy is not the right instrument.”

McConville added that the oil and gas industry remains committed to an updated decommissioning policy framework to “ensure clarity and robust financial assurance in the future”.