Strategic land position of ~425km2 with ideal climatic conditions and access to infrastructure

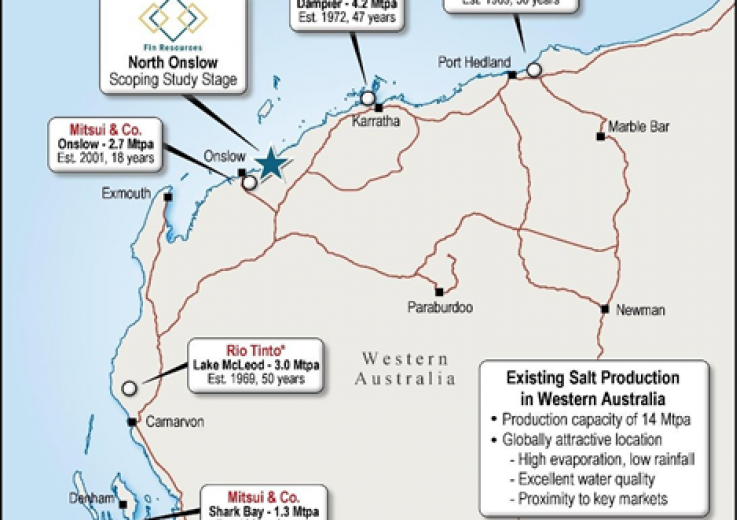

Existing Salt Production projects and Fin’s proposed North Onslow Solar Salt Project. (Credit: Fin Resources Limited)

Fin Resources Limited (ASX: FIN) (Fin or the Company) is pleased to announce it has entered into a binding agreement to acquire an 80% interest in the North Onslow Solar Salt Project (“NOSSP”) from North West Solar Salt Pty Ltd (ACN 611 454 178) (“NWSS”) (“Agreement”). The NOSSP comprises five granted exploration licences and one pending exploration licence (together, the Tenements) covering 425km2.

About the North Onslow Solar Salt Project

The NOSSP is comprised of 425km2 of contiguous exploration licences (including one pending application), north of Onslow, that have been selected based on the ideal parameters required for a successful solar salt project. Climatic conditions in the region of Onslow give rise to amongst the highest evaporation rates in Australia with very high solar exposure and low rainfall. Onslow also has significant existing support infrastructure in addition to being close to markets due to its location on the north west coast of Western Australia.

The NOSSP is adjacent to an existing solar salt project that has been successfully operated by Mitsui and Co for 20 years with a production capacity of 2.7 million tonnes and also BCI Minerals Limited’s Mardie Salt & Potash Project, a potential Tier 1 project located on the West Pilbara coast in the centre of Australia’s key salt production region.

The NOSSP is the subject of a scoping study that is currently being updated, with results expected in the 3rd Quarter of 2021. There is a clear pathway for the environmental and planning approvals required for the project due to the regional precedents, and work associated with these approvals is underway.

Fin Resources’ Director, Mr Jason Bontempo said, “The acquisition of the strategically located North Onslow Salt Project interest is an outstanding outcome for our shareholders. With abundant solar and wind energy as well as proximity to infrastructure and markets, we hope the project will become a major supplier in the lucrative yet stable global salt market. We look forward to providing further detail in the near term.”

Board Appointment

It is proposed, subject to shareholders approving of the Proposed Acquisition, that Mr Ryan de Franck is to join the board of FIN as a Non-Executive Director. Mr de Franck has a broad range of experience across corporate finance, corporate development and company management with a focus on the natural resources sector.

He holds a Bachelor of Commerce degree from the University of Western Australia, a Masters in Applied Finance from Financial Securities Institute of Australia and a Graduate Diploma in Mineral Exploration Geoscience from the Western Australian School of Mines.

In 2014 he founded Valperlon, a diversified natural resources exploration and project development group. In 2016, having identified the compelling market opportunity, highly favourable natural conditions and unique logistics and infrastructure advantages, he established North West Solar Salt to pursue the development of the North Onslow Salt Project.

From 2011 to 2014 he was a Corporate Finance Executive with Liberum Capital in London and from 2007 to 2010 he was a Corporate Finance Executive with Deloitte in Perth, WA.

Terms of the Agreement

Under the Agreement, as consideration for the acquisition by FIN or its wholly owned subsidiary (“FIN Nominee”)

of an 80% interest in the Tenements (the “Acquisition”), FIN will:

· issue 83,333,333 fully paid ordinary shares (“Consideration Shares”) to NWSS or its nominee; and

· pay A$500,000 to NWSS.

Completion of the Acquisition is subject to FIN obtaining shareholder approval for the issue of the Consideration Shares for the purposes of Listing Rule 7.1 and FIN, NWSS and other parties to an existing royalty deed in respect of the NOSSP executing a variation and assumption deed. The meeting is expected to be held in early June. The Consideration Shares will be escrowed for a period of 12 months from the date of issue.

With effect on and from completion of the Acquisition, FIN (or the FIN Nominee, as applicable) and NWSS will form an unincorporated joint venture in respect of the NOSSP, under which the joint venture interest of FIN (or the FIN Nominee) will be 80% and NWSS will be 20%. NWSS’ 20% joint venture interest will be free carried by FIN to completion of a Definitive Feasibility (as defined in JORC 2012).

The shareholders of NWSS will retain a 1% gross revenue royalty interest in the NOSSP. At completion of the Acquisition, FIN (or the FIN Nominee, as applicable) will assume the obligation to pay the 1% gross revenue royalty to the extent of its 80% joint venture interest in the NOSSP.

Placement

Concurrently with the Acquisition, FIN has received firm commitments for a placement of 89,333,333 shares to raise up to A$1.6 million. The placement will be undertaken in two tranches. The first tranche will comprise up to 72,922,860 shares that will be issued under Listing Rules 7.1 and 7.1A. The second tranche will comprise up to 16,410,473 shares and will be subject to shareholder approval. In addition, FIN will seek shareholder approval for the participation in the placement of Non-Executive Director Mr Jason Bontempo (or his nominee), who intends to subscribe for a further 8.33m shares to raise up to a further $150,000.

FIN intends to use the funds raised under the placement for exploration across FIN’s projects (including McKenzie

Springs and the NOSSP if the 80% interest is acquired) and for working capital.

Max Capital Pty Ltd and Chieftain Securities Pty Ltd have acted as corporate advisors to FIN and NWSS respectively and will each have the right, subject to FIN shareholder approval, to subscribe for 25 million options in FIN at a subscription price of $0.00001, exercisable at $0.018 on or before 30 June 2024.

The Company also intends to seek shareholder approval for the issue of 25 million Director and Management Performance Options exercisable at $0.00001 with vesting conditions of 5-day VWAPs of $0.036 (8.33m Options),

$0.054 (8.33m Options) and $0.072 (8.33m Options) within 3 years of issue.

McKenzie Springs Project.

On 25 February 2021, FIN announced the results from its maiden drilling program at the McKenzie Springs Project located 85km northeast of Halls Creek, Western Australia. The program was the Company’s first-ever drilling within the McKenzie Springs Project, comprising three diamond drill holes for a total of 947.9m. The drillholes were designed to test multiple modelled strong high priority conductors defined from Fixed Loop Electromagnetic (FLEM) geophysical surveys. Downhole transient electromagnetic (DHTEM) surveying was completed on each drillhole.

Whilst the drilling did not intersect significant sulphides, broad disseminated zones of sulphides were encountered and several weak to strong in-hole and off-hole anomalies were identified by the DHTEM survey, many of which are likely to be related to sulphide mineralisation. Further geological and geophysical modelling is in process.

Source: Company Press Release