Exercises option on the Moran Lake Uranium and Vanadium Project

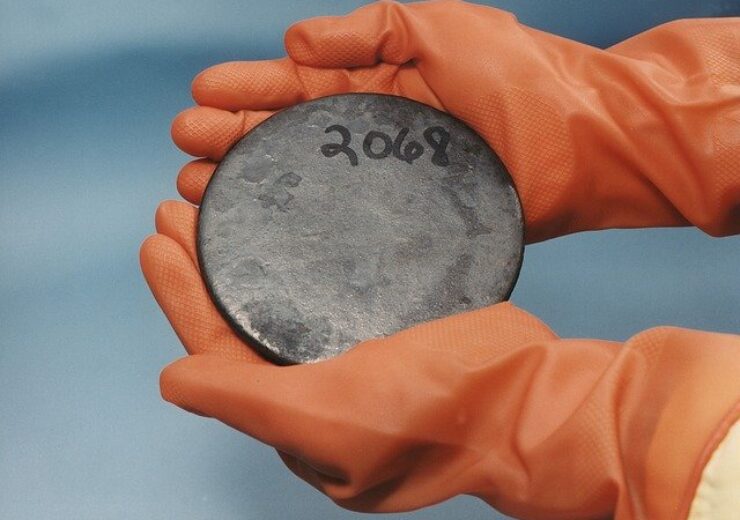

Consolidated Uranium announces proposed spin-out of Labrador Uranium Inc. (Credit: WikiImages from Pixabay)

Consolidated Uranium Inc. (“CUR”, the “Company” or “Consolidated Uranium”) (TSXV: CUR) (OTCQB: CURUF) is pleased to announce the creation and planned spin-out of Labrador Uranium Inc. (“Labrador Uranium” or “LUR”), currently a majority-controlled subsidiary of CUR focused on the consolidation, exploration and development of uranium projects in Labrador. In connection with the proposed spin-out of LUR, the Company has provided notice to exercise its option pursuant to the option agreement announced on November 18, 2020 (the “Option Agreement”) to acquire 100% of the Moran Lake project (the “Moran Lake Project”).

To effect the spin-out, the Company has entered into an arrangement agreement with LUR (the “Arrangement Agreement”), pursuant to which among other things the Company will transfer ownership of Moran Lake Project to LUR in exchange for common shares of LUR (“LUR Shares”) which the Company intends to distribute to its shareholders on a pro rata basis (the “Arrangement”). The Company also intends to apply to list the LUR Shares (the “Listing”) on the Canadian Securities Exchange (the “CSE”). The Listing will be subject to LUR fulfilling all of the requirements of the CSE.

In addition, the Company and Labrador Uranium have entered into a purchase agreement (the “Altius Agreement”) with Altius Resources Inc., a wholly-owned subsidiary or Altius Minerals Corporation (“Altius”), pursuant to which LUR has agreed to acquire from Altius a 100% interest in the Central Mineral Belt Uranium-Copper Project (the “CMB Project”) and the Notakwanon project (the “Notakwanon Project” together, the “Altius Projects”), both located in Labrador (the “Altius Transaction”).

Transaction Highlights:

- Labrador Uranium Formed as New Entrant into Resurgent Uranium Market – Purpose built to explore for and develop uranium in Labrador, it is anticipated to hold a dominant land position in the Central Mineral Belt of Labrador (the “CMB”), a well-known uranium and multi-commodity metal district.

- Moran Lake Expected to Form Cornerstone Project – Located on the western side of the CMB, the Moran Lake Project hosts historical uranium and vanadium mineral resources. LUR intends to focus on confirming and potentially expanding the known historic mineral resources as well as exploring the property more generally. See “Technical Disclosure and Qualified Person” below.

- Agreement with Altius Expected to Secure Large Land Position – The ~125,000 hectare CMB Project is located adjacent to the Moran Lake Project to the east, west and south and spans to Paladin Energy’s Michelin Project in the east. In addition, the Notakwanon Project, located in Northern Labrador, is drill ready with previous evidence of high-grade uranium on surface.

- Proposed Spin-Out of Labrador Uranium is an Attempt to Unlock Value for CUR Shareholders – LUR is being spun out as a stand-alone, CSE-listed uranium exploration and development company, with CUR shareholders receiving their pro-rata portion of the LUR Shares issued to the Company.

- Experienced Team in Place – Under the leadership of Stephen Keith as Chief Executive Officer and Philip Williams as Chairman, the LUR management team and anticipated board of directors has decades of experience in exploration, development, and finance, with a significant focus on uranium.

- Summer 2021 Work Programs Completed Setting Up For Active 2022 – Work programs completed this summer at the Moran Lake Project and the CMB Project included: collecting and analysing data from decades of historical exploration work on the CMB Project by previous owners and government programs and field work to verify the >140 targets generated by this data collection and analysis. Results pending from this work are expected to be used in designing an aggressive field exploration program for 2022.

Philip Williams, President and CEO of CUR, commented “We are pleased to be announcing the partnership with Altius in the formation of Labrador Uranium. We believe that the Central Mineral Belt is an important uranium camp in Canada, which has tremendous exploration potential for uranium and other metals. As CUR focuses on near-term production in the United States, we determined that repositioning the Moran Lake Project as a part of a larger, Labrador-focused exploration portfolio would be the best way to unlock value for our shareholders. We liken this transaction to the original IPO of Aurora Energy in 2006 whose main asset was the Michelin Project. That company garnered a peak market cap of over $1.3b in 2007 and was ultimately taken over by Paladin Energy in 2011.”

Stephen Keith, CEO of LUR commented “I am looking forward to working with such an experienced team on this exciting new uranium exploration vehicle. LUR is expected to have all the underpinnings of a dynamic and successful new player in the resurgent uranium sector; a dominant land position in a prolific camp, historic mineral resources, backing by key uranium and mining industry players in CUR and Altius, and a strong team in place with significant uranium exploration, development and finance experience. Exploration success is driven by strong teams and quality assets. Combining the excellent work completed by, and historical successes of, these companies give me great confidence in the future of Labrador Uranium. I plan on hitting the ground running with the benefit of recently completed work programs on the projects. These programs have already generated over 140 targets setting the stage for an aggressive 2022 exploration season”.

Moran Lake Option Exercise

On October 17, 2021, CUR provided notice to the vendor of the Moran Lake Project that it has exercised the option to acquire the Moran Lake Project, for total consideration of $1,000,000 with $500,000 to be satisfied through the issuance of 191,570 common shares of CUR (“CUR Shares”), at a deemed price of $2.61 per CUR Share based on the five-day volume weighted average price of the CUR Shares up to October 15, 2021 and $500,000 in cash. In addition, the vendor will be entitled to receive certain future payments contingent upon the attainment of certain milestones tied to the spot price of uranium, as further described in the Company’s press release dated November 18, 2020.

In accordance with the terms of the Option Agreement, the vendor will be granted a 1.5% net smelter returns royalty (the “Moran Lake Royalty”) from the sale of the mineral products extracted or derived from the Moran Lake Project by CUR, which will be transferred to LUR in connection with the Arrangement. CUR shall have the right and option to purchase 0.5% of the Moran Lake Royalty for a price equal to $500,000, which CUR intends to retain following the transfer of the Moran Lake Project to LUR pursuant to the Arrangement.

All CUR securities issued in connection with the Option Agreement are subject to final approval of the TSX Venture Exchange (the “TSXV”) and will be subject to a hold period expiring four months and one day from the applicable date of issuance.

The Arrangement Agreement

Pursuant to the Arrangement Agreement, among other things, CUR has agreed to transfer the Moran Lake Project to LUR in exchange for 16,000,000 LUR Shares. Under the terms of the Arrangement, the CUR shareholders will receive the LUR Shares on a pro-rata basis based on the number of CUR Shares held at the effective date of the Arrangement. There will be no change in CUR shareholders’ proportionate ownership in CUR as a result of the Arrangement. In addition, holders of options and warrants of CUR as of the effective date of the Arrangement will have such securities adjusted in accordance with their terms as a result of the Arrangement.

The Arrangement will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario). The Arrangement will be subject to regulatory approval, including the approval of the TSXV, court approval, conditional approval from the CSE for the Listing, as well as approval by not less than two-thirds of the votes cast at the special meeting (the “Meeting”) of the CUR shareholders, anticipated to be held in the first quarter of 2022. Full details of the Arrangement will be included in the management information circular to be sent to CUR shareholders in connection with the Meeting.

It is anticipated that the Arrangement and Listing will be completed in the first quarter of 2022.

The Altius Agreements

On October 17, 2021, the Company and Labrador Uranium entered into the Altius Agreement with Altius pursuant to which LUR has agreed to acquire the Altius Projects from Altius in exchange for 8,000,000 LUR Shares and a 2% gross overriding royalty on the CMB Project. Completion of the Altius Transaction is subject to certain closing conditions including, among other things, completion of the Arrangement and the conditional approval from the CSE for the Listing.

In the event that the Arrangement and Listing are not completed, Altius has the right (the “Put Right”) to require CUR to acquire the Altius Projects in exchange for $3,000,000 to be satisfied by the issuance of CUR Shares based on the volume weighted average price of the CUR Shares at the time of the exercise of the Put Right, subject to approval of the TSXV. In the event that the Put Right is not exercised by Altius, CUR has the right to acquire the Altius Projects on the same terms and conditions as the Put Right, subject to approval of the TSXV. Any CUR securities issued in connection with the Altius Transaction are subject to final approval of the TSXV and will be subject to a hold period expiring four months and one day from the applicable date of issuance.

Additionally, Altius, LUR and CUR have agreed on an area of interest whereby the two companies will work together in generating new targets and claims to bring to LUR.

In connection with closing of the Altius Transaction, LUR and Altius have agreed to enter into an investor rights agreement pursuant to which, for so long as Altius’ equity ownership in LUR remains at or above 10%, Altius will be entitled to equity participation rights to maintain its pro rata equity ownership in LUR. Altius has also agreed to certain resale restrictions on the LUR Shares it will hold and to provide voting support in certain circumstances.

Source: Company Press Release