The Magnolia LNG project is an 8.8 million tonnes per annum (Mtpa) liquefied natural gas (LNG) export terminal planned to be developed in Lake Charles, Louisiana, US.

Magnolia LNG (MLNG), a wholly-owned subsidiary of Liquefied Natural Gas Limited (LNGL), will develop and operate the terminal along the US Gulf Coast.

The engineering, procurement and construction contractor for the project was finalised in November 2015, while the US Federal Energy Regulatory Commission (FERC) granted approval for the construction and operation of the terminal in April 2016.

The US Department of Energy (DOE) approved LNG export from Magnolia LNG terminal to the countries that are part of the USA’s non-free trade agreement (FTA) in November 2016.

Construction activities are expected to be started after reaching final investment decision (FID) by the end of 2019. The cost of the Magnolia LNG project is estimated to be £3.63bn ($4.62bn).

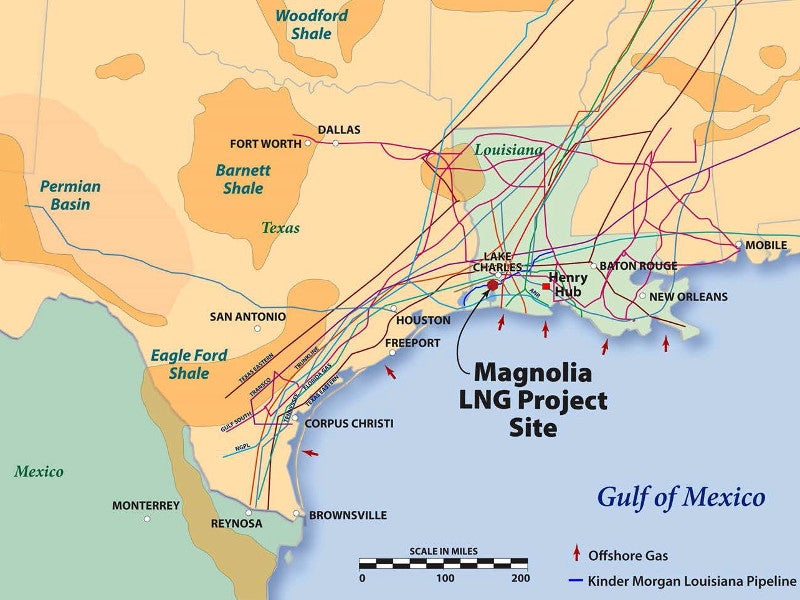

Magnolia project location and site details

The Magnolia LNG terminal will be developed on a 115-acre site near the Calcasieu Ship Channel in the Port of Lake Charles, in south-west Louisiana.

Land for the Magnolia LNG project was procured on lease for 70 years in December 2012.

Magnolia LNG project details

The front-end engineering and design (FEED) for the Magnolia project was based on the FEED works completed for LNGL’s Gladstone Fisherman’s Landing LNG export project at the Port of Gladstone in Queensland, Australia, which was cancelled in 2017.

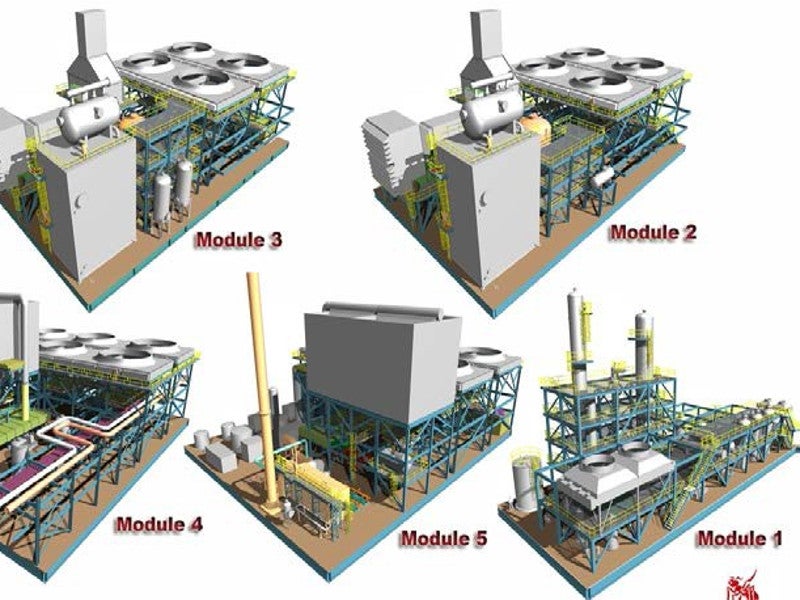

The Magnolia LNG export terminal will consist of four liquefaction trains each capable of processing 2.2 million tonnes (Mt) of natural gas per annum.

Other primary infrastructure components of the project will include two 160,000m³ full containment LNG storage tanks, and ship-loading facilities capable of accommodating 180,000m³ LNG carriers.

The structures for liquefaction trains, LNG storage tanks, and control and administration building will be supported on 24in-diameter precast concrete piles, while the foundations for LNG loading platform, mooring and breasting dolphins will comprise open-ended steel pipe piles with 96in, 54in, and 48in diameters, respectively.

LNGL’s proprietary optimised single mixed refrigerant (OSMR) liquefaction technology will be used at the Magnolia LNG project. MLNG was granted a US patent for the technology in May 2015. Use of the OSMR is claimed to result in 30% lower greenhouse gas emissions.

Feed gas supply

The Magnolia LNG terminal will receive gas supply through the Kinder Morgan Louisiana Pipeline (KMLP), which is capable of transporting up to 2.2 billion cubic feet of gas per day (bcfd).

The pipeline is interconnected with several pipeline systems, including the ANR, Transco, Columbia Gulf, TETCO, Texas Gas, and Pine Prairie pipelines to procure gas from the US Gulf Coast states.

In January 2015, MLNG signed an agreement with Kinder Morgan to receive 1.4bcfd of gas for a period of 20 years, which will be sufficient to sustain the capacity of the Magnolia LNG terminal.

LNG off-take

In September 2019, LNGL agreed to export 2Mt of LNG from the Magnolia terminal to the Bac Lieu LNG-to-power project proposed to be developed in Vietnam,under an initial 20-year supply and purchase (SPA) agreement with Delta Offshore Energy (DeltaOE).

Financing

The Magnolia LNG project is planned to be developed through 70% debt financing and 30% equity investment.

BNP Paribas was appointed as the financial advisor and debt arranger for the project in December 2013.

LNGL secured £1.1bn ($1.5bn) of equity commitment from Stonepeak Infrastructure Partners, an asset manager based in the US, for the Magnolia LNG project in July 2017.

Contractors involved

KSJV, a joint venture between Kellogg Brown & Root (KBR) and SK Engineering & Construction (SK E&C), was awarded a lump sum £2.9bn($4.35bn) turnkey engineering, procurement, and construction (EPC) contract for the Magnolia LNG project in November 2015.

KBR holds 70% ownership in the joint venture, while the remaining 30% is held by SK E&C.

In June 2019, the validity of the EPC contract was extended until December 2019, while the contract cost was updated to £3.6bn ($4.6bn).