The Definitive Agreement as now amended provides for the issuance of 2,800,000 common shares of Trillium Gold and a cash payment of $175,000 to Imagine Lithium

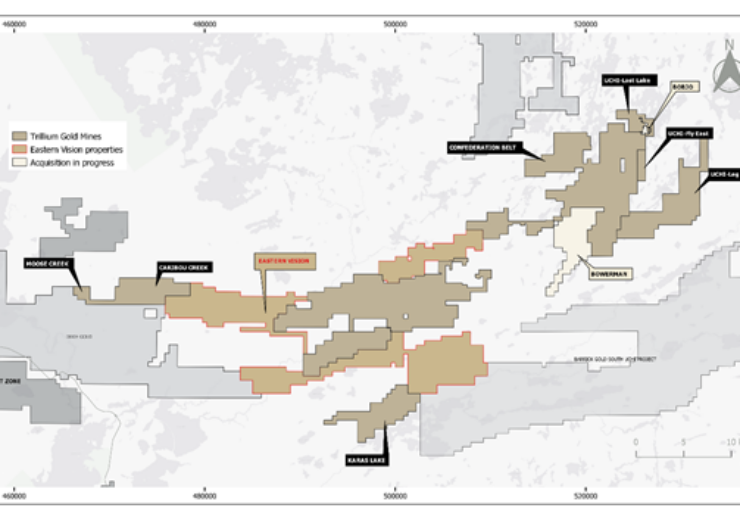

Map showing Trillium Gold’s current landholdings and the acquired Eastern Vision claims. (Credit: Trillium Gold Mines Inc.)

Trillium Gold Mines Inc. (TSXV:TGM, OTCQX:TGLDF, FRA:0702) (“Trillium Gold” or the “Company”) is pleased to announce that it has signed an amended Definitive Agreement (the “Definitive Agreement”) to acquire the majority of Imagine Lithium Inc.’s (formerly Infinite Ore Corp.) Eastern Vision property holdings in the Confederation Lake assemblage within the Birch-Uchi greenstone belt in the Red Lake Mining District of Ontario.

The Definitive Agreement has been amended such that the property now covers 13,958 hectares between the Fredart, Confederation North and Confederation South properties (see map below), giving Trillium Gold control over a significant portion of the Confederation Lake assemblage and creating a contiguous land package covering greater than 100 km of favourable structures on trend with Kinross Gold’s Dixie Deposit and Evolution Mining’s Red Lake Operation.

The Definitive Agreement as now amended provides for the issuance of 2,800,000 common shares of Trillium Gold and a cash payment of $175,000 to Imagine Lithium. In addition, the Company assumes Imagine Lithium’s cash payment commitments under Imagine Lithium’s existing option agreements, while Imagine Lithium retains its original share issuance obligations.

Concurrent with the closing of the Definitive Agreement, Trillium Gold will pay to Pegasus Resources Inc. (“Pegasus”) $20,000 in cash, as well as 100,000 common shares in the capital of Trillium Gold to earn into certain option agreements that Trillium is assuming as optionee from Imagine Lithium under the Definitive Agreement. The cash consideration represents the remaining option payments under said option agreements, while the equity consideration purchases Pegasus’ carried interest in the relevant properties such that Trillium Gold will be transferred 100% of those properties upon closing of the Definitive Agreement.

Pursuant to the remaining option agreements that Trillium Gold is assuming as optionee under the Definitive Agreement, Trillium Gold must pay a total of $186,000 in option payments over approximately two years in order to earn in to and exercise the options.

Trillium Gold has also entered into a Royalty Purchase Agreement under which it will, concurrently with the closing of the Definitive Agreement, purchase a 2.0% NSR royalty on the Fredart property from prospector Perry English in consideration for the issuance of 60,000 common shares in the capital of Trillium Gold and $50,000 in cash.

The Definitive Agreement and the transactions contemplated thereunder, including purchasing Pegasus’ carried interest in properties covered by certain option agreements and entering into the Royalty Purchase Agreement, remain subject to TSXV approval.

Source: Company Press Release