By Perry Stoneman, global head of energy & utilities sector at Capgemini

The energy industry is at an inflection point. There is an accelerating urgency for utilities and energy companies to use more renewables, a fact highlighted at COP21 in Paris, which demonstrated that the international community is placing a significant focus on limiting the rise in our planet’s temperature, pledging to cap it at 2°C by reducing greenhouse gas emissions. To help achieve this, the EU has set a target of a 40% reduction in greenhouse gases by 2030.

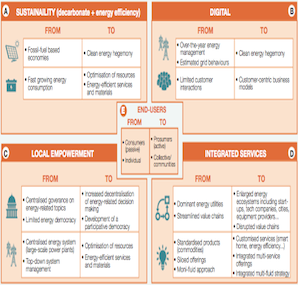

Alongside the industry-wide impact on operations and investment, incumbent energy players must contend with another challenge that promises to upend traditional models — technology-led disruption. It is a story that is playing out across industries such as retail, financial services and automotive. Organisations must rapidly transform their structure, products and services to adapt in the face of new digital opportunities and threats. With its complex infrastructure, regulatory framework and long-established model, the energy and utilities industry has proven more resistant than others to these changes. However, in recent years technologies like connected sensors and mobile applications have begun to impact the market, for both consumers and plant operators. The use and effects of such technology will now increase at an incredibly swift pace as, thanks in part to the infrastructure and model that has delayed its onset, the energy and utilities market, being ripe for disruption.

Individually, these issues would be enough to concern the leader of any energy or utilities company. But arriving together, they will lead to some unprecedented challenges that will emerge over the coming months.

The 2016 European Energy Markets Observatory (EEMO), an annual publication from Capgemini that monitors the main indicators in the electricity and gas markets in Europe, revealed that a rapid increase in the share of renewables has destabilised the wholesale electricity markets. The growth in renewables in a market experiencing overcapacity, combined with low oil and gas prices, resulted in a fall in electricity wholesale market prices, to €22/MWh at the beginning of 2016 compared with €40/MWh on average in 2015. This has negatively impacted utilities’ revenues.

The share of renewables is only set to increase. Costs will continue to fall as onshore wind becomes more competitive, offshore wind prices reach a lower threshold and the trend of falling PV installation costs continues. Meanwhile, with the deregulation of the markets, a large part of utilities’ turnover is exposed to low wholesale market prices and as such their financial situation will continue to be threatened in 2017.

Just as the financial services industry has witnessed the emergence of ‘FinTech’ companies, typically start-ups that use new technology and innovation to compete with incumbents, small and agile ‘energy technology’ companies will come to prominence. Built around internet technology, including mobile devices, cloud computing and data analytics, EnTechs will introduce innovative business models and services built around customer demand. These might blend energy storage and a ‘pay-per-need’ approach, use big data and machine learning for predictive maintenance of power plants and grids, or even offer a service to larger players that use connected devices and the Internet of Things (IoT) within a home, alongside the Industrial Internet of Things (IIoT) in the plant, to much more effectively manage energy demands.

The impact EnTechs have will not just be technological, but social. Some will provide a platform for communities to spring up, similar to the Airbnb model, where members may conduct a range of activities, such as trade energy. This has the potential to be highly disruptive, particularly if established in a traditional utilities service territory.

As in other industries, the growth of EnTechs will prompt a slew of acquisitions, partnerships and upheaval.

One of the world’s largest technology giants — Google, Microsoft, Apple or Amazon — will enter the utilities market shortly. In fact, to a degree this is already happening. Google and Amazon have introduced Home and Echo, respectively, which respond to speech and can control your connected devices in the home. Google’s smart Nest thermostat learns how to optimise your heating and energy usage. Microsoft has announced plans to turn tablets and PCs into ‘home hubs’. All of these are early steps into the industry as they look to expand their play for the connected home and take advantage of a wealth of data that will help deliver a modern, digital experience for consumers.

It is natural that in due course one of these companies will expand operations further up the supply chain. Google, Amazon and Microsoft all have extensive experience in building infrastructure from broadband cables to data centres, and each would no doubt be enticed by the opportunities afforded through controlling the end-to-end process.

For those at the back end of power generation with limited access to consumer data, this challenge will prompt drastic action. They will likely seek to join with non- traditional partners such as retailers, or forge closer relationships with utility providers, in order to gain access to more sophisticated customer profiles.

For utilities facing the implications of renewables and new technology, there is now a realisation that disruption is inevitable and that they can no longer rely on regulation alone.

Incumbents will find it essential to adapt their models to the fundamental changes in the market that are coming over the course of the next several years — and begin to do so quickly.

Organisations often ask how long they have to transform. The answer is to take the amount of time they think they have and reduce it by half.

While the threat to utilities is both significant and immediate, so too is the opportunity. Those that simplify their organisation and accelerate digital transformation will make productivity gains and become more innovative and agile, allowing them to not only survive the shift to renewables and technological innovations, but to thrive.