Alamos Gold has revealed that the Puerto Del Aire (PDA) gold project in Mexico will require a total capital expenditure (capex) of $231m, based on the findings of a positive internal economic study.

The total capex includes an initial capital expenditure (capex) of $165m and sustaining capex of $66m.

According to the study, the Mexican gold project will have a mine life of eight years. It extends the Mulatos District mine life from 2027 to 2035.

Alamos Gold said that the Puerto Del Aire project will have an average annual gold production of 127,000 ounces over the first four years and 104,000 ounces over the estimated mine life. This is based on mineral reserves as of 31 December 2023.

Located within the Mulatos District in Sonora, the Puerto Del Aire gold project will be the second underground mine developed and operated in the Mulatos District, following the San Carlos underground mine.

The Canada-based intermediate gold producer aims to commence the development of the Mexican gold project in 2025. The first production at Puerto Del Aire gold is expected in mid-2027.

The study projects a post-tax net present value (NPV) of $269m for the Mexican gold project. It projects an after-tax internal rate of return (IRR) of 46%, with a payback period of two years.

These are estimated using the base case gold price assumption of $1,950 per ounce.

Alamos Gold CEO and president John McCluskey said: “The development of PDA and transition to underground sulphide milling operations will open up additional opportunities for growth in the Mulatos District.

“Given our ongoing exploration success at PDA, and newly defined and growing higher-grade zones of mineralisation at Cerro Pelon, we see excellent potential to further extend the mine life and add to already attractive economics.”

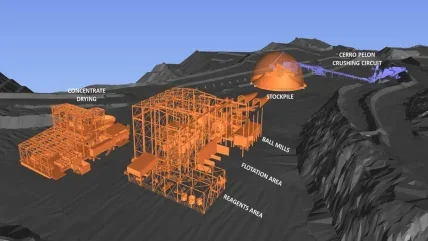

The Puerto Del Aire gold project is expected to utilise existing crushing and mill infrastructure from Cerro Pelon and Island Gold, complementing lower initial capital and project execution risk.

Alamos Gold has submitted the amended environmental impact assessment (MIA) for the gold project. The approval is expected to be secured by the end of this year.

In July 2024, Alamos Gold completed its acquisition of all the issued and outstanding common shares that it did not already own of rival gold company Argonaut Gold.