How will evolving electricity-pricing mechanisms affect the economics of operating US nuclear power plants? By Meredith Angwin

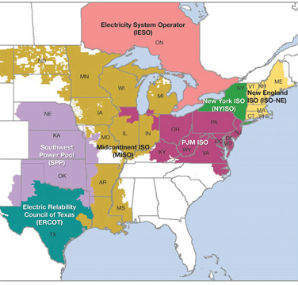

The US electricity system includes traditional (vertically integrated) and liberalised markets. In the liberalised markets, Regional Transmission Organisations (RTOs) and Independent System Operators (ISOs) operate the grid, using free-market auctions. All the nuclear power plants that are in danger of shutting for economic reasons are in RTO areas, which are the most challenging for nuclear plants.

Neither RTOs nor vertical integration are perfect systems for pricing electricity. RTOs are relatively new (started in the 1990s) and are still evolving. From 2018, some RTOs are planning to reward reliable plants by instituting a "Pay for Performance" measure. Unfortunately, despite the hopeful name, this change is not likely to help nuclear plants.

The RTOs aim to lower power prices using auctions. When the grid needs power, plants bid to supply and the operator chooses the cheapest offers first.

Electricity is also sold via power purchase agreements (PPAs) between power plants and utilities. But in many markets, investor-owned utilities are prohibited from entering into long term PPAs with conventional generation sources. PPA electricity prices tend to follow grid pricing, though sometimes with a major lag time.

The missing money

Real-time energy markets immediately ran into a problem. Why should plant owners build or maintain plants if they are not guaranteed a price or a number of hours that the grid is sure to call on them?

It became clear that paying only for energy (kWh) might not provide enough money to maintain all the plants that are needed for reliable grid operation. At a recent meeting of the Consumer Liaison Group for ISO-NE, James Bride of Energy Tariff Experts provided useful figures on the subject (Figure 2).

Plants now bid into a second market, the forward capacity auction that provides "missing money" that makes gas turbines and peaking plants economic. (See Figure 3, prepared by Entergy, and used with their permission).

Nuclear plants get most of their money from energy payments, not capacity payments. That is because nuclear plants make so many kWh, compared to other types of plants with the same nameplate capacity rating (see box). Ultimately, of course, the grid is all about kWh delivered.

RTO auctions – the figures

RTOs run two types of auctions: a real-time energy auction, and a forward capacity market. Plants bid in to supply either kWh immediately (energy market) or capacity availability some years in the future (capacity market).

Both auctions are so-called ‘pay as clear’, which means that all the bidders get the payment at the level of the highest bid accepted. The auctions are meant to move prices in synch with demand, and provide the lowest price that meets the demand.

Nuclear plants and others have very different revenue streams from these two markets.

Let’s look at an overly simplified example. Let us assume that we have a price on the grid of 4 cents per kWh, and a capacity price of $3 per kWmonth.

A 500MW nuclear plant and a 500MW combined cycle gas plant (CCGT) will both get the same capacity payment of $1,500,000 per month, because they have the same capacity. But the nuclear plant earns around $13 million from energy sales as it has a 90% capacity factor, while the combined cycle gas plant, with half the capacity factor (according to the Energy Information Administration), earns around $6 million from energy sales. In this simplified case, the capacity payment is about 10% of the nuclear revenue stream, and 20% of the CCGT revenue stream.

If the gas plant were a "peaker," running about 10% of the time, it would receive the same capacity payment as the other two plants. However, it would earn only $1.5 million from energy sales, and capacity payments would be about half of its revenue (although in practice, plants used at peak times see high energy prices).

For a nuclear plant, even a small reduction in energy prices can override a modest increase in capacity payments.

What about delivery?

Capacity markets did not completely solve the reliability problem. What happens if the plant receives capacity payments, but does not run when called on?

ISO-NE and other ISOs were aware of this potential problem, and began designing so-called "Pay for Performance" incentives. These incentives were to start in 2018.

However, since the shale gas boom, the grid has became more and more dependent on natural gas. The ISOs needed to ensure winter reliability, something they could put in place more rapidly then Pay for Performance.

The capacity market results misled the ISO about the amount of electricity that would be available to the grid in crisis situations. During cold snaps, much less electricity was available than had been promised because gas-fired plants had made firm capacity commitments to the grid but did not have firm delivery commitments for gas supply. The Polar Vortex laid bare this problem.

The ISOs needed a stopgap for Pay for Performance, so they instituted winter reliability programmes. They too used auctions, but the aim was to support plants to keep oil, CNG and LNG onsite to burn when gas was not available. ISO paid for oil, or paid storage costs for unburned oil. FERC (the Federal Energy Regulatory Commission) approved the winter reliability programmes on a temporary basis.

Pay for Performance

Pay for Performance (PFP), which will start in 2018, is supposed to be fuel-neutral. It will provide an economic incentive for power plants to come online when needed during tight situations on the grid.

Sadly, PFP is not market-based. It is a regulatory system based on a complex penalty formula. If a plant contracted to provide capacity does not provide electricity when called upon, it will pay a penalty.

Penalties paid will be added to the capacity payments of plants that do perform.

Losing a month’s capacity payment, or more, would be a blow for a plant that depends on capacity payments, such as a CCGT. An ISO-NE hypothetical example shows a 100MW plant losing or gaining $50,000, $150,000 and $350,000 dollars in a month, under various scenarios.

Nuclear plants may get some extra payments from PFP, but these payments would be part of their capacity payments. For nuclear plants, capacity payments are a small portion of their revenue stream, and PFP will not make much difference.

The major effect that PFP seems to have had is to encourage all new gas-fired plants to be dual-fuel, and pay for oil themselves. As ISO-NE said in a statement about Pilgrim closing: "Most of this new gas-fired generation is seeking to become dual-fuel capable, meaning they will be able to switch to use oil if natural gas is not available, or if the cost of oil is lower than that of natural gas."

PFP and nuclear

Will PFP help nuclear power? Will PFP reward nuclear plants for their reliability? The answer is: No. The main result of PFP has been to encourage natural gas plants to commission or recommission dual fuel capabilities so that they can burn oil.

Nuclear plants get most of their revenue from energy payments, not capacity payments. Nuclear plants may get some higher capacity payments through PFP, but it will not make a big difference to them. The PFP transfer will make a difference to peaking plants, which will have more of an incentive to become dual-fuel or make other arrangements to be able to deliver when called on.

RTOs are moving pretty far from a market, as markets are usually considered. Nuclear power plants in RTO areas of the USA are not well valued for their steady performance and PFP will not change that. Meanwhile, the RTO market solution is becoming an increasing series of tweaks and attempts to keep the grid operating smoothly. The tweaking in RTO areas (including PFP) is complex, and it becomes more complex all the time.

In general, RTO markets favour plants with low capital costs, high fuel costs and low utilisation, rather than plants with high capital costs, low fuel costs and high utilisation. This is the outcome of the current market design.

In other words, RTO markets are unfavourable to nuclear power. Whether this outcome was a goal of the design or an unintended consequence is not clear. At any rate, despite all the tweaks, RTO markets allow local grids to move to natural gas, despite problems with gas delivery. Except for dual-fuelled plants, Pay for Performance will make little difference.

About the author

Meredith Angwin is physical chemist, a writer, and a former project manager at the Electric Power Research Institute.