Sanbrado gold project is a high-grade mining project being developed in the south-eastern region of Ouagadougou in Burkina Faso.

The gold project is being developed by West African Resources (90%) and Government of Burkina Faso, which holds a 10% free-carried interest.

With an estimated pre-production capital cost of $186m, the project is expected to produce 301,000oz of gold in the first year of production.

It is forecasted to produce an average of 217,000 ounces (oz) of gold during the first five years and 153,000oz gold through the remaining five -year life of mine.

Environmental approval for the project was received in April 2018 and an optimized feasibility study was completed in April 2019. Construction of the project was commenced in July 2018, while first gold production is anticipated in the third quarter of 2020.

Sanbrado gold project geology and mineralization

The Sanbrado gold project lies approximately 90km from Ouagadougou, the capital of Burkina Faso and extends in more than 116km² area. It lies on the northeast-trending volcano-sedimentary belt surrounded by the Tiébélé-Dori-Markoye fault.

The gold deposit is associated with the Lower Proterozoic system of the Birimian, which hosts metavolcanic and metasedimentary rocks. It is divided into four separate resources/prospects namely Mankarga 1 North (M1 North), Mankarga 1 South (M1 South), Mankarga 3 (M3), and Mankarga 5 (M5).

Gold mineralization at Sanbrado is believed to be the result of a main hydrothermal event that resulted in the silicification of the surrounding rocks.

The underground gold identified is mainly associated with minor pyrite, chalcopyrite, and arsenopyrite.

Sanbrado gold project reserves

The probable ore reserves of Sanbrado gold project are estimated to be 21.6Mt, grading 2.4g/t Au, as of April 2019. It is estimated to contain 1.7 million ounces (Moz) of gold.

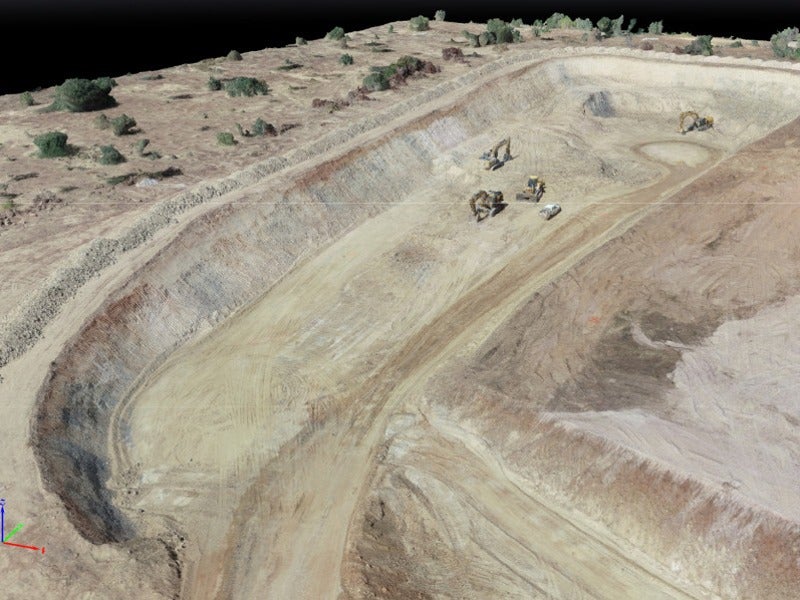

Mining at Sanbrado gold project

Conventional underground mining will be applied for the first six years, followed by open-pit mining for the rest of the mine life.

Long hole open stoping method, involving conventional two boom jumbos, will be used to extract the underground ore. The underground mine will be accessed through a box-cut and portal located immediately to the south-west of the M1 South open-pit.

Conventional open-pit mining method, using drill and blast followed by material movement using hydraulic excavators and trucks, is proposed for the project.

Mining fleet proposed for the project majorly includes 120t to 200t class excavators and 95t-class mine haul trucks.

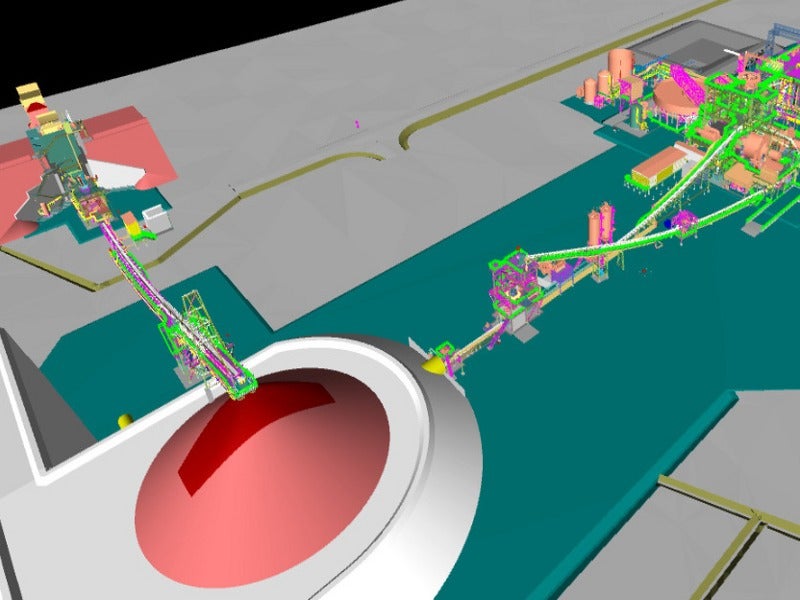

Ore processing at Sanbrado gold project

The processing plant, being developed to the south-east of the M5 pit, is designed to have a throughput capacity of 2.2Mtpa.

The mined ore will be stockpiled on the run-of-mine (ROM) pad before being fed to the primary crusher by a front-end loader. Two apron feeders will forward the crushed ore to the milling circuit, which comprises semi-autogenous grinding (SAG) and ball mills, to achieve finer ore.

The resultant slurry will be discharged to the mill discharge vibrating screen, while the undersize will be sent to the mill discharge hopper. The slurry will be forwarded to a cyclone cluster, while the underflow will be fed to the gravity circuit.

The gravity recovery circuit will include one centrifugal concentrator and a leaching reactor to treat the resultant gravity concentrate.

The concentrate will undergo carbon-in-leach processing, wherein cyanide will be added. The pregnant liquor from the reactor will pass through electro-winning circuit and the resulting sludge will be refined to produce the final gold doré bar.

Sanbrado gold project financing

A finance facility of $200m was secured with Taurus Funds Management for the development of the project in 2018, of which the first draw down of $75m was made in April 2019.

Sanbrado gold project infrastructure

Sanbrado gold project can be accessed by sealed highway Highway RN4. Raw water for ore processing will be sourced from Nakambe River using submersible pumps and stored at the proposed 1.5 million m³ water storage facility. Potable water will be sourced from the groundwater bores drilled in the mine site.

Power supply for the project will be provided by a heavy fuel oil (HFO) power station, to be constructed by an independent power producer (IPP), at the processing plant.

Tailings generated by the project will be stored at the 25Mt tailings storage facility (TSF), while the workers will be accommodated at the 270-person accommodation camp located approximately 0.5km from the processing plant.

Contractors involved

The optimized feasibility study of the project was prepared by a group of consultants including Lycopodium Minerals, Aurifex and ALS Ammtec, OMC, Knight Piésold Peter O’Bryan & Associates, and Sylvatrop Consulting.

Other participants include International Resource Solutions, SCME, Capital Mine Consulting & Kenmore, and Model Answer Commercial Analytics.

WAF engaged Byrnecut Burkina Faso for conducting underground mining at the Sanbrado project, while Outotec is the supplier of the SAG and ball mills.

Lycopodium was selected as the engineering, procurement, and construction management (EPCM) contractor for providing processing plant and associated infrastructure for Sanbrado, in November 2018.