China is currently dominating the lithium-ion battery supply chain – but Europe is continuing to increase its stake, says an industry report.

The rechargeable batteries, which are used to power everything from mobile phones to electric vehicles, have experienced a rapid rise in popularity due to their growing importance in sustainable and more environmentally-friendly technologies.

BloombergNEF’s (BNEF) Global Lithium-Ion Battery Supply Chain Ranking has China leading the way after it “quickly surpassed” Japan and South Korea – two countries that dominated the industry for the majority of the previous decade.

Kwasi Ampofo, BNEF’s lead analyst covering battery raw materials, said access to raw materials, talent and infrastructure are “vital in attracting investment into the value chain”.

“In addition to making significant investments into the mining of critical minerals all around the world, China is also the dominant player in materials refining,” he added.

“This has given it the advantage over Japan and Korea. Other countries seeking to be dominant players in the overall value chain may need to support upstream metals mining and refining development, while also formulating policies that will safeguard the environment.”

China’s success a result of its large domestic battery demand

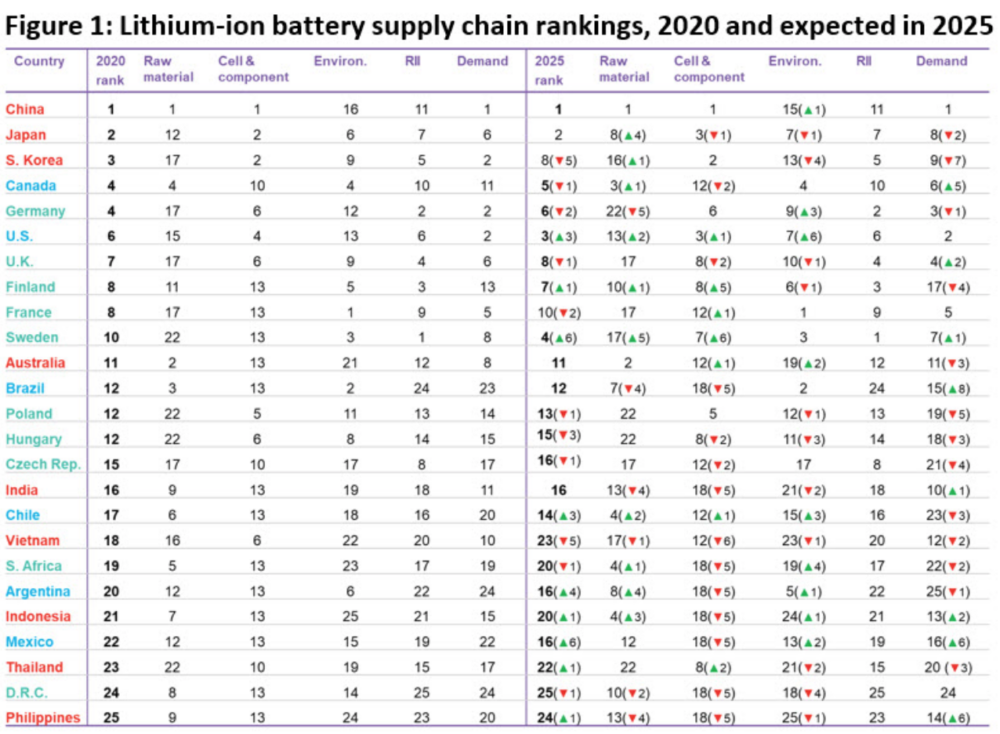

BNEF’s lithium-ion battery supply chain ranking provides a snapshot of a country’s position in 2020 and where it will place in 2025, based on its current development trajectory.

It ranks countries across five key themes related to the supply chain – raw materials, cell and component manufacturing, environment, RII (regulations, innovation and infrastructure) and end demand across EV and stationary storage.

The report notes that China’s success has come as a result of its large domestic battery demand, 72 gigawatt-hours (GWh), alongside control over 80% of the world’s raw material refining, 77% of the world’s cell capacity and 60% of the world’s component manufacturing.

In 2020, Japan and South Korea rank number two and three respectively. While both countries are leaders in battery and components manufacturing, BNEF said they “do not have the same influence” in raw materials refining and mining as their East Asian counterpart.

But for what they lack in control over the raw materials supply chain, the nation’s make-up for in higher environmental and RII scores compared to China.

James Frith, BNEF’s head of energy storage, said China’s dominance of the industry is to be expected given its “huge investments” and the “policies the country has implemented over the past decade”.

“Chinese manufacturers, like CATL, have come from nothing to being world-leading in less than 10 years,” he added.

“The next decade will be particularly interesting as Europe and the US try to create their own battery champions to challenge Asian incumbents who are already building capacity in both places.

“While Europe is launching initiatives to capture more of the raw material value chain, the US is slower to react on this.”

Europe aided by its ‘strong environmental credentials’

As EV demand grows, there is an increasing need for cell manufacturing facilities close to automotive production.

BNEF said this has led to a “boom” in European cell plants and the rest of the supply chain is also “slowly making its way to Europe”.

The growing industry within the region and Europe’s “strong environmental credentials” have helped five European countries – Germany, UK, Finland, France and Sweden – find a place in the top 10 ranking for 2020.

Although the US is currently in sixth place, the report highlights that the upcoming presidential election could potentially change things.

If the country was to increase its investment in raw materials and promote EV adoption, BNEF believes it could overtake Japan and China to be number one in 2025.

In contrast, it suggests the UK could fall in the rankings by 2025 if it becomes “unable to access the large demand” in continental Europe, which at 152GWh, will be around five times the size of its domestic market.