The UK has published a new strategy that would see it as a major producer and user of both green and blue hydrogen. What does it mean for the power sector?

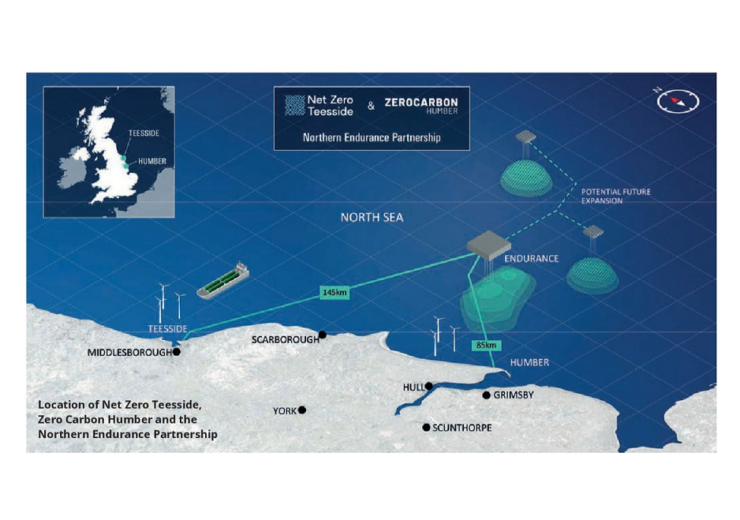

Location of Net Zero Teesside, Zero Carbon Humber and the Northern Endurance Partnership

In August the UK published a long-awaited hydrogen strategy. It suggested plans for a hydrogen economy were still very much a work in progress, with further consultations on business models, support for early projects and hydrogen standards.

But it said, “We recognise the importance of a clear goal alongside long term policy frameworks in bringing forward low carbon technologies. Our ambition for 5GW of low carbon hydrogen production capacity by 2030 is a signal of the government’s firm commitment to work with industry to develop a strong and enduring UK hydrogen economy.”

The strategy, developed by BEIS (Department for Business, Energy and Industrial Strategy) is in firm support of a hydrogen production industry for the UK – hardly surprising, given the UK’s past experience as a gas producer. It says “the UK cannot, and would not want to, rely solely on low carbon hydrogen imports. An over-reliance on imports could create risks around the security of supply for hydrogen and associated investment in the wider value chain. It would also reduce opportunities for UK companies to leverage domestic capabilities and strengths and translate these into clean growth opportunities.”

But the complex task of the strategy is to grow hydrogen supply and demand together. As a result, the government sees an important role for blue hydrogen, in which hydrogen is produced from methane using steam methane reforming (SMR) with, crucially, a carbon capture and storage (CCUS) route for the CO2 produced. The need to grow CCUS and SMR together is why emerging consortia developing hydrogen are also, in most cases, CCUS consortia, with power generation used to provide market ‘pull’ for the CCUS infrastructure.

The support for blue hydrogen disappointed some in the industry, but it was clearly twin-tracked with green hydrogen – ie, produced by electrolysis using renewables – which was seen as the longer-term solution. The strategy says, “Deploying CCUS-enabled hydrogen capacity will achieve cost-effective near-term low carbon hydrogen production at scale, drive investment across the value chain (including transmission, distribution and storage), and pull a range of hydrogen technologies through to commercialisation. Alongside this, supporting the scale-up of electrolytic hydrogen production can drive down costs to establish a cost-optimal and credible technology mix for our pathway to net zero.”

A major driver behind the government’s hydrogen strategy is its need to decarbonise the industry. That requires hydrogen to replace fossil fuels (largely gas) for industrial processes. Heavily industrial areas that also have relatively easy access to offshore sites where carbon dioxide can be stored are expected to be the most economic sites to develop initial CCUS and large-scale hydrogen facilities. In an earlier strategy, the government identified six ‘industrial clusters’, around Grangemouth, Teesside, Humberside, Merseyside, South Wales and Southampton. Each has a different history and a different flavour to its hydrogen or CCUS plans.

The industrial cluster on the Scottish west coast has two main centres. At industrial Grangemouth, the aim is to bring together hydrogen with other facilities. Carbon captured from this group of industries would be transported north by pipeline to Peterhead, a site that has long been investigated as a front-runner for CCUS. Peterhead is now a lead option for investment in CCGT-with-CCUS and hydrogen production (see below), which would see the carbon dioxide stored in the Acorn depleted offshore oil field.

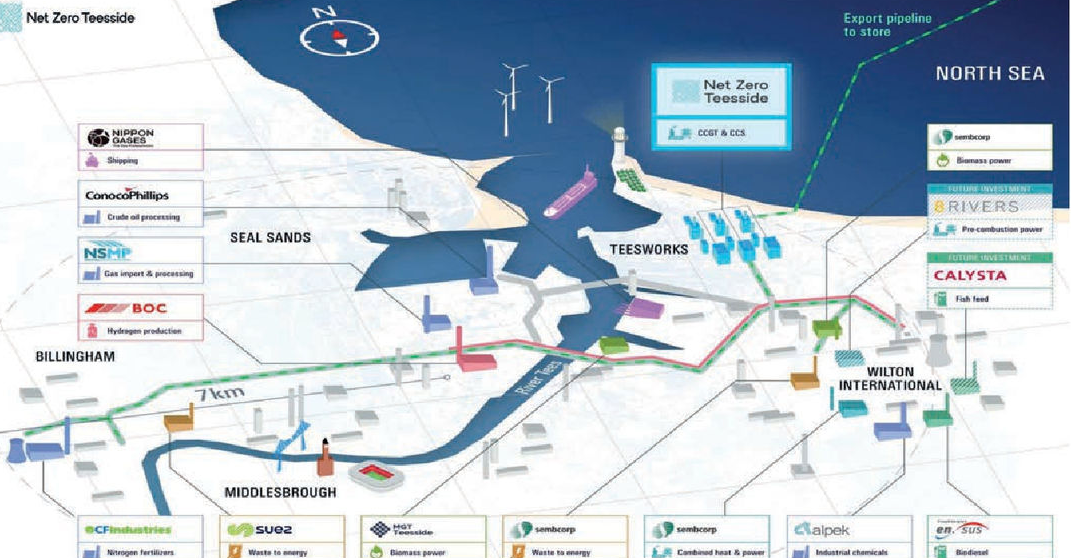

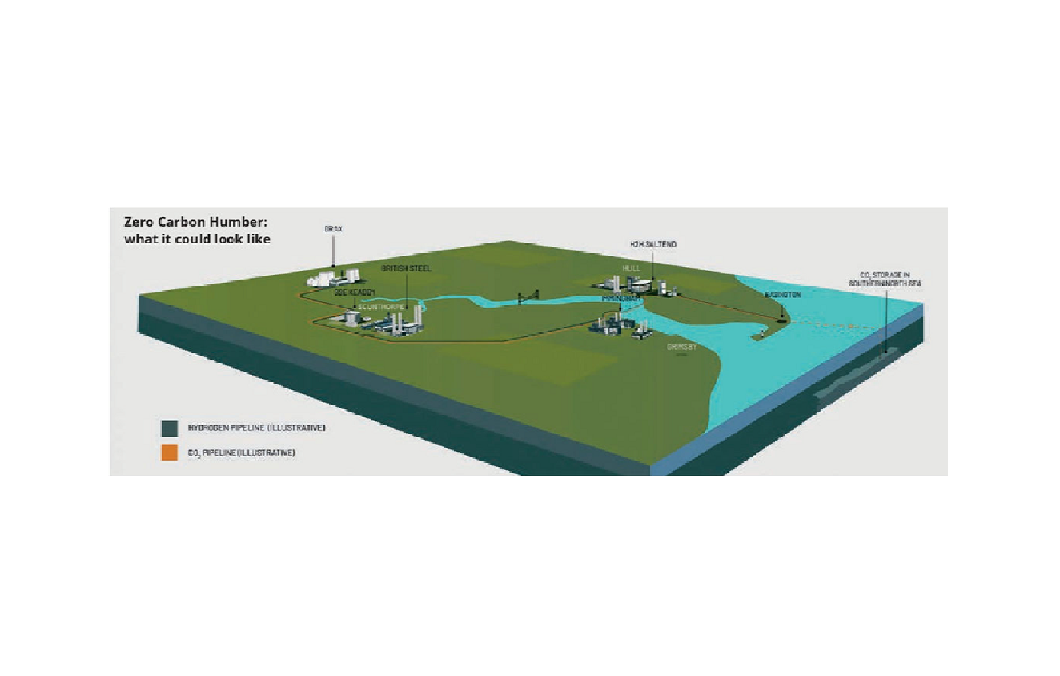

At Teesside, on England’s northeast coast, the chemicals industry already produces and uses half the UK’s industrial hydrogen. Teesside and a second industrial cluster further south on Humberside together represent half of the carbon dioxide emissions produced by the six industrial clusters referred to above. Each is the focus for hydrogen production and CO2 disposal consortium – Net Zero Teesside and Zero Carbon Humber, respectively – and the two are collaborating with Northern Endurance Partnership (which aims to repurpose offshore oil and gas sites for CO2 disposal) in the East Coast Cluster. Each has a new power generation project that has progressed into the planning process (see below). But both also already encompass existing power facilities that may be converted to zero carbon. Zero Carbon Humber includes both Saltend, which is aiming at conversion to hydrogen before the end of the decade, and Drax, whose projects include biomass with CCUS (BECCS).

The Merseyside industrial cluster on the west coast is relatively small in emissions but it overlaps with the major cities of Liverpool and Manchester and is a key area for underground gas storage. Local industry is looking for low-carbon gas supplies but the area is also the focus for HyNet, one of several major initiatives exploring replacing methane with hydrogen in GB’s extensive natural gas domestic supply network.

The industrial cluster in South Wales is the largest in geographic terms, with a need to pipe gases large distances and relatively little large industry, while Southampton is the smallest cluster identified by the government in carbon dioxide terms. That is likely to place them in the second rank as the government chooses where to invest in lead projects.

Alongside these major clusters, other regions have tried to pick up the hydrogen opportunity. Among them:

East Anglia. This region already houses a gas interconnector at Bacton and EDF’s nuclear site at Sizewell, as well as a growing array of multi-GW offshore wind farms. Promoters have somewhat different agendas: Oil and Gas UK sees the interconnector as a ‘credible’ option for hydrogen export/import; options around the planned Sizewell C nuclear plant include hydrogen production for the region’s important goods transport industry; and the wind industry has its eyes on green hydrogen production as an option for managing constrained days or arbitraging with offshore wind.

Aberdeen. A hydrogen assessment by the Scottish government noted that Aberdeen, Orkney, Glasgow and Dundee all had hydrogen clusters forming. Aberdeen has support from the Scottish government and Aberdeen city not least because of the city and region’s status as an offshore oil and gas centre. It has huge expertise and investment in the North Sea fossil industry, which can potentially be transferrable to the offshore wind and hydrogen sectors; the danger is that it fails to make that transition. The ‘Aberdeen Hydrogen Hub’ aims to deliver a commercially scalable and investable, growth-focussed hydrogen production site making use of the region’s offshore wind resources. The Aberdeen Hub has won £4.5 million funding from the Scottish government’s £62 million Energy Transition Fund (ETF) which has been invested in hydrogen buses, to provide predictable hydrogen demand.

A hydrogen strategy is a step forward and BEIS has maintained plans to establish CCUS in two industrial clusters by the mid-2020s in its new strategy. Has it pulled forward any projects?

Go big, go centralised? Blue hydrogen and CCGTs

Two consortia have taken the significant step of submitting applications for development consent to the Planning Inspectorate, the body responsible for processing and managing consents for large infrastructure projects in England. Once accepted by the Inspectorate, the consenting process has, in theory, to adhere to a strict timetable: three months for interested parties to make representations; six months for the Inspectorate to carry out an examination; three months to produce a recommendation report for the Secretary of State; and three months for the Secretary of State to make a decision. The timetable has been extended before – a decision on the Hornsea 3 offshore wind farm was delayed by 18 months while further work was carried out on seabird effects.

In August, the Planning Inspectorate ‘accepted for examination’ Net Zero Teesside (NZT). This is a comprehensive project, described as “a full chain carbon capture, utilisation and storage (CCUS) project”. It has two components, whose organisational structures differ.

One consortium, NZT Power, is focused on electricity generation with post-combustion carbon capture and it comprises BP, Eni, Equinor and Total, with BP leading as operator. It will be responsible for the construction, operation and eventual decommissioning of a CCGT plant with a capacity of 850MW when abated, and a carbon capture plant, plus cooling water, gas and electricity grid connections etc.

The second partnership is centred around transport and disposal: a CO2 ‘gathering network’ that includes pipeline connections from industrial facilities on Teesside to transport captured CO2; a CO2 compression plant and the onshore section of a CO2 export pipeline. The consortium, NZNS Storage, comprises BP, Eni, Equinor, National Grid, Shell and Total, with BP leading as operator.

NZNS Storage will also be responsible for an offshore export pipeline and injection into offshore storage, but offshore consents are handled by a separate body.

NZT was in fact the second CCS project accepted for examination by the Planning Inspectorate. The first accepted, in June, was Keadby 3 – a combined cycle gas turbine power station whose development is being led by SSE Thermal and Equinor. The project, according to the application documents, comprises a CCGT unit with a capacity of up to 910MW, carbon capture and compression plant, electrical, gas and cooling water connections. Keadby will be associated with Zero Carbon Humber (see above) and it will use the planned ZCH network to export the captured carbon dioxide. As a consequence the carbon dioxide export infrastructure will require separate development consent to be managed by the Zero Carbon Humber (ZCH) Partnership. The eventual geological store will be developed and consented to by Northern Endurance Partnership.

An alternative or nearer term option would see the Aldbrough gas storage facility (commissioned in 2011, and currently representing 40% pf UK gas storage) converted to store hydrogen. SSE is also preparing for hydrogen burning up to 20% in Keadby 2, now under construction, and has outlined proposals for a fully hydrogen-fuelled 1800MW power plant, Keadby Hydrogen.

SSE is also the lead party on a further planned CCGT with CCS at Peterhead, which would be connected to the Acorn pipeline and offshore store. Peterhead is in Scotland, which has its own consenting process and Peterhead is at an earlier stage than Keadby. SSE began ‘stage 1’ consultations in March and will complete ‘stage 2’ consultations in October, which both precede any application for consent.

Development consent is, of course, just one element of an investable project and the government has only just opened consultations on business models and financial support for centralised CCS and carbon disposal projects. That suggests a timeline of at least two years until ‘final investment decisions’ can be taken on these three CCS projects.

Go small, go distributed? Green hydrogen and renewables

Are electrolysis projects to produce green hydrogen entering the planning system alongside the blue hydrogen projects mentioned above? That is not so easy to determine.

There are some projects visible. In April this year, Scottish Power announced it had submitted a planning application for a 20MW electrolyser able to produce up to 8 t of green hydrogen per day, which will be combined with 40MW of solar and 50MW of battery storage at its existing Whitelee wind farm. The project will be engineered and operated by BOC, and the 20MW electrolyser will be delivered by ITM Power. The project aims to supply hydrogen to the commercial market before 2023.

Carlton Power subsidiary Trafford Green Hydrogen Ltd has applied for planning permission for a ‘low-carbon hydrogen fuel hub’ at the Trafford Low Carbon Energy Park. Hydrogen will be produced using electrolysis, with power from a 20MW solar farm on the site – a planning application is expected in the next few months – and from offsite renewable energy. The hydrogen will mainly be used for transport, which means it will benefit from the Renewable Transport Fuel Obligation (RTFO).

These two projects indicate the distributed nature of electrolysis for the production of green hydrogen and that raises interesting possibilities, because of a quirk in the consenting regime and the recent experience of new investors entering the UK power sector.

Energy projects rated at over 50MW are referred to the government for energy consents and typically (but not exclusively) to the Planning Inspectorate for development consents as described above. Smaller projects are dealt with by planning bodies attached to local authorities and are connected to the local distribution network operator’s (DNO’s) low voltage network. This tends to make development consent for small projects faster, cheaper and more flexible.

Experience from gas generation is instructive here. When the capacity market was introduced in GB it was expected to underwrite new gas turbines. Instead, small fleets of distribution-connected gas engines entered the market, driving CM prices down because they could take advantage of the planning regime and be built more cheaply using standardised units. That model has continued to prove attractive. This year 170 small – under 50MW – gas engines, representing over 2GW of capacity in total, won contracts in the Capacity Market auction, for delivery in 2024/25. A further 150 small gas engine projects, representing another 2.3GW, entered the auction but exited as the price fell.

The advent of gas engines attracted new investors, who saw in them a similar profile to a previous boom in solar farms. ‘Kit-type’ technologies and small multiple sites offer easy entry for investors, and a raft of new funds have been set up specifically to invest in these projects. A similar story has been emerging in the battery storage sector. So far the numbers are small: 32 battery projects were awarded contracts in this year’s CM auction, for a total of 251MW. But the pool of capacity is growing. Other battery storage projects entered the auction and exited as the price fell and these are the next wave: they are new-build projects, somewhat larger than the first – but below the key 50MW limit – with 27 projects representing a total of 515MW.

The initial surge of investment in gas engines was a surprise to most. The current boom in battery projects was less surprising, not least because it was led by the same investors who saw they could replicate the conditions of the gas engine funds.

Electrolysis combines a replicable technology whose costs are likely to fall as manufacturing matures and the availability of sites where renewable generators are regularly constrained off – meaning a potential payment for absorbing excess power. In comparison to CCS, whose support is only now being consulted on by BEIS, support for hydrogen as a low-carbon transport fuel is already in place. This time it should be to no-one’s surprise if the industry sees small installations spread quickly. It is certainly the view from BEIS, which said in its hydrogen strategy that when it comes to green hydrogen, “The first movers in the early 2020s are likely to be relatively small (up to 20MW) electrolytic hydrogen projects that can be deployed at pace, with production and end use closely linked, for example, at a transport depot or industrial site. By the mid-2020s we could start seeing larger (100MW) electrolytic hydrogen projects” which will coincide with the first CCUS-enabled hydrogen production facilities based in industrial clusters.

This article first appeared in Modern Power Systems magazine.