Canadian Utilities, a member of the ATCO Group of companies, has agreed to offload a fossil-fired power generation portfolio with a capacity of around 2.36GW in Canada in two separate deals worth about C$835m (£490.33m).

Canadian Utilities transaction with Heartland Generation

The biggest of the deals includes sale of 11 partly or fully-owned natural gas-fired and coal-fired power generation facilities to Heartland Generation, an affiliate of Energy Capital Partners. The power plants to be sold are located across the provinces of Alberta, British Columbia, and Ontario, and have a combined capacity of around 2.1GW.

Energy Capital Partners managing partner Tyler Reeder said: “We are impressed by the portfolio’s high-quality assets and strong operating history. We look forward to partnering with the portfolio’s talented management team and employees and to continuing to provide a high level of service to the portfolio’s offtakers and customers.”

The transaction, which is subject to regulatory approvals and satisfaction of other customary closing conditions, is expected to be completed in the second half of 2019.

For Canadian Utilities, the transaction follows the announcement it made last September for exploring strategic alternatives for the Canadian power plants. The company then said that the move was in line with its practice of continuous evaluation and streamlining of its portfolio of businesses.

Canadian Utilities deal with SaskPower

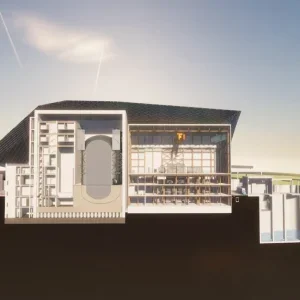

Through a separate deal, the ATCO company agreed to divest its stake of 50% in the 260MW Cory Cogeneration Station in Saskatchewan province to SaskPower International. The deal will see SaskPower take full ownership in the Cory Cogeneration Station located at the Nutrien Cory Potash mine near Saskatoon, which has been operating since 2003.

Canadian Utilities president and CEO Siegfried Kiefer said: “These assets provide reliable and affordable energy to customers across Canada and I want to thank our employees for their commitment and dedication to operating these assets to the highest standards.

“We are focused on building a globally diversified portfolio of energy-related infrastructure assets. Continually evaluating our business model and strategies ensures we are well-positioned to capture opportunities in markets at home and abroad.”

The company said that the transactions exclude ASHCOR Technologies, the Oldman River Hydro Facility, or projects outside Canada, which will be retained by it. Upon closing of the deals, Canadian Utilities will have nearly 250MW of power generation facilities across Canada, Mexico and Australia.