There has been major growth in the hydropower sector in South America. Carrieann Stocks presents a round-up of some of the latest projects under development in the resource rich region

Chacayes

Hydropower dominates the renewable scene in South America, but there is still some major untapped hydro potential in the region. With demand for electricity set to grow considerably over the next few years, a number of countries are utilizing this potential through the development of both large and small schemes. Below is a snapshot of some of the latest projects recently completed or under construction, together with details on planned developments

Peru

Peru has a long history of utilizing hydropower. Traditionally, hydro has been the major source of electricity in the country, supplying the majority of power requirements. However, its share declined in recent years with the development of the country’s natural gas resources. A combination of increasing power demand, and a need to battle climate change, has once again however put hydro back on the government’s agenda, and a number of new schemes have been announced.

Late last year for example, the Ministry of Energy and Mines announced that construction work on phase II of the rehabilitation of Machu Picchu hydroelectric project in Peru will start the first quarter of 2012.

The project will require investment of US$148.9M, and is to be built by local turnkey contractor Grana y Montero, for state-owned utility Empresa de Generacion Electrica Machu Picchu SA (Egemsa).

The project has come after many years of negotiations. Rehabilitation is needed after a landslide buried the original plant in 1998. The first phase of rehabilitation was completed successfully in 2001 – the second phase is expected to give a total capacity of 192MW once complete.

Another major project being developed in the country is the 406MW Chaglla hydropower facility.

The Inter-American Development Bank (IaDB) announced in December that it is to provide a $150M loan to help finance construction of scheme, which is being built on the Huallaga river in the Chaglla and Chinchao districts of the department of the Huánuco. The project will represent about 13% of the country’s installed hydropower capacity once complete in 2016.

“This project will make a significant contribution to Peru’s economic development,” said Esteban Sarzosa, the project team leader at the IDB’s Structured and Corporate Finance department. “It advances the delivery of environmentally responsible and socially sound infrastructure by incorporating sustainable solutions such as biodiversity conservation, local employment and capacity building”.

The IDB loan will be granted to Empresa de Generación Huallaga SA, a subsidiary of Odebrecht Energia SA, both of which are part of Brazil’s Odebrecht Group. Drawing from its successful experience in Brazil, Odebrecht will implement an innovative professional training program, known as “Creer Peru”, for local communities in areas related to civil construction.

The training program aims to give employment priority to local communities that lack qualified labor. It is designed to offer qualification programs for the Peruvian workforce in technical areas related to civil construction including carpenters, electricians, masons, welders, etc. Once certified, many of the participants are hired for Odebrecht construction projects. The skills they acquire are universal and can be helpful in seeking employment opportunities long after the construction phase of any particular project is complete.

The IDB loan will also help finance the construction of related infrastructure, including the transmission line linking the plant to the national electricity grid, access roads and other ancillary facilities.

The total cost of the project is $1.2B. The IDB loan (A loan) is expected to be coupled with a syndicated B Loan from international commercial banks for a total IDB A/B loan of approximately $400M. Additionally, it is expected that Banco Nacional de Desenvolvimento Econômico e Social (BNDES) will be participating in the long-term debt package with a parallel loan of $323M.

Elsewhere in the country, Astaldi, in a joint venture with the Peruvian Group Grana y Montero (GyM), is to build the 510MW Cerro del Águila hydroelectric project after winning a US$680M contract.

The EPC deal includes the development of a concrete dam, an underground power plant, 9km of tunnels, and 60km of roads accessing the site.

Work on the project – commissioned by Peruvian power distribution company Kallpa Generación – is expected to take four years, with preliminary activities starting this year.

Italian firm Astaldi, which is leading the JV, is currently working on another five projects in Latin America – the 98MW Santa Teresa and 90MW Huanza projects in Peru, 66MW El Chaparral in El Salvador, 125MW Pirris in Costa Rica and the 111MW Chacayes project in Chile.

A number of companies are investing in future hydropower in Peru. Mining company Malaga Inc and Hidropesac, a joint venture between Malaga and its Swiss partners, Emerging Power Developers and Stucky S.A., recently announced they are to build a new hydroelectric power plant on Malaga’s Pasto Bueno property in Peru with a potential capacity of up to 38MW.

Plans for the project are based on Hidropesac’s updated feasibility study on the construction of a hydroelectric power plant using the water resources of the Pelagatos and Plata rivers. Hidropesac has a temporary concession permit and is presently updating the environmental assessment and archeological artefacts study. When those studies are finished, it will then complete the generation and transmission technical specification, a feasibility study for the electromechanical equipment, engineering for the civil and electromechanical works, and engineering for the substations and transmission line in order to obtain the permanent concession.

Malaga expects to obtain final approval early in the fourth quarter of 2012, which would allow building to begin the following quarter. Construction is expected to take 18 to 24 months, followed by a six-month commissioning period.

While initial capacity of the project is expected to be 20MW, given the area’s watershed and water flow characteristics, as well as enhanced dam retention capacity, potential capacity could subsequently be increased up to 38MW.

“Tungsten concentrate at the Pasto Bueno mine is currently produced using a gravimetric process that’s powered by a 600kW feed from a hydroelectric plant (about 70% of the power requirements) built by Hidropesac in 2007,” said Pierre Monet, President and Chief Executive Officer of Malaga. “Given the access to the large rivers on the property, we are now planning an expansion that would enable us not only to meet our long-term power requirements, estimated at 3-4MW, but also sell surplus power to private users or the Peruvian national power grid.”

Electricity utility Rurelec PLC also recently announced it is to develop a number of new hydroelectric projects in the country following its agreement to acquire a 50% interest in newly formed development company Cascade Hydro Limited alongside Peruvian and other international partners.

In a statement, Rurelec said it has secured an option over a 32MW pipeline of prospective developments, which it proposes to inject into Cascade on completion of successful final due diligence. The initial package includes Canchayllo, a 4MW project located in the Junín Province to the east of Lima, which was awarded a power purchase agreement (PPA) in the latest round of renewable energy tenders in Peru.

With a planned construction period of about 18 months post financing, the US$8M project is expected to enter commercial operations in 2013. Rurelec’s Board has approved initial funding of US$600,000 to cover operating expenses and development costs which should bring the Canchayllo project to financial close as well as substantially fund the development of the other run of river hydro projects now under option in Peru.

“I am delighted to announce our expansion into Peru, which has been a long term strategy for the Company,” commented Peter Earl, Chief Executive of Rurelec. “Our investment in Cascade is the first small step in the process of replacing Rurelec’s 538MW of installed capacity at Guaracachi which was lost as a result of the Bolivian Government’s nationalisation of the electricity generation sector on 1st May 2010. After three years of retrenchment, we are finally moving ahead again in Latin America with excellent new partners and with only limited exposure for Rurelec’s hard won cash resources.”

Ecuador

Hydropower investment is also up the up in Ecuador. In early January, the country’s Government said it is looking to invest up to $605M in 2012 for the construction of eight hydroelectric projects, as part of a plan too double the country’s generating capacity by 2020.

Among the projects to benefit from the investment will be the 1500MW Coca Coda Sinclair plant, the 487MW Sopladora project and the 252MW Toachi Pilaton scheme.

Both the Sopladora and Coca Coda Sinclair projects are being part financed by the China, with the Export-Import Bank agreeing to lend $571M and US$1.7B for the projects, respectively.

Another project with Chinese involvement will be the 275MW Minas San Franc. Not many details on this proposed project are available yet, but early reports suggest that Harbin Electric International Co, the main subsidiary of China’s state owned Harbin Electric Corp, has confirmed an agreement with La Corporacion Electrica del Ecuador to start the hydropower project, which is expected to cost US$477M.

Chile

Another country planning major hydro investment is Chile. President Sebastian Pinera announced recently that the government wants to increase hydro’s share of output to between 45-50%, from the current 34%. This is part of a plan to improve energy security and lower costs.

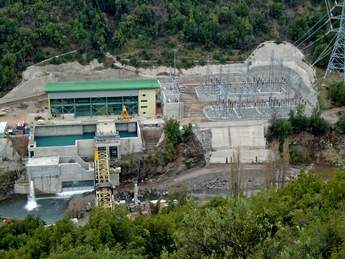

A number of new hydro projects are currently being developed or have recently been commissioned in the country. In November last year, the 111MW Chacayes run-of-river project in Alto Cachapoal Valley was inaugurated by Pacific Hydro, and Chilean utility Colbun is developing the 316MW Angostura project in the Bio-Bio region for commissioning in 2013.

The Chacayes run-of-river hydropower plant is located in Chile’s Alto Cachapoal Valley and required an investment of over US$450M. Pacific Hydro chief executive officer Rob Grant said that the company has long term plans to invest almost US$2B in Chile as the country has proven to be serious about its renewable energy policies, providing a level of investment certainty that is vital for investors.

“Chacayes is the first of a number of run-of-river hydro power projects that Pacific Hydro plans to develop in Chile’s Alto Cachapoal Valley as part of our US$2B investment pipeline in the country,” said Grant. “These projects will add more than 600MW of renewable energy capacity to Chile’s national grid by 2020 when fully operational, avoiding more than 1.13 million tonnes of greenhouse gas pollution from entering the atmosphere every year.”

Chacayes is currently going through the registration process with the Kyoto Protocol’s Clean Development Mechanism (CDM) to issue and trade in carbon credits. Once registered, the plant is expected to create around 340,000 carbon credits annually, which can be traded on international carbon markets.

“The business case for our Chilean assets is supported by revenue gained from the sale of carbon credits in global markets,” added Grant. “With the introduction of a price on carbon in Australia, we can expect to see increased clean energy production, regional jobs and significant investment opportunities over the coming decades.”

Chacayes is co-owned by Italian construction company Astaldi, which holds a 27.3% stake and was responsible for delivering the project under an Engineering Procurement and Construction agreement.

Pacific Hydro is currently awaiting environmental approval for the Nido de Águila run-of-river hydropower project that it plans to build in the same valley.

Its not just traditional hydro that has seen investment recently – there have been some major investments in small hydro and wave and tidal power.

Late last year it was announced that up to eight small hydropower schemes with a total capacity of 160MW in the country are to benefit from an investment of $5M from the Multilateral Investment fund (MIF), part of the Inter-American Development Bank (IDB) Group.

The MIF is to provide equity investment of up to $5M in the Chilean Renovarum Renewable Energy Fund, a project that seeks to create a new development model for the local venture capital industry around low-carbon and climate-friendly technologies.

The fund, managed by Renovarum Investment Management S.A., will then invest in around eight small-scale hydro projects in the country, which as of 2010 had a total gross installed power capacity of 15.8GW.

“By supporting specialized venture capital funds and investment vehicles, the MIF plans to create an effective means of combining the energy and financial expertise needed to develop these deals at an early stage and help Chile address its climate and energy challenges,” said Patricio Diaz Lucarelli, co-team leader of the project.

The project will contribute to help Chile create new jobs and reduce its reliance on foreign fossil fuel imports and CO2e emissions, which can potentially be quantified as carbon credits under the Clean Development Mechanism (CDM) of the Kyoto Protocol. Ultimately, the fund’s impact will be higher contributions from investee companies to sustainable economic growth and greenhouse gas emission reductions.

Also late last year, wave energy developer Carnegie Wave Energy Limited completed a site assessment study for CETO projects along the Chilean coast, identifying a potential 17GW of capacity.

Carnegie, in conjunction with its Chilean representative and local development partner has been working on Chilean opportunities for its CETO technology for some time. Part of this effort has now resulted in a detailed Chilean site assessment study which builds on the previous Chilean wave energy study by Garrad Hassan. That study found that if only 10% of the theoretical wave resource identified was extractable then potentially 17GW of capacity could be installed off Chile. This has the potential to completely power the main Chilean Electricity grid (the Sistema Interconectado Central). Carnegie’s site assessment study, which analysed a number of CETO specific criteria, identified a number of immediately viable CETO sites along the Chilean coast.

Based on the favourable site assessment results Carnegie has also now appointed the Chilean based Renewable Energy Development Enterprises (REDE) as its local Chilean development partner. Carnegie and REDE have signed a five-year development agreement which will see the companies work together in building CETO projects in Chile.

As part of the agreement Arturo Troncoso, the Executive Director of REDE, has been appointed as Carnegie’s South American Development Manager.

“It is a great time for us to move forward formally with our Chilean development partners,” commented Carnegie’s CEO and Managing Director, Dr Michael Ottaviano. “It is encouraging to see the Chilean government’s efforts over the last few years and the recognition of the role this enormous untapped resource could play. Our site assessment results combined with the macro economic factors in Chile gives us the commercial confidence to move forward with our Chilean project development plans.”

The Chilean Government has recently supported wave energy feasibility studies including the deployment of wave buoys for site specific measurements. They have also enacted Non Conventional Renewable Energy target legislation to financially incentivise renewable energy development outside of the hydroelectric industry. The main Chilean electricity grid sources approximately half of its energy from hydroelectricity and the other half from imported fossil fuels. Wave energy offers Chile an important alternative opportunity to increase its energy security on a large scale in an environmentally friendly, safe and sustainable way, says Carnegie.

Argentina and Venezuela

Tidal power development is also one of the aspects of an agreement signed last year between Russian firm Rushydro and Energia Argentina SA (ENARSA). The deal will see the two firms engage in joint implementation of projects in hydropower and alternative renewable sources – including tidal power – in Argentina, and exchange expertise in energy efficiency, design, construction, maintenance and modernization of hydropower facilities. They also agreed to work out opportunities for cross-border electricity sales with neighbouring countries.

In Venezuela meanwhile, one of the major projects planned is an upgrade of the Guri (Simon Bolivar) hydroelectric project. A $380M loan was recently approved by the Andean Development Corporation (CAF) for work on six turbines at the plant, in addition to US$700M in financing approved last year by the Inter-American Development Bank.

The Guri project is located in the State of Bolivar in the eastern region of the Bolivarian Republic of Venezuela. It is the country’s largest dam and the eighth largest dammed volume of water in the world. It features two powerhouses with rated capacities of 2785MW and 7300MW.

Brazil

Of course, a country that has recently seen some major hydro development is Brazil. Major projects underway include the controversial 11,233MW Belo Monte project and the Madeira hydro complex, which includes the 3750MW Jirau and the 3150MW Santo Antonio projects.

The Belo Monte project is being built on the Xingu river, in the Amazon region. It will be the world’s third largest hydro plant and the second largest in Brazil, after the 14GW Itaipú scheme on the Brazil Paraguay border once complete.

Being developed by the Norte Energia consortium, the project is expected to start commercial operation in February 2015 and is being built by the Norte Energia consortium, led by state-run utility Eletrobras Chesf, which won the rights to build and operate Belo Monte in an auction held in April 2010. It was recently announced that Brazilian power utility Cemig, in partnership with power distribution affiliate Light SA, is to take a 9.77% stake in the project.

The project has however been stooped in controversy since it was first announced. It has faced fierce opposition from environmental groups concerned about negative impacts on the ecosystem and wildlife in the region. Legal pressures have led to blocks in construction, but these have been overturned and work is underway in earnest on the project, although further legal attempts to stop construction are expected. Brazilian environment protection regulator Ibama however expects the final environmental license for the project to be issued in 2015, and has a specialist team based at the construction site monitoring all works undertaken.

Companies working on the project include Impsa, who will supply four generating units with a combined capacity of 2500MW. A consortium led by alstom and including Voith Hydro and andritz will also supply fourteen 611MW Francis turbine-generator sets and six smaller Bulb units. Metso also recently signed a deal to deliver three automated large crushing plants, two portable plants and two mobile Lokotrack plants for construction of the project.

At the Madeira hydro complex meanwhile, GDF Suez and International Power announced that the Jirau project is be expanded from the original concession of 44 units to 50 units, taking the total capacity of the project from the initial 3300MW to 3750MW.

The news follows a successful outcome of the A-3 energy auction in Brazil on 17 August last year. The six units have been allocated 209MW of assured energy and 100% of this energy has been sold in the regulated market at an inflation-indexed price of R$102MWh (US$64/MWh) for 30 years commencing in 2014. The total assured energy for the whole project now amounts to 2184MW, of which 73% is contracted under long-term PPAs. The balance will be sold in the free market, principally to industrial customers. In addition, this expansion may allow for a further 90MW of assured energy to be allocated to the project.

The design of the Jirau power plant took into account the potential for additional units. As a result, this expansion will benefit from shared infrastructure and economies of scale that will add value to the project.

“The expansion of the Jirau project…reinforces our commitment to providing Brazil with clean and renewable energy. It further illustrates the Group’s strategy to increase its exposure to fast growing markets,” said Gérard Mestrallet, Chairman and CEO of GDF SUEZ.

“The energy auction price and our decision to add six units to the Jirau plant allows us to capitalize on the attractive fundamentals of the Brazilian energy market, which is characterised by strong demand growth,” added Philip Cox, CEO of International Power – which is 70% owned by GDF Suez.

Another project for which additional capacity has been approved is Salto. Infrastructure company Triunfo Participacoes e Investimentos (Truinfo) and its subsidiary Rio Verde Energia (Rio Verde) have been granted approval to increase assured output at the project by 4MW.

The firms obtained the Energy Planning and Development Secretariat’s authorization to increase the assured energy of the plant to 67.8MW, with additional energy to be sold on the free market. The plant has an installed capacity of 116MW.

Other major projects under development in the country include Simplico, Colider, Maua, Batalha, Garabi-Panambi, Sao Luiz do Tapajos and Baixo Iguacu.

TablesLargest projects