Great Pacific Gold has a portfolio of high-grade gold projects in Papua New Guinea (“PNG”) and Australia.

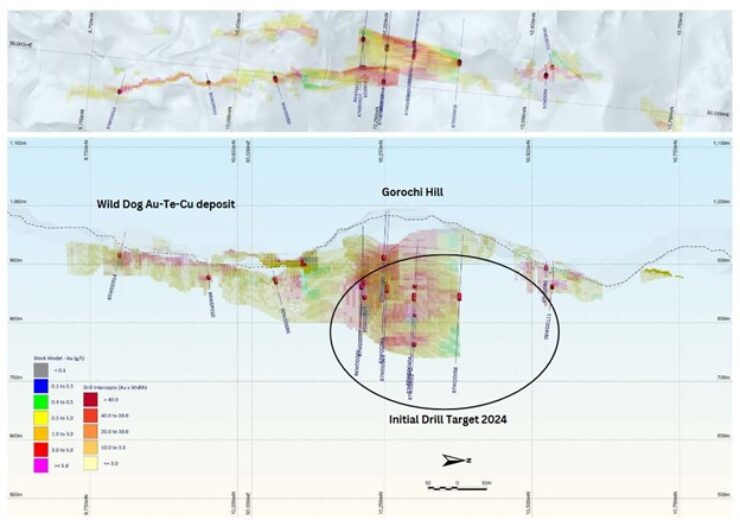

Wild Dog Deposit long section with proposed drill target. (Credit: Great Pacific Gold Corp.)

Great Pacific Gold Corp. (“Great Pacific Gold,” “GPAC,” or the “Company”) (TSXV: GPAC) (OTCQX: FSXLF) (Germany: 4TU) is pleased to announce that it has received notification from the Papua New Guinea Mineral Resources Authority (the “MRA”) of the grant of the advanced stage and past producing Wild Dog Exploration License (“EL”) 2516.

Bryan Slusarchuk, CEO of GPAC, states, “EL 2516 covers a well known and highly coveted project, with a history of high grade epithermal near surface drill intercepts reported within a limited strike length of 1km. There is significant potential along strike, with more than 90% of the projected strike of the main structure untested due to a thin layer of volcanic ash masking the prospective target area. Our management and technical team have already been preparing a detailed work program to advance this significant advanced stage asset along strike and at depth. With this EL grant, GPAC now has a multiple high priority gold and copper drill ready targets across the Wild Dog, Arau, Kesar Creek and Tinga Valley Projects.”

With this grant of EL 2516, all of the Exploration License Applications (“ELA”) acquired via the transaction through which GPAC purchased Wild Dog Resources have now been converted into Exploration Licenses. 100% of the ground in PNG within GPAC now have EL, with no additional WDR applications pending. Combined, these various EL total approximately 2500 sq. km.

Chris Muller, GPAC Director, adds, “The focus of past drilling at Wild Dog has been on the near surface high grade system, and this has obviously yielded some exceptional results. What attracted me to the project originally, however, is the size potential which quickly became evident during the due diligence process and through both field visits and an examination of a substantial amount of historic data.”

The Wild Dog Project

The Wild Dog Project consists of two ELs (EL 2516 and 2761) totalling 1424 sq. km, which are located on the island of New Britain and are approximately 50 km southwest of Rabaul and Kokopo, PNG.

The Wild Dog Project occurs within a major NNE trending structure of at least 26 km in length which transect apparent volcanic caldera structures and intrusions. During the Mio-Pliocene at least three volcanic centres, known as the Nengmutka, Keravat and Sikut calderas, were localised along this horst and graben zone. This structural corridor constitutes an epithermal and porphyry hydrothermal-magmatic mineralized field.

The Nengmutka Caldera, which hosts the Wild Dog deposit, is characterised by a suite of calc-alkaline andesite breccia and ash flow tuff known as the Nengmutka Volcanics (Lindley, 1988). This formation has been mapped over an area of 600 sq. km. Tonalite of the Arabam Diorite intrudes the volcanic sequence and appears to be partly coeval with the caldera related volcanism.

The precious metal prospects are associated with epithermal type veining that contain gold-silver-telluride (Au-Ag-Te) mineralisation. Gold and silver occur as native metals and as telluride minerals. Porphyry copper-gold type mineralization also occurs associated with these intrusion centres that usually underly the epithermal systems. The whole of the recognised belt is held within the Wild Dog tenements.

Within the central part of the Wild Dog project, a significant structural corridor called the “Wild Dog – Gunsap Corridor” occurs. The corridor is at least 15 km long and up to 4 km wide and hosts at least three porphyry copper-gold prospects and several epithermal gold deposits and prospects.

The original Wild Dog epithermal gold deposit occurs within the “Wild Dog – Gunsap Corridor” in the central part of the tenements. It was discovered in 1983, with exploration including extensive mapping, trenching, rock sampling and drilling between 1983 and 2005 by various explorers. New Guinea Gold Limited operated a small open pit mining operation from 2007 and 2011. No exploration has occurred since the closure of the mine.

Historical work completed by a previous operator returned significant gold assays. Channel sampling at the Kavursuki Prospect yields 4m at 9.41 g/t Au and at the Kargalio Vein 6m at 11.5 g/t Au.

Drilling of the Kavursuki Prospect by previous explorers, located within the Wild Dog Zone and north of the former Wild Dog mine, also yielded positive high-grade results.

Apart from the drilling conducted at the former Wild Dog gold mine there remain several drill intercepts that require further exploration outside of the mine environment as tabulated below, apart from the various trenching and channel sampling targets.

Additionally, multiple samples collected from a historic stockpile near the Wild Dog Zone returned bonanza grades of gold and copper including Sample 30104 which assayed 242 g/t Au, 601 g/t Ag, 9.52% Cu and Sample 68001 which assayed 122.5 g/t Au, 350 g/t Ag and 11% Cu.

The exploration program at the Wild Dog Project will initially focus on drilling extensions to known gold mineralization within the Wild Dog – Kavursuki mineralized corridor (Figure 3, Tables 1 & 2) as well as other targets within the Wild Dog Structure such as Mengmut prospect (Table 3). Other targets to be explored include the copper-gold Magiabe porphyry target as well as regional geochemical targets established by previous explorers. Extension of the IP coverage in the Magiabe area could better define the target. Orientation soil geochemistry and auger drilling through the shallow cover sequence in prospective areas will be undertaken (Figure 2).

As a result of the grant of EL 2516, the Company issued to certain property vendors and/or stakeholders a total of 982,143 common shares at a deemed price of $1.12 for a deemed value of $1,100,000. The Company will also be making cash payments to certain vendors and stakeholders (see news release dated July 5, 2023). The shares issued are subject to restrictions on resale for a period of four months from the date of issue.

Source: Company Press Release