New gas sales and purchase agreements provide encouraging signs for Mozambique’s bid to become a top 10 global LNG supplier by the mid-2020s, according to GlobalData.

The market intelligence firm predicts the country will bring online more than 30 million tonnes per annum (mtpa) over the next five years, placing it next to African rivals Nigeria and Algeria.

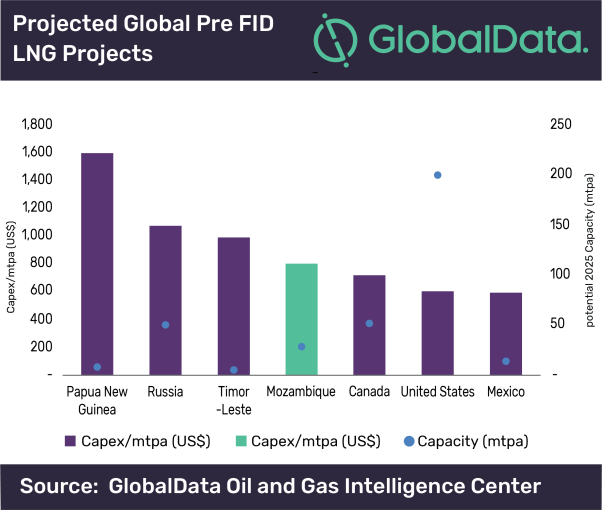

Its oil and gas analyst Cao Chai said: “The development break-even gas price of around $4-5 (£3-4) per thousand cubic feet (mcf) for the onshore LNG projects in Mozambique is competitive compared to current Japan spot LNG prices of $9.24 (£7) per mcf.

“This is due to the relatively low expected capex per mtpa in comparison to other integrated LNG projects around the world, and the low upstream cost compared to non-integrated LNG projects in the Americas.”

Can Mozambique become a top 10 global LNG supplier?

Mozambique caught the oil and gas industry’s attention after it was found to harbour more than 125 trillion cubic feet (tcf) of natural gas reserves.

Anadarko and Eni, the companies responsible for this discovery, are not alone in attempting to exploit it, with ExxonMobil, Qatar Petroleum and China National Petroleum Corp (CNPC) all vying for control over Mozambican LNG.

And with hungry markets standing ready in north Asia and large swathes of Europe, it isn’t hard to see why – the appetite for natural gas in China, alone, is enough to make its extraction in the African nation a worthwhile endeavour.

However, while it ostensibly promises prosperity for one of the world’s poorest countries, the prospect of a booming LNG market in Mozambique has sparked hostilities from the local residents who could be negatively impacted by the consequent upheaval.

Political tensions on the country’s border with Tanzania, which have long since begun breeding violence, also present a concern for investors and a challenge for the government.

“The advancement of LNG business in Mozambique will transform the country to a major global LNG supplier,” explained Mr Chai.

“It will also bring direct revenue to Mozambique government and promote the growth of local industries through a domestic gas component of the initial project and follow-on expansions.

“Furthermore, construction on the LNG megaprojects is expected to last for over a decade providing significant employment and training opportunities for Mozambicans.”