In conjunction with the demerger, Hamelin intends to undertake an IPO and apply for listing on the Australian Securities Exchange

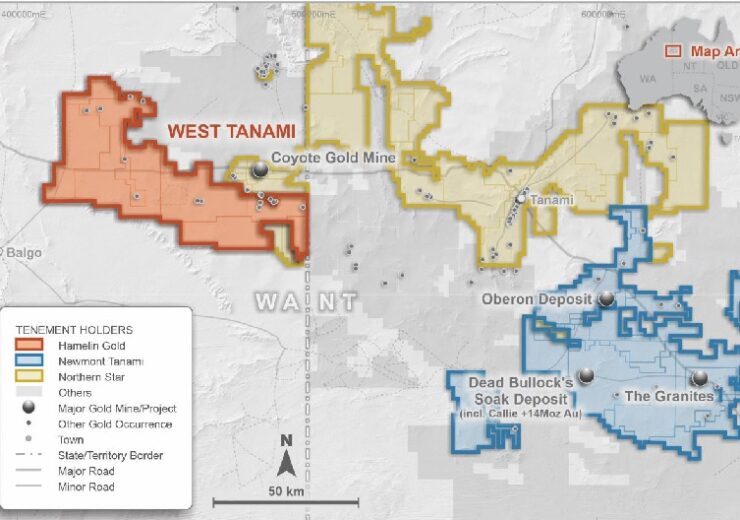

Tanami regional tenement summary. (Credit: Encounter Resources Ltd)

The directors of Encounter Resources Ltd (“Encounter” or “the Company”) are pleased to announce the Company’s intention to seek shareholder approval for the demerger of its wholly owned subsidiary, Hamelin Gold Limited (“Hamelin”), which will hold the West Tanami Gold Project (“West Tanami”). In conjunction with the demerger, Hamelin intends to undertake an IPO and apply for listing on the Australian Securities Exchange (“ASX”).

Commenting on the planned demerger, Encounter Managing Director, Will Robinson said: “With the rapid expansion of Encounter’s copper portfolio, including the major ground acquisitions in the NT and the recent farm- in agreement decision by BHP, we believe that the time is right to demerge our highly prospective West Tanami gold assets. Importantly, our shareholders will continue to participate in Hamelin via a pro rata in-specie distribution.

Given the quality of the exploration opportunities within the West Tanami, Hamelin provides an attractive exposure for investors to the systematic modern exploration of this exciting and underexplored belt scale gold project. We also believe Hamelin will attract stronger investor attention and valuation in a standalone entity, while allowing Encounter to maintain its focus on its growing copper portfolio in the Paterson Province in WA, the Greater McArthur Superbasin in the NT and the West Arunta region of WA.”

Rationale

West Tanami is a rare, belt scale gold project covering 2,275km2 of a well- endowed, emerging gold province that is significantly underexplored. The project encompasses 100km of strike along the Trans-Tanami structural corridor which hosts Newmont’s giant Callie 14Moz gold deposit in the Northern Territory1. The project contains open, high-grade gold intersections beneath shallow cover, significant multi-kilometre scale geochemical anomalies and large untested geophysical targets in a Tier 1 jurisdiction.

In order to effectively execute a modern exploration program, Encounter considers it is the best outcome for shareholders that a separately listed entity drives this gold focused business forward. Accordingly, a demerger of Hamelin via an in-specie distribution to eligible Encounter shareholders offers the most efficient and direct delivery of value and allows shareholders to continue to participate in Hamelin.

The in-specie distribution will allow shareholders to participate in an exciting, gold-focused business while Encounter continues to focus on its copper portfolio in the Paterson Province of WA, the Greater McArthur Superbasin in the NT and the West Arunta region of WA.

Leadership

A highly respected team has been assembled to run Hamelin including Encounter Exploration Director Peter Bewick as Managing Director and former Gold Road Resources Executive Director, Justin Osborne as a Non-Executive Director. Further information on the strategy and management of Hamelin will be released in due course.

Next Steps

Encounter will shortly convene a General Meeting of shareholders to seek approval for the demerger. The notice of meeting will summarise the advantages and disadvantages of the demerger, key risk factors and key dates for the proposed demerger.

Subject to Encounter shareholder approval, as well as satisfactory ASX and other regulatory approvals, Encounter will distribute 100% of the Hamelin shares on issue to eligible Encounter shareholders via a capital reduction and in-specie distribution of those shares, pro-rata to their shareholding in Encounter on a record date to be determined by the Encounter board (“In-Specie Distribution”).

Following completion of the In-Specie Distribution, Hamelin proposes to complete a capital raising which will include a public offer to new investors and a priority offer to eligible Encounter shareholders which will provide shareholders the right (but not the obligation) to invest further in the advancement of Hamelin’s gold exploration and development assets.

In conjunction with the capital raising, Hamelin will also apply for admission to the official list of the ASX and for quotation of its shares on the ASX. Further details regarding the IPO will be provided in a prospectus to be lodged by Hamelin.

Furthermore, Encounter will seek demerger relief from the Australian Tax Office (ATO) pursuant to Division 125 of the Income Tax Assessment Act 1997 (ITAA 1997) among other matters. The proposed demerger remains subject to Encounter receiving a satisfactory response from the ATO.

Subject to Encounter shareholder approval, as well as satisfactory ASX and other regulatory approvals, the ASX listing of Hamelin is expected to occur in the December 2021 quarter, with further information to be released as the process proceeds. Encounter reserves the right to amend the proposed terms of, or not proceed with, the demerger in its absolute discretion.

Source: Company Press Release