The need for gas and coal plants to flex in response to wind generation will radically transform electricity markets. This is analysed in a major new study by Pöyry – based on an unprecedented quantity of wind data and completely new GB electricity market models. The analysis also suggests that nuclear and wind are good partners, contradicting the popular belief that the future must be either nuclear or renewable – but not both.

Across Europe, the future of electricity markets is being deliberated and redesigned. Starting from the Renewable Energy Directive in April this year, which has set Europe on a path to dramatically increase its renewable generation to 20% of final energy supply by 2020, governments are gearing up to change the generation fleet in Europe at the fastest rate ever seen.

In the UK, the challenges are greatest of any European country, with a seven-fold increase in renewables required. The Renewable Energy Strategy, published by the government in mid-July, confirms the UK’s renewable targets for 2020, with an ambitious goal of 15% of final energy use (covering heat, transport and electricity) sourced from renewables. This could mean that over 30% of electricity generation will have to be met by renewable energy, with the government anticipating the majority of that coming from wind. As a result, there could be as much as 35 GW of wind on line in the GB system by 2020 (33% of total installed capacity), compared with a current installed capacity of about 3.5 GW. The long-term reduction of 80% of CO2 emissions by 2050 and a carbon intensity target of 70 gCO2/kWh by 2030 suggested by the Committee on Climate Change may lead to over 45 GW of wind and marine installed by 2030.

This flood of new renewables will transform the shape of electricity markets. However, it is not only wind generation that has the potential to change the shape of the electricity market. Much of the new generation that could be deployed in GB in the next 20 years will be fundamentally different from existing generation in four main ways:

• Price insensitive. Most new generation planned for a future low carbon world, such as nuclear, coal, CCS and biomass, is price insensitive. This means that the amount of plant that varies its generation in response to price and/or varying demand will decrease significantly.

• Intermittent (not always available when needed). Wind and marine technologies are highly variable in their output, with swings of 80% possible within a day.

• Unpredictable. Wind and wave generation are both difficult to predict accurately – and the error in a forecast of wind generation increases dramatically as the time interval increases, in the same manner as any weather forecast. (Tidal generation, on the other hand, is extremely predictable – we know the time of high tides accurately for the next thousand years or so.)

• Subsidised. In the UK, from an electricity system where about 5% of generation is subsidised, the proposals from the government will lead to over 30% of generation receiving government support. It is a similar situation across much of Europe.

A major multi-client study has been recently completed by Pöyry, looking specifically at how electricity markets will change in response to the challenges of renewable deployment and decarbonisation. In this year-long project, Pöyry investigated how the future GB electricity market may look in 2020 and 2030, which required assembling an unprecedented quantity of wind data, building completely new electricity market models, and has entailed more than 20 000 hours of effort.

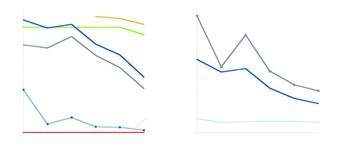

Many of the effects of large amounts of wind on the system are illustrated in Figure 1 and Figure 2 below. Figure 1 shows what might happen in January 2010 if the weather patterns of January 2000 repeated themselves. In this simulation, nuclear baseloads throughout the month, with coal largely running at full generation with small reductions at weekends. The CCGT plants provide most of the within-day and weekend flexibility, with some units running at baseload, and many others two-shifting – running for 16 hours during the day and turning off or down to minimum stable generation over night.

The wind generation has been separated out, but it is clear that it has a very marginal effect on the system as the volumes are so small. Overall the system runs in a predictable fashion, with variations only introduced through higher or lower demand due to weather, or outages and unavailable plant. This stable and relatively predictable market has existed in GB for the last 20 years, and is typical of most mature electricity markets in Europe.

However, if we now roll the clock forwards 20 years to 2030, the picture looks very different, as shown in Figure 2. Now wind is contributing 35% of generation during the year, with a peak installed capacity of 43 GW. Wind generation is highly variable, frequently rising to high levels and falling back again to low levels. During the month, wind peaks at 40 GW six times, typically falling back to 10-20 GW afterwards.

As a result of this, the entire thermal system must flex in response to the wind generation. The nuclear plant continues to run primarily at baseload, although there are four periods during the month when it is curtailed to allow wind to generate. At times when the wind is blowing strongly across the entire UK, all of the thermal generation is taken off the system. Firstly the CCGTs are turned off, then coal plant, then biomass and industrial CHP plant (assuming back-up boilers).

Thus the electricity system in 2030 is fundamentally different from what we have now. Large amounts of wind generation will change markets comprehensively, and new rules, regulations and designs will be required to meet the challenges that present themselves.

Effect on thermal plant

With large amounts of wind generation on the system, along with increasing nuclear, biomass and CHP, load factors of conventional thermal plant are strongly impacted, as shown in Figure 3. In GB by 2020, load factors of older, 1990s, CCGTs are below 10%, and those of newer CCGTs are under 60% whilst coal is at 50%. The main reason for this is the reduced ‘space’ for these plant to operate in – with rising volumes of baseload nuclear, CCS coal and biomass plant, and increasing volumes of low-cost intermittent generation, the running patterns of conventional plant by 2020 are increasingly the inverse of wind generation.

The reducing load factors of the new CCGTs means that the number of starts carried out will change. Older CCGTs will move from starting around 140 times a year and being on for 14 hours, to around starting 20 times a year and being on for 10 hours, as they drop rapidly from mid-merit operation to peaking operation. The newest plant, and those least flexible, may see starts rising from around 50 starts per year and being on for three days to over 120 by 2030 and being on for 24 hours.

However, these average figures disguise a dramatic change in the start pattern of plant. Although the number of starts is not greater than many CCGTs currently cope with, the distribution over time will be significantly different.

Currently, during winter, a CCGT might start five times a week (once every morning) and not generate over the weekend. This two-shift pattern is regular and predictable.

However, the pattern of starting in 2030, with 43 GW of wind on the system, will be highly irregular. A plant might two-shift for three days, and then not generate for two weeks, followed by a few days of continuous generation. It is inherently a world of less predictability.

This will inevitably have an effect on maintenance of the plant, both increasing its cost, and reducing the life of plant. Furthermore, the likelihood of unexpected outages will increase. One side effect of increasing intermittency may be a need for more reliable plant. With a more unpredictable market, prices are likely to become much more volatile, with prices peaking over £1000/MWh and dropping to below zero. As a result, reliability of plant will become increasingly important. If a plant has an unforeseen outage when prices are over £1000/MWh, and imbalance prices are even higher, it would have a dramatic effect on its profitability.

Effect on nuclear

Current government policy and market expectations suggest that a few new nuclear power stations will be operational by 2020, and after that a significant new build programme of nuclear, perhaps as much as one plant per year, may be required as part of wider decarbonisation of the electricity sector. However, at first sight the combination of baseload nuclear power stations and intermittent wind do not appear to be ideally suited.

The requirement for the thermal plant on the system to flex in response to wind suggests that all new built plant must be flexible, and it is not yet clear the extent to which new nuclear plant may be able to operate flexibly – either from the engineering point of view or the commercial standpoint. Although new nuclear designs may allow plant to drop to a minimum stable generation of 25% overnight on a regular basis, it is not clear if the commercial rationale will exist to do so. Operating a brand-new extremely high-cost nuclear plant for anything other than baseload may be difficult to justify. However, flexible nuclear plant do exist – for example the French system has coped with over 75% nuclear generation which is partly achieved by having some nuclear units that are sufficiently flexible to switch off (or down to a low minimum stable generation) overnight.

So should wind switch off before nuclear? Currently in GB, along with most European markets, wind generation is subsidised on a per-MWh basis. As a result, if electricity prices drop below zero, wind generation will pay to generate – provided it pays less than the value of the subsidy. This means that if wind meets most demand in a given hour, it is likely to push prices below zero. Nuclear plant, on the other hand, has a marginal cost above zero, reflecting its cost of fuel. However, the start-up costs associated with turning down a nuclear plant to minimum stable generation or fully

off may be quite significant, meaning that it is more efficient to curtail wind for a few hours rather than nuclear. In this case, market prices would typically remain negative for a number of hours.

Interestingly, the study strongly suggests that nuclear and wind can co-exist, belying the frequently held view that the choice of a future generation system is either nuclear or renewable – not both.

Since wind generation has a variable cost of zero, it could be expected to depress electricity prices, which would reduce the profitability of nuclear generation. This would effect nuclear in particular as it is directly exposed to wholesale prices, as opposed to CCGTs and coal plant which are exposed to spark- and dark-spreads respectively. However, the requirement of other plant on the system to make a return means that market prices must remain high enough to incentivise new plant or keep existing plant running, in turn creating favourable prices for nuclear.

Overall, the major risk to developers of nuclear generation remains commodity prices as these have a large effect on wholesale prices – high oil and carbon prices are good, low oil and carbon prices are bad.

In sum, a world where the conditions are ripe for renewable generation – high carbon prices and high fossil fuel prices – is a world where nuclear also thrives.

Role of peaking plant

A market with large amounts of baseload nuclear and variable wind generation appears to lend itself to cheap peaking generation. The low capital cost and low efficiency of peaking generation makes it ideal to operate at low load factors to balance the intermittency of wind.

However, the market design is critical to determining if peaking generation is viable. In the GB market, peaking plant has two main sources of revenue – first when it is generating from the wholesale market price, and secondly from the ancillary services market.

Since peaking generation runs at such low load factors, the revenue from the wholesale market – even if prices are very high, is quite small. In GB, the combination of ancillary services revenue and energy-only revenue is not sufficient to make building peaking plant viable. Additionally, from the point of view of a developer, investing in peaking generation is a high-risk affair, with much greater uncertainty over future revenue than is the case for a conventional baseload plant.

In the Irish market (the Single Electricity Market or SEM), there is a capacity payment which remunerates generation for being available. As a result, new build of peaking generation in the SEM is economic.

The differences between the market designs are emphasised by the generation queue in both countries. In GB, there is around 50 GW of thermal plant awaiting connection by 2023, of which 30 GW is CCGT with no OCGTs at all. In the SEM, the figure is around 6.4 GW, of which 2 GW is peaking plant.

Rest of Europe

Although the study undertaken by Pöyry was focused on GB and Ireland solely, the lessons are relevant for a wide range of markets – particularly in Europe. With a renewable energy target of 20% across Europe as a whole, significant wind generation is likely to be built in the next 10 years, and the impact of intermittency is likely to be faced across many European countries.

There are a number of countries where the impact of wind generation is likely to be particularly great, eg, Spain and Denmark.

In Spain, wind penetration has already reached 16 GW, with a target of about 37 GW by 2020. Given the low interconnection between Spain and France it remains a relatively isolated system, which means it is likely to experience many of the problems associated with variable wind. However, Spain does have significant installed hydro capacity, 14 GW at present, which provides a natural balance to wind generation and helps mitigate many of the effects. Although, in a low hydro year, such as 2005, this natural balance will be absent.

Denmark has been leading the wind revolution, with a current wind penetration of around 25%, 4 GW in total. However, Denmark is a very small country in comparison to its neighbours, and as a result can export much of the ‘excess wind’ to Germany and Norway. It also has access to Scandinavian hydro, which provides large amounts of flexibility.

Thus, although countries across Europe will be affected, each generation system is unique, with varying geographic size, interconnection, installed plant and market arrangements. As a result, the impact of intermittency across European countries will be different for each country.

Winds of change

There can be no doubt that the ambitious targets for renewable generation in GB are going to transform the wholesale market, and with it how the system operates. In particular, the need for fossil fired plants to flex in response to wind generation will create a highly different market from that which exists currently, and plant will have increasingly unpredictable operational patterns. Nuclear will be another growth area, and can co-exist with wind generation, although some flexibility may be required if nuclear penetration increases substantially. The market design is critical to ensure that despatch of plant is efficient, and that the correct type of generation is built.

It is unclear to what extent the other European markets will be affected by wind generation, but the changes in the UK and Ireland are likely to be the most dramatic given their isolated nature. However, intermittency will undoubtedly impact European energy markets and in the coming years, policy makers and market participants will have to address these winds of change.