The Aphrodite gas field is the first gas field to be discovered and granted a production license in the eastern Mediterranean Sea, offshore Cyprus.

Discovered in 2011, the deep-water gas field is estimated to hold up to 4.5 trillion cubic feet (Tcf) of recoverable gas reserves.

US-based Noble Energy is the operator of the field holding a 35% participation interest, while the other development partners are Israel-based Delek Drilling (30%) and the Anglo-Dutch oil major Shell (35%).

The Aphrodite gas field development partners were granted the exploitation license for a period of 25 years in November 2019.

A final investment decision (FID) on the massive gas field development is expected after the completion of front-end engineering and design (FEED) as well as the drilling of an additional appraisal well in 2022.

Scheduled for commissioning by 2026, the Aphrodite gas field is hoped to deliver more than £7.2bn ($9bn) of direct economic benefits while providing energy independence to the Republic of Cyprus.

Location

The Aphrodite gas field is located within Block 12 of the Cypriot Exclusive Economic Zone (EEZ) in the eastern Mediterranean Sea, approximately 160km south of Limassol, Cyprus.

The field lies in a water depth of 1,700m and covers an area of approximately 120km2.

The deep-water gas field is situated in the Levant Basin that also hosts other prominent fields including Tamar and Leviathan , offshore Israel.

Discovery, appraisal and ownership history

The Aphrodite gas field was discovered by the A-1 discovery well which was drilled up to a depth of 5.8km below the seabed in late 2011.

The A-2 appraisal well drilled in 2013 further confirmed the reservoir productivity.

British Gas (the BG Group) acquired a 35% interest in the field from Noble Energy in November 2015. Shell became a stakeholder of the field by acquiring the BG Group in February 2016.

The Aphrodite gas field development plan

The initial production phase is expected to involve five production wells capable of producing up to 800 million cubic feet (Mcf) of gas a day.

The gas wells are proposed to be connected to a floating processing, storage and offloading (FPSO) facility within the Block-12 license area.

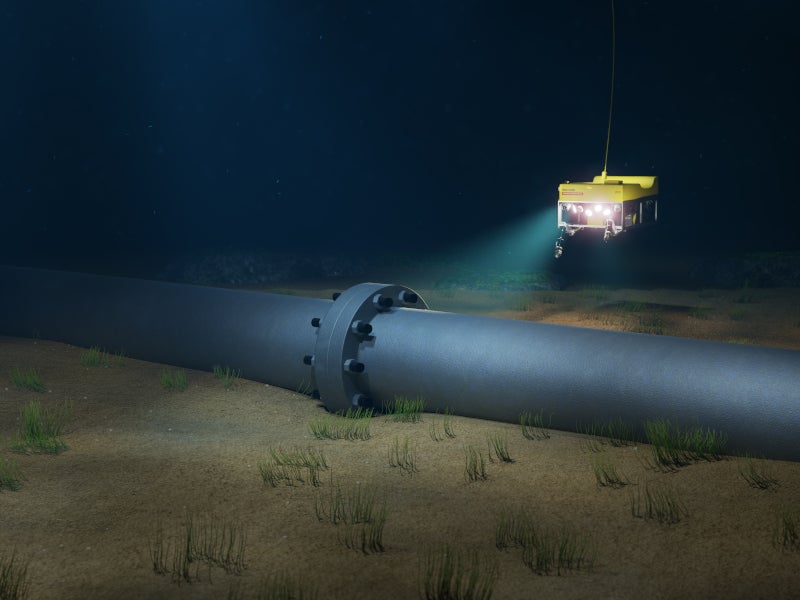

The gas output is proposed to be transported through an under-sea pipeline to the Idku LNG terminal in Egypt for liquefaction and export to the international market.

Cyprus and Egypt signed an agreement for the subsea natural gas pipeline from the Aphrodite field to Egypt in September 2018.

The initial field development expenditure, excluding undersea pipeline, is estimated to be approximately €3.17bn ($3.5bn).

Egyptian LNG Project

The Egyptian LNG Project, also known as the Idku LNG plant, located on the Mediterranean coast of Egypt, is currently the only operational LNG plant in Egypt.

It consists of two liquefaction units with an aggregate capacity of 7.2 million tonnes per annum (Mtpa). Shell holds a 35.5% stake in the Idku LNG export facility.

Cyprus-Israel tangle

The Aphrodite field is located adjacent to Israel’s Yishai field in the eastern Mediterranean Sea. A minor portion of the Aphrodite reservoir stretches into the Yishai field. Despite negotiations for last few years, Israel and Cyprus have not reached a resolution on sharing the resources yet.

In November 2019, just days after Cyprus granted exploitation rights for the Aphrodite field, the Israel Ministry of Energy issued a letter asking the field partners not to proceed with the Aphrodite gas development until a settlement agreement is reached between the two countries.

The Cyprus Energy Ministry, however, has asserted that the development of the Aphrodite reservoir will continue as planned.

Recent gas discoveries in the Cyprus Exclusive Economic Zone

Eni discovered the Calypso gas field in Block-6 of the Cyprus Exclusive Economic Zone (EEZ) in February 2018. Eni and Total hold 50% stake each in the Block-6.

ExxonMobil discovered the Glaucus gas field in Block-10 off the coast of Cyprus in February 2019. It is believed to be the biggest gas discovery in Cyprus till date. ExxonMobil holds a 60% stake in Block 10, while the remaining 40% is held by Qatar Petroleum.