Turnagain nickel-cobalt project is situated 70km east of the township of Dease Lake in Northern British Columbia, Canada. It is 100% owned by Giga Metals (previously Hard Creek Nickel Corporation) and considered to be one of the world’s biggest undeveloped sulfide nickel deposits.

Pre-feasibility study for the project is expected to be completed by the third quarter of 2019, while production is expected to begin in 2021. The estimated mine life of Turnagain is 28 years.

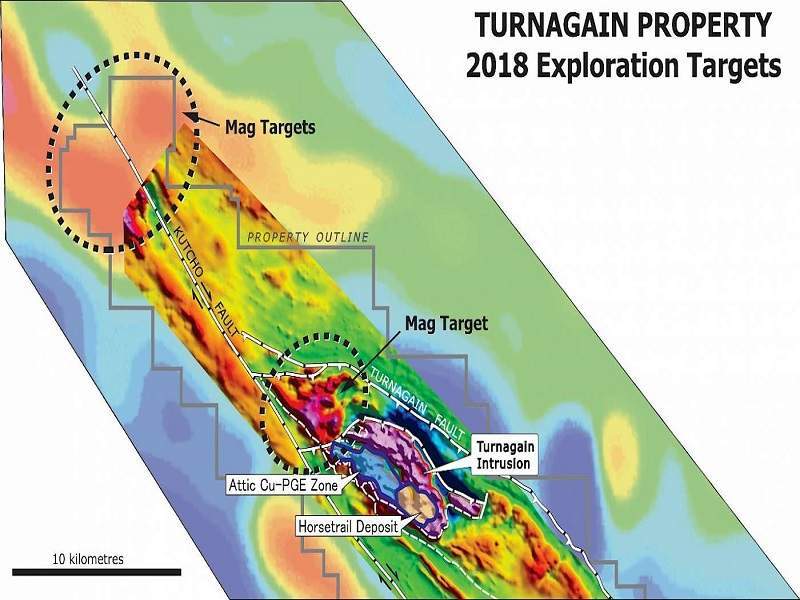

Geology and mineralization

The Turnagain mineral complex is part of an Alaskan-type ultramafic intrusion extending in northwest direction. The complex consists of a central dunite core bound by crystal cumulate sequences of wehrlite, olivine clinopyroxenite, and clinopyroxenite.

Disseminated sulphides are hosted within dunite and wehrlite near the southern and northern boundaries of the ultramafic intrusion. The main suplhides present in the property include pyrrhotite, pentlandite, chalcopyrite, and bornite.

Turnagain nickel-cobalt project reserves

Measured and indicated reserves of the Turnagain property are estimated to be 865Mt grading 0.21% nickle and 0.013% cobalt.

Inferred reserves are estimated to be 976Mt grading 0.2% nickel and 0.013% cobalt.

Mining and ore processing

Conventional open-pit mining will be employed to mine the Turnagain property. High-volume trucks and shovels will be used to achieve high mining rates and low-cost mining operations. Mining will initially be focused on the Horsetrail pit and will be carried out in five phases.

“The Turnagain mineral complex is part of an Alaskan-type ultramafic intrusion extending in northwest direction.”

A conventional comminution and flotation plant with a capacity of 87,000 tonnes per day (tpd) will be used for processing the ore. The processing plant will consist of two stages of primary crushing operation and two stages of grinding, including a semi-autogenous (SAG) ball mill pebble-crusher (SABC) circuit.

The crushed ore will pass through four rougher flotation banks and a three-stage cleaner circuit. The final step will include concentrate filtration, following which the extracted concentrate will be transported for use.

The flotation plant will operate at 50% capacity during the initial five years and ramp up and operate at full capacity for the rest of the mine life.

Infrastructure at Turnagain nickel-cobalt project

The mine can be accessed by Highway 37 and 32km of unpaved roads and trails. A 287kV transmission line from Tatogga Lake is planned to be built to connect to a switching station near Dease Lake, which will supply power to the mine through step-down substations at the site.

Fresh water will be sourced from groundwater wells near the Turnagain River for the mill and mine facilities. The water will be pumped to a storage tank located 120m above the processing plant.

The mine site will also house service buildings, vehicle shop, warehouse, laboratory facility, process control room, and administration building.

Financing

Giga Metals signed an agreement with Cobalt 27 Capital to sell 2% net smelter return (NSR) royalty on all metal produced from the Turnagain mine.

Cobalt 27 Capital made a cash payment of $1m in addition to $9m-worth common shares to Giga Metals for the NSR. The cash paid along with cash in hand will be used to advance the development of the project.

Contractors involved

Piteau and Associates was contracted in 2007 for geotechnical and logging guidance. Pit optimization was performed by Moose Mountain Technical Services.

The resource estimate of the property was done by GeoSim Services, while geotechnical core logging protocol was designed by Knight Piesold.

Valard Constructions carried out the preliminary study for developing the transmission line for the project.

Reid Resource Consulting conducted the comprehensive study on the nickel-cobalt market. ALS Global was contracted as the analytical provider for 2018 drilling program at the Turnagain nickel-cobalt project.