Aker BP said that it will proceed with nine out of the ten previously announced field development projects on the Norwegian continental shelf (NCS), which entail an investment of over NOK200bn ($19bn).

In this connection, the company informed the Norwegian Ministry of Petroleum and Energy that it has acceded to all the plans for development and operation (PDOs) submitted in December 2022, with the exception of the Troldhaugen project.

Located in the Edvard Grieg area, the Troldhaugen project, which has been discontinued, makes up nearly 4% of the net estimated resources in the 10 projects, said Aker BP.

According to the company, when a decision is made on the development of an offshore field in Norway, the licensees have to submit a PDO to seek approval from the Ministry of Petroleum and Energy (MPE). Following this, each licensee should notify the MPE within three months if they accede to the plan for field development or not.

The estimated total recoverable resources from the 10 development projects are 730 million barrels of oil equivalent (mmboe) net for Aker BP, with an average break-even price of $35-40 per barrel.

Troldhaugen makes up nearly 30mmboe of the total recoverable resources while needing an investment of $500m.

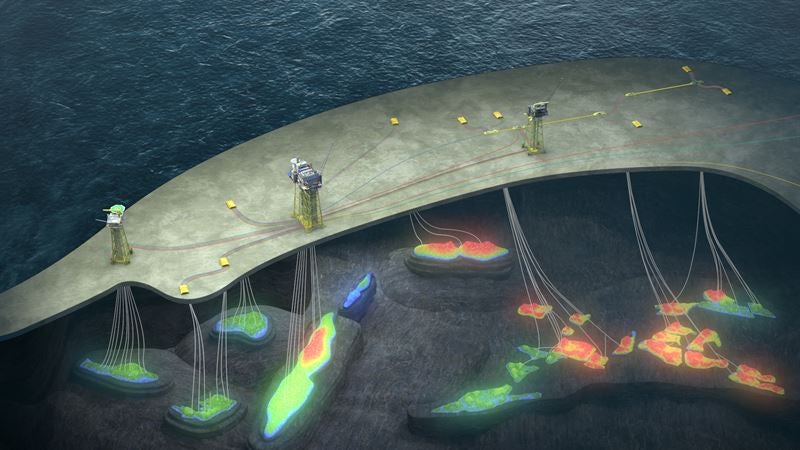

The development projects planned by Aker BP and its partners are grouped into four main regions, which are Yggdrasil (formerly NOAKA), Valhall process and wellhead platform (PWP) – Fenris (formerly King Lear), Skarv, and Utsira High.

Troldhaugen alongside Symra made up the Utsira High project.

Aker BP had previously stated that the Troldhaugen field development was conditional on the performance of an extended well test (EWT) which has been in production since August 2021.

The company stated: “The experience from the EWT has resulted in a reduction in the expected recoverable volume. The project is no longer considered to have sufficient financial robustness, and Aker BP has decided not to accede to the PDO.”