Karlawinda gold project, located 65km south-east of Newman, Pilbara, Australia, is owned and operated by Capricorn Metals.

The company completed a feasibility study on the project in October 2017. The final investment decision and start of construction are expected in the first half of 2019, while first gold production is scheduled for mid-2019.

The project is estimated to involve an investment of $133.3m. It is expected to produce approximately 100,000 ounces (oz) of gold a year over its initial mine life of approximately 6.5 years.

Karlawinda gold project background

The gold mineralisation in the Francopan prospect of the property was originally discovered by WMC Resources in 2005.

Project Gallery

In January 2008, the project was acquired by Independence Group (IGO), which subsequently discovered the main deposit of the property, the Bibra deposit, in 2009.

In 2015, the Karlawinda gold project was sold to Greenmount Resources, which was acquired by Malagasy Minerals (now Capricorn Metals) in February 2016.

Geology and mineralisation

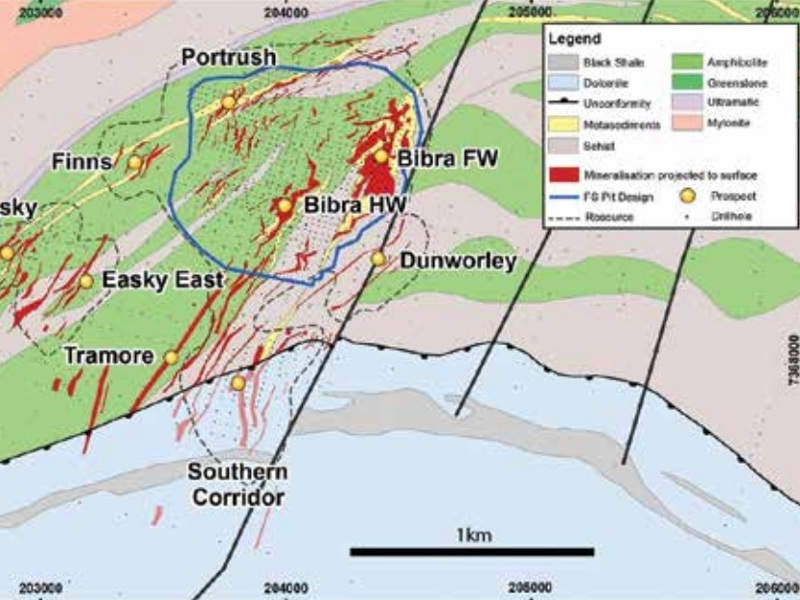

Mineralisation in the Bibra deposit occurs in the Archaean-aged belt of greenstone rocks and is hosted within deformed volcanic sequences interlaced with meta-sediments and volcanoclastic units in at least two parallel dipping structures called the Main Footwall Lode and the Main Hanging Wall Lode.

Laterite mineralisation occurs close to the surface with oxidisation reaching up to a depth of 70m. A horizontal laterite mineral zone containing gold lies at a depth of 15 below the surface. The project also covers other exploration targets such as the Francopan prospect.

Karlawinda gold project reserves

As of May 2018, the JORC 2012-compliant proven and probable gold reserves of the mine were estimated to be 27.5Mt grading 1.0g/t Au, while contained gold was estimated to be 892,000oz.

Mining and ore processing

A multi-stage open-pit mining method using conventional mining methods will be used to mine the Bibra deposit. The open-pit operation will have a life-of-mine stripping ratio of 4.8:1.

Drilling and blasting will be performed on benches up to 5m-wide for mining the ore.

The mining fleet will consist of four 100t haul trucks, eight 130t haul trucks, excavators, and additional equipment such as dozers, loaders, graders, and water carts.

The run-of-mine (ROM) ore will be passed through a comminution circuit comprising a primary crusher. The crushed ore will be stockpiled and passed through a semi-autogenous ball mill crusher (SABC) circuit, which includes a semi-autogenous grinding (SAG) mill and ball mill (4.8MW), to further grind the ore.

The gold recovery process will involve a conventional cyanide leaching and carbon-in-leach (CIL) recovery process utilising two 40in Knelson concentrators with a gravity leach reactor and a hybrid CIL circuit.

Standard recovery techniques such as elution and electrowinning will be used before smelting.

The process tailings will be deposited either in a tailings storage facility or an integrated waste landform (IWL). The process water will be recovered by using recycling techniques.

Infrastructure

The Karlawinda gold project will be connected to the Great Northern Highway by a new 40km access road, which will provide the required allied services and supplies.

The project involves the development of equipment service facilities, a 200-man accommodation village, and site infrastructure buildings.

The workforce will fly in-fly out (FIFO) of Newman via commercial flights through the Newman airport.

A gas-fired power station will be built on site to supply power to the project, while water will be sourced from on-site water production bores.

Contractors involved with Karlawinda gold project

360 Environmental, a company based in Australia, was contracted for the environmental study and social impact assessment of the project.

Groundwater Resource Management (GRM) was engaged for conducting the hydrogeological assessment of the project in 2017.

Peter O’Bryan & Associates was responsible for conducting the geotechnical studies, while Cube Consulting and Entech conducted the open-pit mining studies and ore reserves estimates.

George Boucher Consulting was contracted for modelling the blasting techniques, and fragmentation studies.

Minelogix, ALS, and Gekko conducted the metallurgical test work for the project.

Mintrex and Orway Mineral Consultants provided the processing plant design and non-process infrastructure, whereas MHA Geotechnical provided the civil geotechnical study.

Graeme Campbell & Associates was responsible for the tailings and waste rock geochemistry.

Land and Marine Geological Services and CMW Geosciences provided the design for the tailings storage facility.

Capricorn Metals and Ironstone Capital provided the financial modelling for the project.