Los Azules is a porphyry copper development project located in the San Juan Province of Argentina. The project is said to be one of the largest undeveloped high grade open pit copper projects in the world.

McEwen Copper, a majority-owned subsidiary of by McEwen Mining, is the owner of the project.

A Preliminary Economic Assessment (PEA) of the property was completed with an effective date of 1 September 2017. According to the report, Los Azules is expected to be world’s 25th largest copper producer in the first ten of the planned 36 years of operations (LOM).

The total initial capital cost was estimated to be $2.36bn.

The indicated mineral resource estimate is 962 million tonnes (Mt) at an average grade of 0.48% Cu, 0.06g/t Gold (Au), 0.003% molybdenum (Mo) and 1.8g/t silver (Ag).

The updated PEA is slated to be completed in the first quarter of 2023 and a feasibility study in 2024. The project is expected to produce 100,000 tonnes per year of cathode copper at 99.9% purity from 2027.

Location and Site details

The Los Azules project is in the San Juan pro-mining Province of Argentina. The project site is around 80km west northwest of the Calingasta town and 6km east of Argentina’s border with Chile.

The elevation at the site ranges between 3,300 metres above sea level (masl) at the proposed camp location and 4,500masl on the high peaks.

The project is situated in a broad valley with a central ridge called La Ballena with sparse vegetation at lower elevations.

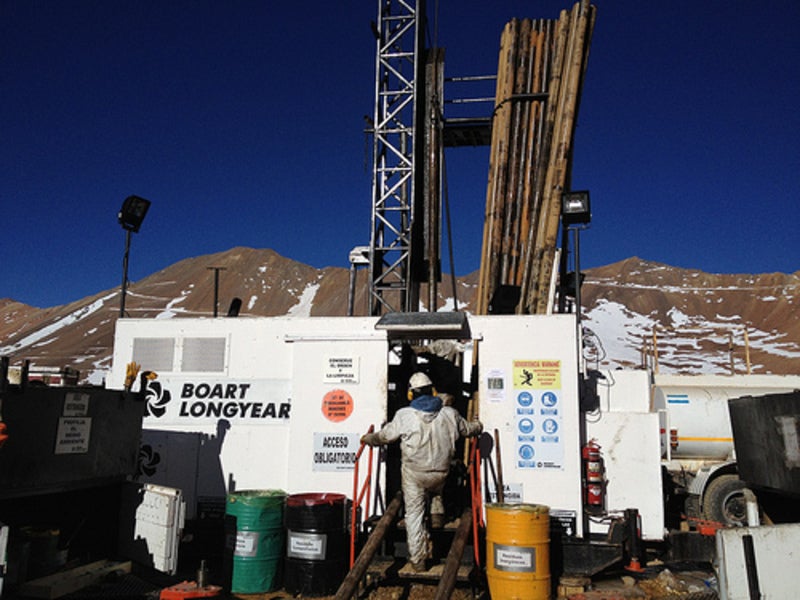

There is no infrastructure present at the site. Exploration works are usually conducted from November or December to April or early-May.

Los Azules Property History

At the site, there are no records of exploration before 1980.

In the mid-1980s and through the mid-1990s, Battle Mountain Gold Corporation (BMG) discovered a large hydrothermal alteration zone associated with dacite porphyry intrusions and stockwork zones.

BMG constructed a new access road in 1998.

Minera Andes acquired concessions in the area in the mid-1990s and initiated an exploration programme in December 2003.

In October 2009, Minera Andes became the 100% owner of the project. The company was acquired by US Gold Corporation in January 2012 and the combined firm was subsequently renamed as McEwen Mining.

McEwen Mining created McEwen Copper on 6 July 2021. The wholly owned subsidiary owns 100% interests in the Los Azules project and in the Elder Creek exploration property in Nevada.

In February 2023, Stellantis invested $155m in the Los Azules project while Nuton, a Rio Tinto Venture, made another $30m investment.

Following the closing of the transactions, McEwen Mining will own 51.9% stake in McEwen Copper. The other stakeholders will be Stellantis (14.2%), Nuton (14.2%), Rob McEwen (13.8%), Victor Smorgon Group (3.5%), and other shareholders (2.4%).

Geology, Mineralisation and Mineral Resource Estimate

The geology of the property comprises Mesozoic volcanic rocks intruded by a Miocene diorite stock. The porphyry copper style mineralisation and hydrothermal alteration are genetically, temporarily, and spatially related to dikes and diorite stock.

The deposit resembles a classic Andean-style porphyry copper deposit in many respects.

The hydrothermal alteration system is minimum 5km long and 4km wide elongated in NNW direction. The altered zone is around 4km long by 2.5km wide.

Chalcopyrite, the most important hypogene copper mineral, occurs in the upper levels of the deposit, while hypogene bornite is found at deeper levels together with chalcopyrite.

Copper sulphides are mostly within 2% to 3% of rock volume. In some intersections, silver (approximately 1 gram/tonne), anomalous gold (up to approximately 150 parts per billion) and molybdenum (up to approximately 600 parts per million) are also reported.

The Los Azules mineral resource estimate is based on the results of the 2016-2017 drilling programme.

The estimated indicated mineral resource is 962Mt at an average grade of 0.48% Cu for 10.2Blbs contained metal.

Inferred mineral resources were 2,666Mt at an average grade of 0.33% copper, 0.04g/t Au, 0.003% Mo and 1.6g/t Ag.

Los Azules Mining and Ore Processing

As the Los Azules deposit is a near surface coper porphyry deposit, the property is expected to be mined by conventional, large scale, open pit mining methods. It will involve the use of large open pit mining equipment to extract mineralised material and waste rock.

Electrical drills and rope shovels will be used due to the lower operating costs and better reliability. The rest of mining fleet will be diesel powered equipment and machinery.

High fragmentation blasting methods will be applied to concentrator feed material to minimise crushing and grinding energy demand.

Lower powder factors will be applied to waste zones and a portion of waste zones will be delivered to the tailings dam.

The processing will be done by Los Azules concentrator, producing copper concentrate as the final product.

The on-site concentrator would employ one comminution circuit featuring a primary crusher, stockpile feed conveyor, reclaim conveyor, one SAG mill, two pebble crushers and two ball mills.

Flotation, thickening and filtration circuits; a tailing storage facility; and concentrate storage will follow the comminution circuit.

The processing plant has been designed for average daily throughput of 80,000tpd. The throughput is planned to be increased to 120,000tpd by fifth year through additional comminution and flotation capacity.

The LOM recovery of copper is expected to be 91% at 30% Cu.

Other Infrastructure

The infrastructure of the project includes access roads including internal access and haul roads, airstrip, concentrate export facilities, water supply and management, tailings storage facility, waste rock facility, and employee accommodation.

The power supply to the project that were being considered include High Voltage Alternating Current (HVAC) and in High Voltage Direct Current (HVDC).

Contractors involved

The PEA for the project was prepared by Hatch, a management, engineering and development consultancy. BD Resource Consulting, WLR Consulting, ATC Williams and SIM Geological also offered support.