The Kaskida offshore field is located in the US Gulf of Mexico. The field, 100% owned and operated by British oil major BP, was discovered in 2006.

The company took the final investment decision (FID) on the project in July 2024.

The development of the deepwater field will involve deploying well equipment with a pressure rating of up to 20,000 pounds per square inch (20K).

Once complete, Kaskida will become BP’s sixth hub in the Gulf of Mexico. It is expected to commence production in 2029.

Kaskida Field Location

Kaskida offshore field is located in Block 292 in the Keathley Canyon area of the Gulf of Mexico, about 402.34km (250 miles) southwest off the coast of New Orleans, the US.

The water depth in the area is around 6,000ft (1828.8m)

The offshore field is regarded as one of the largest discoveries in the Paleogene trend. The Paleogene trends are the geological formations formed between approximately 66 million years and 23 million years ago.

Kaskida project will enable BP to unlock potential development of 10 billion barrels of discovered resources hosted in the Kaskida and Tiber catchment areas.

Kaskida Field Discovery and Ownership History

In 2003, BP, Devon Energy and Anadarko Petroleum received the petroleum rights for the Block 292 in a federal lease sale.

Kaskida field within the block was discovered in 2006. The exploration well was drilled to a depth of 32,500ft using Transocean’s semisub Deepwater Horizon.

Overall, the well encountered around 800 net feet of hydrocarbon-bearing sands.

Initially, BP owned 55% in the project, while Anadarko and Devon held 25% and 20% stakes respectively.

In March 2008, Equinor (Previously StatoilHydro) announced plans to acquire Anadarko’s 25% interest in Kaskida.

However, BP and Devon, in April 2008, blocked the deal and divided the interest between themselves. Following the deal, BP owned 73.33% and Devon owned 26.67% interests in the project.

Devon unveiled plans to divest the Gulf of Mexico and international assets in November 2009 to focus on its North American onshore assets.

It signed agreements in March 2010 selling all its assets in the deepwater Gulf of Mexico, Brazil, and Azerbaijan to BP for $7bn. The deal included Kaskida discovery among other assets.

Kaskida Project Development

Kaskida Project will be developed in phases.

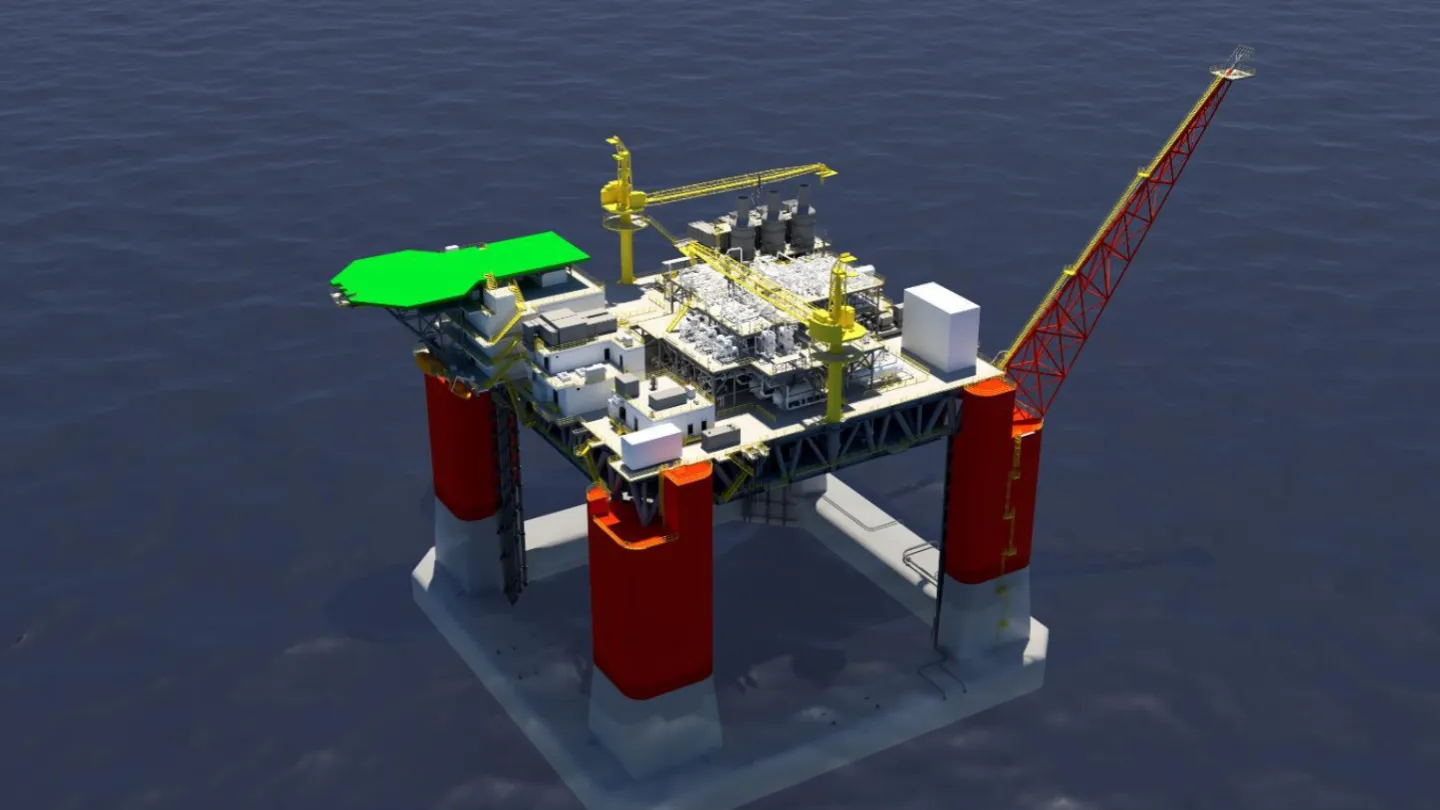

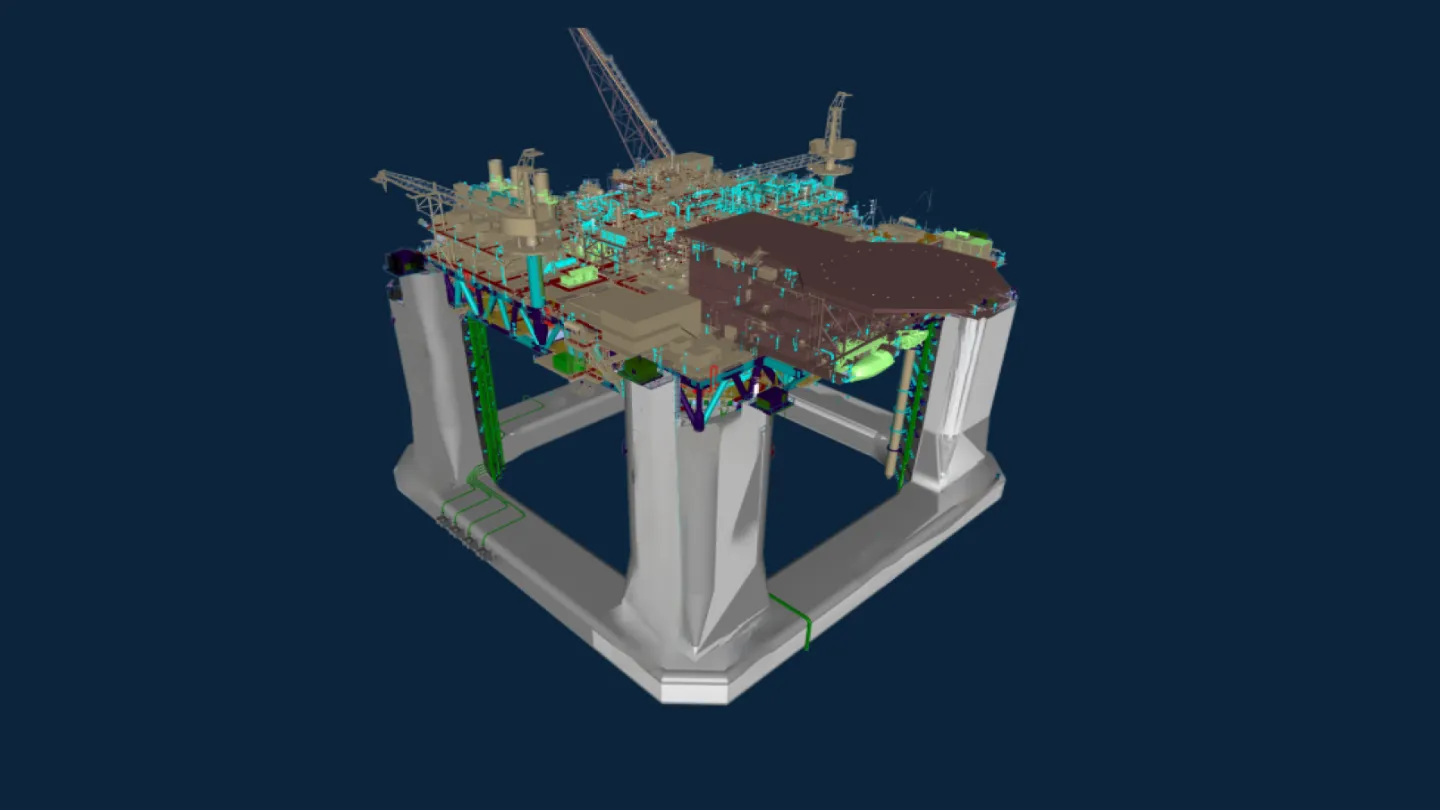

The development of the field will comprise a new floating production platform supported by subsea production wells.

The first phase is planned to feature six wells. Additional wells may be drilled in the future phases of development, subject to further evaluation.

The offshore field contains discovered recoverable resources of around 275 million barrels of oil equivalent for the initial phase. Production from the floating platform will be around 80,000 barrels of crude oil per day.

BP will also use existing platform and subsea equipment designs to reduce cost during Kaskida’s construction, commissioning and operations.

20K Rig Technology Details

BP worked on the development of the 20K rig technology in a bid to complete high-pressure wells. The then equipment had a technical limit of 15,000 psi pressure and temperatures of 250 degrees Fahrenheit.

Project 20K was conceived as a multi-year initiative to develop new systems and tools for deepwater exploration and production.

It was launched in February 2012. At that time, BP estimated that the technology would unlock access to an additional 10-20 billion barrels of resources across its global portfolio.

The technologies that will be deployed are expected to involve advanced operating systems to improve situational awareness; real-time blow-out-preventer monitoring; boost mechanical capabilities of the BOP, rig structures and piping systems.

Several companies such as KBR, FMC Technologies and Maersk Drilling were involved as contractors with the development of Project 20K.

Contractors Involved

In June 2024, BP Exploration & Production awarded a Letter of Intent (LOI) to Seatrium to provide services related to early engineering for the production platform of Kaskida.

BP selected Audubon Engineering, a subsidiary of Nobel Energy, for the Kaskida Project floating production unit (FPU) in August 2024.

As agreed, Audubon will deliver engineering and design services for the topside of the platform.

The hull of the production platform will be designed and engineered by EXMAR Offshore, a subsidiary of EXMAR.

The floating production platform will consist of a single topside module. The module will be supported by a four-column semi-submersible hull.

The new platform will incorporate OPTI hull design of EXMAR. OPTI will provide design and execution efficiency to the production platform.